Specialists get paid more 12-20-22 | The Daily Ticker

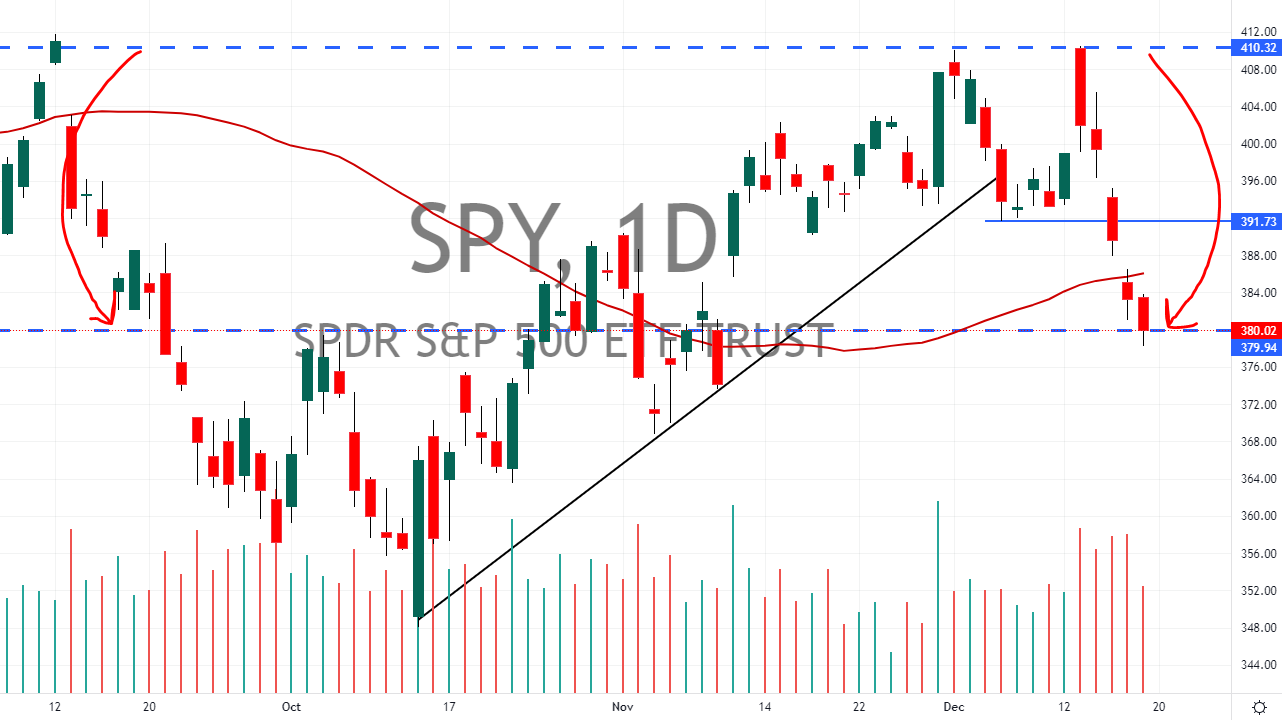

Stocks traded lower again yesterday, but the #SPY remains glued to the $380 level.

Why is that significant? Because it’s the average true bearish move for the indices. Yup, it stopped and hovered right at the average true move.

So what right? Big deal. No. And it’s the reason most people never find stock market success.

Last night we hosted part one of our annual trading review. Note I said trading review, not market review. Each December we gather to discuss what definitely did not “work” and what actions lead to losing less, and ultimately profits.

The epiphany that comes out of these meetings each year is losing traders realize they need to simplify.

They gasp in shock when profitable traders mention “I only trade the same eight stocks each week…”

They type in disbelief when “I only trade a couple of setups, that’s all I look for all day.”

They’re confused when less becomes more. For some reason traders imagine the markets exist in a different universe. One where you can do everything well!

A quick question: Who gets paid more, a brain surgeon or a general practitioner?

Why don’t quarterbacks play defensive end? Why don’t pitchers also play shortstop?

It’s because a specialist decided to become great at something, and because of that decision, gets paid handsomely for it.

They’re paid for focus, precision in their craft. You might say a specialty.

The primary ideas that came out of last night’s call were simplicity, patience and edge.

What’s interesting is that two-thirds of that success equation is inside the trader. Not the markets. We often look for success outside of ourselves. You won’t find it there.

Success is who you are, the actions you take, the thought habits that lead to the results.

Many claim to want it badly! Maybe even take action, but sadly never pay attention to the results.

As Earl Nightingale so eloquently quoted Napoleon Hill; “We become what we think about” [The Strangest Secret]

Going back to average true move, and the #SPY. When I first introduced this concept, many traders found it hard to fathom that trading can be that simple.

We need to use stochastics or MACD! [Note: average true move is simply asking “What does this stock normally do when it moves?”]

More, we need more! No you don’t. And that thinking is why most struggle.

You’ll believe you need to know more before success arrives. I know this for a fact, and I submit my library of a few hundred trading books as proof.

You, me, us, we don’t need to know more. We need to practice and use it better.

Review your trading before the end of the year, and ask what you can remove. I’d bet it leads to the conviction and consistency that we all crave.

Become a specialist.

So what does the “ATM” for the #SPY tell us? It means that the reward potential on new short sale trades (expecting stocks to go lower) does not justify the risk. [The reward is less likely to justify the risk because it’s too far from the optimal entry.]

Could it go lower from here? Yes. But is it likely and worth the risk before it resets?

Pete

Learn to Trade Stocks:

Enroll in our trading boot camp...

Join us 7:30 AM for the Stock Market Live Stream (Monday)

Be sure to SUBSCRIBE to our YOUTUBE channel and hit the LIKE button for updates.

Ready to Uplevel Your Trading?

Schedule an Interview with our team today:

https://stocktradingpro.com/stock-trading-pro-coaching-call/

🥇 Finviz Screener | Find the Top Stocks to Buy Now

https://youtu.be/K5JZNCWIhZo

🥇 Sector Rotation Trading Strategy

https://youtu.be/lcB83RcN23Y

🥇 Swing Trading Strategy | Candlestick Charts

https://youtu.be/2pmYj-Gqm1k

🥇 Tape Reading Explained

https://youtu.be/Jqup9n8BifM

Contact:

[email protected]

Disclaimer:

https://stocktradingpro.com/disclaimer/

These YouTube stock market live stream videos are for financial education purposes. It's up to you to consult your financial advisor to make the final decision before you decide which stocks to buy now.

The Stock Trading Pro mission: How to know what stocks to buy.