The Daily Ticker: EP9: TSLA Earnings, NFLX Earnings – David Trainer

In today's episode of the Daily Ticker David Trainer, CEO Of New Constructs breaks down the expectations for Tesla, Netflix and IBM. Each company reported earnings this week.

David reviews how New Constructs analytics calculates several scenarios for future growth of each company using the current stock price and his Reverse DCF model.

Netflix and Tesla have some work to do in order to justify the current price levels.

But to start the discussion we thought it would be fun to review the concept of GAP, Growth Appreciation Period. Gap is a fascinating topic that considers the expected duration a company creates value.

We also dive into Michael Porter, competitive advantage, and his five forces model and the triggers that could affect the GAP for the lifetime of the company.

DOWNLOAD PODCAST RESOURCES

Pete Renzulli | Stock Trading Pro

https://stocktradingpro.com/invite

Visit our YouTube channel for training. Be sure to subscribe. https://www.youtube.com/c/StockTradingPro

Follow Me on Twitter:

https://twitter.com/PeteRenzulli

Contact:

[email protected]

Disclaimer:

https://stocktradingpro.com/disclaimer/

Could Trading Stocks Help You Become Semi-Retired?

Learn About The NY METHOD

Hey everybody. Welcome to Stock Trading Pro. Today's daily ticket we have David Trainor back again. How's it going, David? I'm doing great. Hey, thank you. So if you didn't happen to watch last week's David Trainor from New Constructs who specializes in, I would say fundamental analytics is that. High level enough.

Yeah, not enough exactly it. Okay. All right, so today we're going to get right into, we're going to hop right into the context. The very first thing we're going to talk about today is we're going to give context to everything we're going to talk about, which is earnings reports. We're going to talk about Netflix, Tesla, and IBM M.

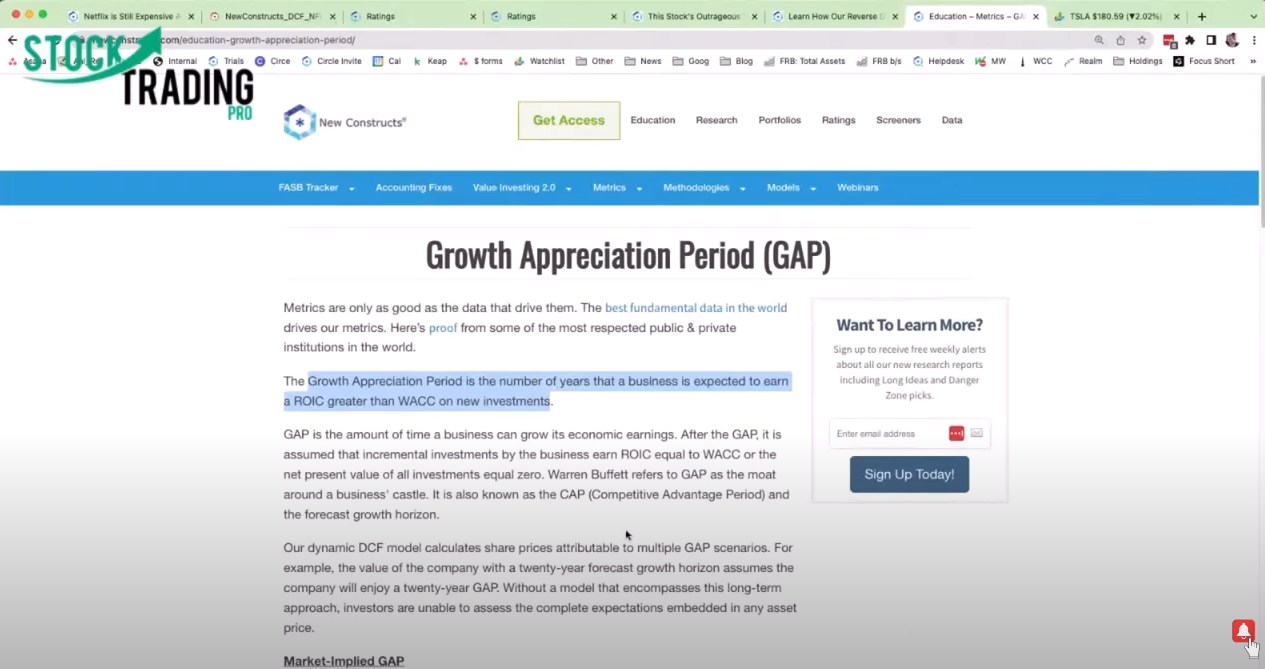

We're going to do it through the lens of new constructs analytics. But we're going to start out with a lesson first, I guess we call it a lesson, which will give some filters for what we're about to talk about, which is something known as growth appreciation period, and how the stock price basically implies the growth appreciation of.

The profits for that company, which is a really interesting topic. David touched on it last week with JP Morgan. JP Morgan came out some pretty good earnings. David said, solid company potential, 22% upside. Very short term. I know that's not investing, but so far so good. So David, take it away. First thing growth appreciation period.

What is that for the person that never really heard in that context before and how does this stock price. Imply the growth appreciation. Yeah. It comes back to the basic principle that the value of an asset is equal to the present value of the future. Cash flows available to the owner, and we all know that future cash flows will not grow forever.

If they did, then you would have an infinite value. So in the same way that a bond has a maturity date that allows you to understand the price of the bond, right? A certain set of cash flows, a certain period of. And because you know that maturity date, you can calculate the exact price of a bond. The same concept can be used to understand the implications for cash flows inside of a stock price.

Whereas people tend to calculate the price of a bond based on right, the coupon payments, maturity, date, and interest rates. The stock price is the opposite. You get the price first and you got to figure out right, the coupon payment or cash flow. And interest rate is your cost of capital. And then the third driver is what we call growth appreciation period, which is analogous to the maturity date for a bond.

The idea being that every stock price has a set of expectations baked into it for the future cashflow lifecycle of that company. And in order to make a good assessment of the underlying valuation of a stock, you need to understand those three drivers, how fast the profit's going to. How profitable is the company going to be?

He's going to get more profitable. And then for how long can it sustain profit growth? Because again, if the profit growth is PR is infinite, then the value is infinite. So at some point in time, the company's competitive advantage will erode to the point to where it can no longer grow profits. So we call it growth appreciation, period.

Other people call it competitive advantage, period. These are the same. Michael Porters work on that. It's fascinating. I got two big books back there on that as well. Big. That's right. No, and this was all like, so when I got onto Wall Street, my boss was like the, he really, he wrote one of the groundbreaking breaking reports on growth appreciation period.

He calls a competitive advantage period. He calls a CAP instead of Gap. And I didn't want to copy him, so I called it gap. And I also wanted to like, introduce this notion of growth because what the competitive advantage period is capturing is the amount of time profits are expected to.

Not the amount of time that, that the company will generate profits. Because think about it, a business loses its competitive advantage before it goes out of business, right? At some point in time you can't open any more stores. You've maximized the amount, you're going to be able to grow profits, and that's the point in time when the valuation of the stock is peaked.

And that's what we're looking to capture when we quantify the expectations baked into a stock. Should we go through, you really need to know then, is it based on the product that's running out of steam and can the company reinvent itself? I guess at the top of that is Apple, where they're constantly reinventing ways to increase that cash flow versus some other companies that have the one shot wonder, and their growth appreciation period is based on that, and they're done.

Yeah, no, I, that's what this, that's what the whole competitive advantage period and gap concept allows us to bring to the valuation process. It's linking strategy to valuation. Cuz strategy, in our opinion, should be all about, hey, am I able to earn a return on capital above the cost of capital?

And how many times can I do that for? How long can I sustain that? And that's an essential question to understanding the competitive position and the valuation of the business and its ability to generate profits and what the gap brings to that. This discussion is quantifiable. Hey, look, if the stock price implies, they're going to grow profits at 20% for the next 50 years, shoot, that's a long amount of time to be coming up with new products to grow for a long time.

And hey, maybe it's expensive. On the other hand, I think we're talking with JP Morgan, the stock price implied zero profit growth, right? And I think if we talk about Netflix and Tesla, we're going to get into some interesting market applied expectations that are particularly. Solvable or quantifiable in our framework in a way that I think is really interesting because we bring this concept of an endpoint in profit growth.

So if you're going to say it ends at some point, and by the way, wall Street wall Street Assumptions and their DCF models, they, they assume perpetual growth. They'll tell you it's a five-year timeframe. Yeah. But they've got perpetual growth assumptions in their terminal. Okay, I'm getting really nerdy here.

That's okay. I just want to stop for one second. D DCF is discounted cash flow. Cashflow. Yes. Sorry. Discounted cash flow. Okay. That's right. Discounted cash flow. And so we've got a, we've got a post on our site. I'm sharing it now, Pete on growth appreciation period and this education section of our site you can see.

For free. This is all free. All the education stuff is free and to, to my opinion, it's pretty amazing. And the growth of appreciation period specifically is the number of years that a business is expected to earn a return on capital greater than its cost of capital. We're weighted average cost of capital, right?

Then at some point in time, you're no longer going to be able to grow profits. And to us, profit is measured purely and only if your return on capital is greater than your cost of capital. And so we really focused on not just a gap, but the market implied gap, right? What is the amount of profit growth baked into the stock price?

The current stock price, right? We want to reverse engineer what the stock price implies. And so I guess the big question David then is how do you come up with the period? What we saw for the. So the way that our model works is that we will very different from Wall Street models. We're not going to say, oh, here's a five year timeframe and here's my stock price.

After five years, I'm going to, my, our models go out over 100 years, and what we do is we look for the period in the model. So maybe it's 16 years, maybe it's 20 years, whatever it is, maybe it's 23, sometimes it's more than a hundred. But what we look for is the year in which the model generates a price equal to the current stock price.

And we call that the market implied growth appreciation. And that's what helps us figure out if a good company is a good stock. Cause a good company's not always a good stock. For example, Tesla is a kind of, is what you could call a good company, right? If you really believe in electric vehicles.

But the question is it a good stock? And the answer to that question is what does the stock price imply about the future for Tesla? And when you do the reverse engineering on the Tesla stock price, that it implies that it will have a hundred percent market share by 2031. Wow. And that's when that's again, you reverse engineer what the revenue's got to be, what the margin's got to be, and then, and the cash flows.

And then you say, okay, based on these assumptions takes me, to 2031 to get a, the DCF to generate a price equal to the current stock price. And then when I look at the revenue implied by that time period, and then I can divide that revenue by the number of cars I. So let's not let that statement go without a pause here implying a hundred percent.

That's a pretty big deal. That's a pretty big No, it's, and this is ridiculous really. We've been writing about for, 10 years, at some points in time it was more than a hundred percent. And it depends on the average selling price. So we got multiple scenarios, and the cool thing is we'll show you.

We'll show all the math, right? It's completely transparent. Like we give it to you. I want you to see it. We're not, math is not our secret, right? Our secret is in better quality data, right? To drive the models and then use of these models to do this kind of analysis. But, as we can demonstrate, like our clients, our institutional clients get to use these models to, to replicate the same scenarios or create their own scenarios, because it's really part of a due diligence process, right?

I learned this stuff when I first got to Wall Street and it's never left me and, in my mind, you really can't fulfill your fiduciary duties if you don't understand the expectations baked on the stock price. And what's interesting now is the ones that we're talking about today, going back to Michael Porter and competitive advantage and strategy.

He's got the five forces, and now we're talking about Netflix right now. What is the reason to expect that growth to continue and all they're talking about now is most of their growth is coming overseas. They've tapped out the total addressable market here in the States. So it's overseas growth and there's password protection.

And then we get over to Netflix Tesla now where margins are starting to come down. So when you factor in future cash flows with lower margins, you really have to, it's basic math at that point. And whether or not you think that big competitive advantage, first mover advantage is going to hold up with lowered margins, more competition and those numbers of what the current price is.

Yeah, I mean we've been writing about both Netflix and Tesla and making these very points, predicting these very things for, I don't know, five or 10 years. Because the law of competition is immutable and if you got a great business, right? That's one something I teach all my analysts in the third or fourth day of training.

Like you got great returns on invested capital. People are coming for you, man. They're going to copy it as much as they can and get into that business. So your business better be good enough to be able to hold them off. Otherwise, it's erased to zero margins, which why I think a lot of people who've never been an entrepreneur before.

I think that's why a lot of companies have such a high r and d number. You would look at it and be like, why are they spending so much money? But it's because they're so successful. People are nipping on the hills. They have to come up with something for a year from now, or even if it's five years from now, they have to invest in that, or they're done.

That's right. That's right. And another book by a Harvard Business School guy Clayton Christensen Innovators Dilemma. About how hard it is for some big companies that are really successful. IBM's a good example of this super successful, how hard it is for them to divert large amounts of capital away from the existing business to find the next big thing in order to keep their competitive advantage going.

Cuz if they just keep doing what they've already been doing and he uses the dis drive industry is an example, and they kept making smaller and better and faster disc drives and then all of a sudden disc drive aren't a thing anymore. Yeah. And they didn't really have the wherewithal or capital or actually institutional.

Creativity to say, Hey, we don't need to be just spending r and d on how to make a better disc drive. We need to make sure we're spending r and d on the thing that's going to displace the disc drive. Interesting. All right, so you want to start getting into, I guess we'll start out with Netflix, because it came out yesterday.

Yeah. Let me share my screen. I want to cut, touch one more thing on this growth appreciation period here. So here's a nice little model we put together and this is how our discounted cash flow model works. You can see how we're projecting values. For the share price over a long period of time, and the year in which the model results equal the stock price as you see here, that's the market implied growth appreciation period.

That's that cross reference I was mentioning before, and that's all that's in the education tab or education section of our site. Just go to metrics. And growth appreciation period. You can check that out. So Netflix, David, any links that you show that are forward facing, we'll make sure we share them for everybody just in case anybody, nobody needs to write down the link or anything.

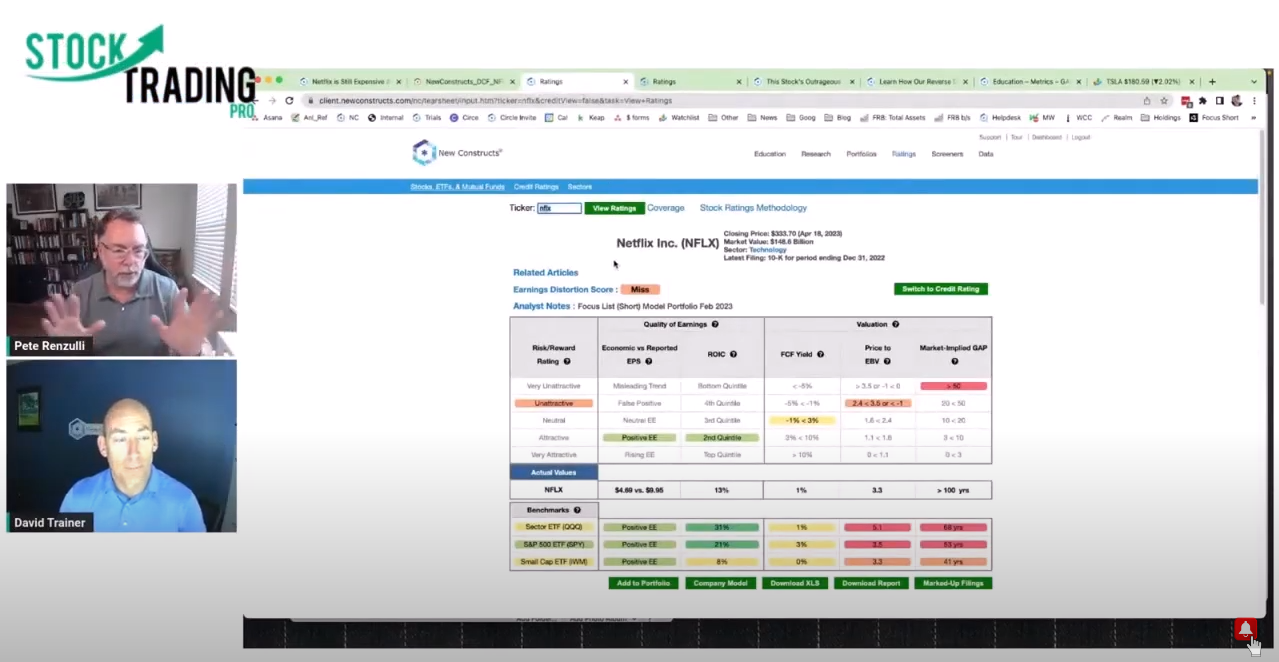

We'll share that below. Yeah, and you can navigate it to our, from our site too. But absolutely Pete, I'll get those to you. Okay, so let's take a look at Netflix. All right. Like this is an unattractive stock. And when you're looking at our ratings, you're going to see market gap is one of the essential elements, one of the five elements we put into this rating that I designed 20 years ago.

Why? Because I think it's important to understand the duration of profit growth embedded in the stock pricing. It's super important. These other metrics for valuation, free cash flow, yield and economic book value give you a great sense of what profits are today and what the stock price implies about those future profits.

But this market applied. Is an important one, and you can see anything over 50 years is very unattractive. And what you'll also see for stocks that are expensive in our system is a really high gap number for them. For Netflix, it's more than a hundred years, and all of the market applied gap calculations in our system are going to be based on the default scenario.

That we put into our discounted cash flow models, right? And so you'll see if you click on this button, people can access the actual discounted cash flow models. I'm going to show you some other scenarios for Netflix. But our default is always going to be based on really what the company's done in the past and what the consensus estimates are, right?

So we're not trying to make wild predictions about the future of the, of a business. We try to extrapolate what's reason. And then let the valuation tell us what the market is implying. So if we put reasonable expectations into our model for Netflix, it takes more than a hundred years for that model to generate a price equal to the current stock price, which means it's really expensive.

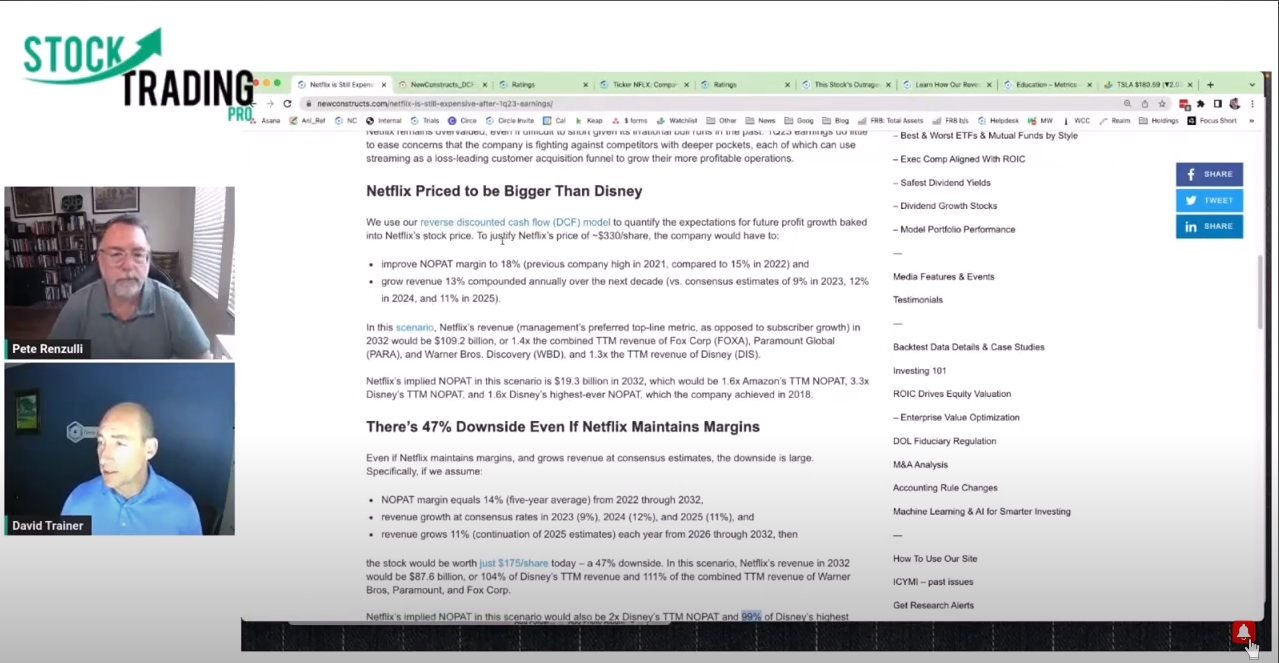

Wow. And we, when we write reports, On stocks. We try to make it a lot simpler than that. So we recently did an update on Netflix and, everybody knows what happened in the earnings, right? They missed on the top line. Bottom line looks a little bit better. And then Pete made the point about the growth that's coming from overseas, we've said for years now by the way, customers overseas are NPV negative.

They don't make. On the overseas customers, they lose money on overseas customers. And I don't think that has changed. So it's not positive growth. And then of course, ads and password sharing things they said we'd never do. They're doing because they have to, because there's so much competition. So let me see let me show you some another ways.

We use the discounted cash flow on our content team when we write reports. Here. And this is my favorite chart. I love this chart. I think it's, I think these charts are awesome because it's so telling, right? So let's look at what Netflix has done in the past. You see here on the left this is their historical net operating profit after tax, right?

And then what we run out into the future are different scenarios to help you understand what the current valuation means and maybe what the actual valuation. And what you see here in the blue line is the implied nopa baked into the current stock price. That's what you got to do to just to, for the DCF model, to generate a value equal to 330 bucks in the year 2032.

This is what notepad's got to do. And by the way, if you notice over here that notepad is quite a bit higher than what Amazon has, what Comcast? That's pretty impressive. That's what's baked into the current stock price. And then, we show, okay, all right let's peel back those assumptions a little bit and let's make it a little bit less optimistic.

And here's what, here's another scenario. This is the implied notepad for 175 bucks a share. And by the way, that's the stock price today implied by this future cashflow life. 175 bucks is what the stock is worth today. If you believe they can achieve this notepad, which by the way is significantly higher than where Disney is, it's nearly two times higher than where Disney is in the trailing 12 months, and it's the same 99% of the highest ever nopa for Disney in 2018.

And I like to draw that comparison because Disney we think is a meaning. Better competitive positioned business for one big reason, Pete. They can monetize content in multiple ways and Netflix can monetize content in one way. Yep. And we think that's a severe disadvantage for Netflix. I think having context of the other companies is a big deal because you, the growth rate is one thing, but when you compare it to historical growth rates for what the company themselves have done and competitors, the numbers really just jump out like 1 75 right now at the stock trading at 3 22, It's ridiculous.

And this is why I, this is why I love this tool because I think it's just so simple and fair. I'm not trying to sell you in some narrative. I'm not trying to tell you the company's a bad company and. And nobody should watch Netflix and outer banks is terrible. My kids love it.

Good things, but there's a difference between a good company and a good stock. And let's just be honest about valuation. The reason I love this, David, is because we're not projecting, we're basically saying what have they done and what's reasonable to expect and what is the stock price telling us?

That's right. That's right. And we'll give people the context as well like in detail. So this is the valuation section of the report, and it talks about using our reverse discounted cash flow model. We'll send a link to that too, Pete, for everybody to quantify the expectations for future profit growth baked into the stock price, which is a three 30 when we wrote this, right?

So what does that mean? All right. We're going to assume that they improve their profit, their after tax profit margin to 18%. The best ever was in 15% was 15%, I'm sorry. 18% is the previous company high. 2021. They're now at 15%, so we're going to go back to the best ever, and then they're going to grow revenue.

13% content compounded annually over the next dec, next decade. Where while consensus is at 9% in 2023, 12% in 2024, and 11% in 2025. Now, let's not forget that. Best was during a pandemic. That's right. That's right. The point I like to make here is that we're being optimistic about the future, right? So in this scenario, Netflix revenue.

The top line metric that they love would be 109 billion or 1.4 times the combined revenue of Fox, paramount Global and Warner Brothers. Wow. Wow. Wow. All right. And then the after tax profit would be 19 3.3 billion, which is over one and a half times Amazon, 3.3 times. And they're trailing 12 months and 1.6 times Disney's highest ever.

And then here's the details on the 1 75 scenario, right? So margins are 14%, which is the five year average revenue grows at consensus for the next three years, and then 11% after that. So still, I think generous. Very generous, right? Considering the competition that's coming in, the ads and password sharing, I think margins are going to go down.

Growth is certainly not likely to be that big. And sorry, margin's going to go down cause they're going to lower profit customers internationally and they're struggling to grow. And that's what you get, this 1 75 a share. We'll also show you in all of our reports, we'll show you click on this and you can see the actual discounted cash flow model.

Here you can see it gets to 1 74, 1 75 a. That's the revenue CAGR over that timeframe. That's the 11% we told you about. That's the nopa margin we told you about. So yeah you get the idea behind, the straightforward math That makes this kind of analysis possible.

And I like math because it's honest and objective and you can check it. You don't have to believe in my narrative or my, my winning personality to decide what you want to do.

And we, you want to jump into Tesla? We do the same thing with that. Absolutely. Yeah. So Tesla's a fun one. Here in our system, you just type in a ticker, you get an answer. Test of the economics of that business look pretty good. I think that's a little odd, but I don't think that'll hold, but that's regardless.

Again, it could be a good company that doesn't necessarily make it a good stock. You can see here you're looking pretty rough in terms of expectations for future cash flows, in terms of how high they are, right? And so what does that mean? And we're actually going to be publishing an update on Tesla.

It's probably in the next 30 minutes or half hour. But I want to share a similar report that we did on Tesla. This was October of 2022. That does a similar analysis of what we did for Netflix. This was an update. We covered a lot of stuff in this report, and a lot of it's around Tesla going to be, Continue to grow, market share, forever, right?

And the answer is probably not. It's already declining pretty significantly. Especially mature markets. And the other thing is just how much competition is coming online. Let's face it, like it's, there's going to be a lot of competition. We're already seeing it. It's huge. And we think the competition's only going to get bigger and they got a whole lot more money to spend on r and.

Then Tesla has, because Tesla has actually been free cash flow negative to the tune of 4 billion over the last five years. So whatever you think about their profits, their free cash flow is highly negative. Wow. So let's get to the valuation stuff because I think that's in, that's the interesting part here.

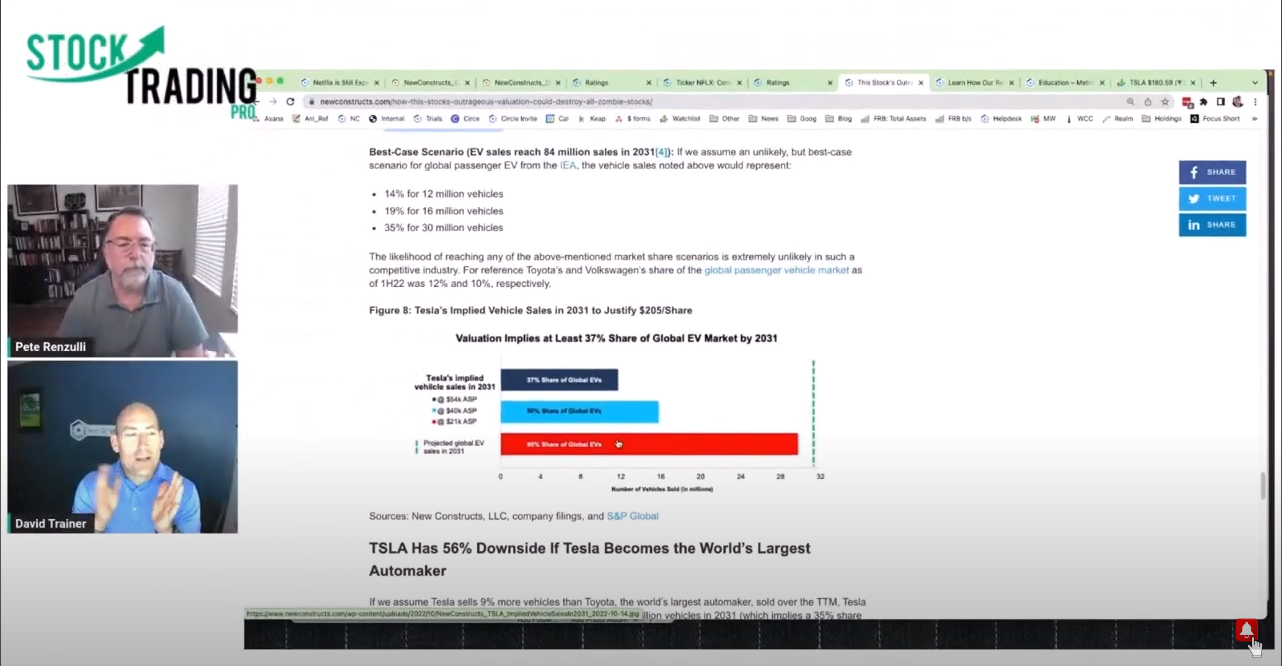

First we look big picture, right? The market cap of Tesla versus its incumbent peers is pretty, ridiculous, right? They're bigger. It's almost twice as big as all the other top 10 car companies combined. Okay? And then let's do the reverse DCF stuff. Let's get into it here. Okay. We use a reverse c CF model to provide more clear mathematical evidence that Tesla's valuation is too high and offers unattractive versus reward.

At its current average selling price per vehicle of 54,000. Tesla's stock price at 205 bucks a share. When we did this implies that it will sell 12 million vehicles in 2031 versus the 1.2 million it did in the last in the trailer 12 months or 10 times as many. Wow. 12 million in sales in 31 would be 40% of the global electric vehicle, passenger vehicle market.

54 K is a really high selling price. You don't have 40% market share in anything. Probably a 54 K. So then let's get some more details in terms of what this means financially. That means Tesla's going to have to go to immediately achieve a 13%. Which is higher than their 12% which is quite a bit higher than Toyota which has typically been the most profitable car company, grow revenue by 30% compounded annually, and invest a capital at 14% right for the next decade.

Now, it's important to understand, invest a capital. That's what they, that's how we measure how much they're spending to build all these plants. And that's been growing at 50% for the last 10 years. So we're saying they can cut that down by 40. Again, we're trying to be generous, right? Because you cut down that invested capital and that makes the free cash flows a lot higher, which makes the DCF model generate higher prices sooner.

So in that scenario, Tesla would generate 712 billion in revenue, which is 1.1 times the combined revenue of Toyota General Motors, Ford, Honda, Lantis, over the trillion 12 months. So more revenue than all those companies combined. And there's some more comparisons here that we put in here that I think are really cool.

Like for example it would achieve a no pet margin that's higher than the highest margin achieved by any incumbent peer over the last five years. 89 billion in net operating profit. And at 89 billion it would be 1.4 times all of its peers and almost as high as Apple in the trailing 12 months. So basically Tesla's priced to be as profitable as Apple.

And we're talking about a large-scale manufacturer. Man, it's not like an iPhone. Okay, so let's go into some more examples. I told you guys about the 30 million vehicles, right? That's what's apply. At 205 bucks a share with an as P of 21,000, and that's where Toyota is. That's a pretty, pretty, I think, representative, probably global a s P at an as P of 40 K, it's 16 million.

So if you look at the base case scenario for the electric vehicle market, 31 million in 2031, this gives you the percentages of market share that those sales numbers imp. And so it's up to you. Do you believe in that? And we, for one think it's a little bit, probably aggressive that the market share would grow from where it is now to these unheard-of high levels and what is typically a commoditized, very competitive industry, especially now with the C E O focused on a different company. That doesn't help whole other conversation, but I have a, I have pretty strong opinions on that.

Yeah, no, it's, it doesn't make any sense. And the competition's ridiculous. You got China like that Neo, they're killing it. China, the Beyond car. China's killing it. They're killing them. This just gives you a bar chart showing you the percentage of the global electric vehicle market applied by 205 bucks a share at different ASPs.

Just trying to show it a different way, man. Cuz we, we've been looking at this for so long and realizing it's so expensive. It's like we're just what else we got to do to make people understand how expensive this is. And then we do a couple other scenarios. If they sell more than, 10, 9% more vehicles than to, than Toyota.

What Toyota said in the last 12 months, the stock still has 50 56% downside, and here we show margins go to 12 and they then they fall to where Lanis is. They still grow revenue at consensus at 40% and then 19% compounded annually through TH 2031 and a capital again, very low. Keep in mind. Revenue growth compounded at these at 19% for long periods of time is almost unheard of in any industry.

And then we have another scenario here, and I'm not going to bore you with the details, but we show them all, here's the money. And that's actually at a time when the co, when that industry is going to be more mature as well, where the growth rates are going to slow down. Absolutely. Never mind historically.

100%. A 100%. If anything those growth rates really do look it's absurd when you consider the increasing competitiveness of the market going forward. They're absolutely running into a major headwind on revenue growth. So this chart again my favorite right, to give you a sense of what's implied by the stock price.

So you can see past, no. And then the future nopa implied by the stock price. You can see why 205 is pretty ridiculous, right? Here's where Apple is. Here's the combined profits of all their peer incumbents, or most of them, right? Here's Toyota's Nopa. Wow. Toyota's a pretty good company, man. Pete, we grew up in the eighties, right?

We remember like how Toyota just took over the world, like back then yeah. Lean manufacturing changed everything. That's right. That's right. So yeah that's the example of like how to use growth appreciation period. You can see in these examples for Netflix and Tesla we choose a growth appreciation period.

Over a shorter timeframe because we just think there's a lot more context. It's so much easier, Pete, for people to understand if we say, okay, we're going to look out to 2032 and we're going to force the revenue and profit margins up high enough to get to the current stock price in 2032 so that we can say over a 10 year timeframe, this is what the company has to achieve.

Cuz when we found, when we point out that it's going to take more than a hundred years with of reasonable expectations. Feedback from my institutional clients was like David your, actually, your inputs aren't reasonable. They're too low. So I said, okay, maybe it makes it more of an impact on you.

If I say, let's assume best case scenario margins, 30% compounded annual revenue growth and 10 years, and that was something people could really get their heads around. So we use a 10 year growth appreciation period, and then we reverse engineer what the revenue growth and profit margins got to be. And capital utilizations got to be to generate a.

Equal to the current stock price and a 10 year horizon. And that's how we're using Gap and how we're using that, I think very straightforward and honest approach to help people have a better understanding of evaluation. And then I think, David, one more thing that you have introduced me to in the past is then thinking through what would be the triggers that would change those projections, whether it be margin competition and other products, some of those things.

So when you know there's the projections. Historical numbers, and then there's what would change those what would be the triggers that would change those? So just everybody's listening to this. There's the numbers and then there's what would keep those numbers on track or change them some, something else to think about.

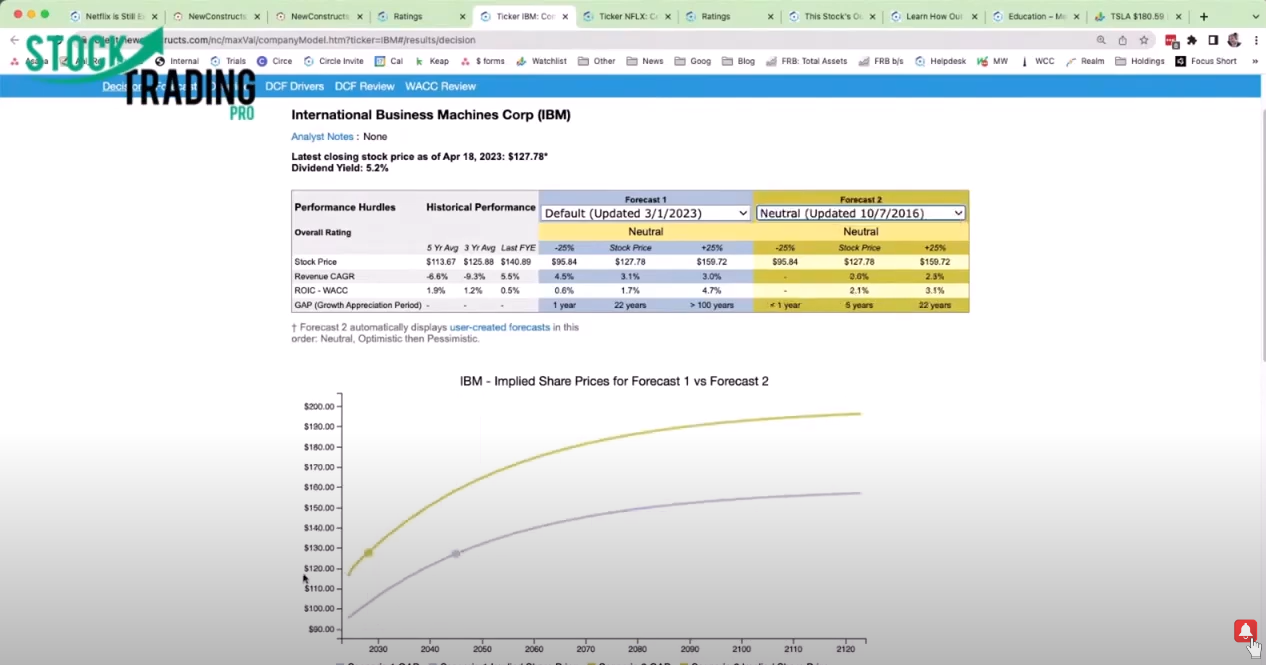

David, if we can just, maybe just go over IBM's chart. Okay. And then we'll call it a, we'll call it a meeting and give everybody a chance to watch this twice and take some notes. Yeah. Yeah. So we can go through the, we can go through the rating and we can pull up a model. On IBM and we can do a scenario if you'd like.

It's going to take a little while, but I'm happy to do that. Sure. So anyway, here's ibm, type in Integr or get an answer neutral. It stuffs all over the place here. Free cash flow looks good, but I think it's mostly because they're culling a lot of the business. But you got a 22 year market implied gap.

That's, I think that's interesting. So what we can do in our models is dig a little deeper into what that means. I'm opening one of the models so we can do some analysis on that. But it's interesting here how free cash flow, again is attractive price to economic book value.

Attractive. Let me restate free cash flow. Yield is very at. And then you've got a unattractive market implied gap. That's why you want to look at this through different lenses. And it takes a mile to generate a minute to generate this. Peter, actually, we can do, David, we could generate that in the background.

If you want, we could have that report available for download, if that's all right with you. This part won't be downloadable. I can send you a pdf, but Yeah, that's fine. That's. Okay here's it's up now. Are you able, you're going to be able to edit a lot of this stuff out, right? Yeah. So here's our reverse DCF model on international business machines.

And this is a view Pete, for what our clients use and what we use internally to create scenarios. So you can see in this default scenario, right? Remember I told you guys that like when we create a model, we always have a default scenario in there and we put what we think is most realistic.

That was last. David, if you could maybe make that just a little bit bigger so we could see it a little better. Absolutely. Perfect. You can see this was updated on March 1st, right? We got a new probably 10 K or 10 Q for those guys, and we updated the forecast, and this is 22 years. That's this blue line.

That's how many years it takes for the model to generate a price. Equal to, but still less than the current stock price. You can see 1 27 0.1 right there, and then you can see the current stock price is 1 27 0.78. So that's when the system says, oh, okay. I'm going to say the market applied growth appreciation period is 22 years.

And so I got another scenario here, neutral. It's, any other scenario, I got an optimistic, what does that look like? I did these a while ago. So that's why you see the old dates. It's been a while since I've opened the IBM. But the idea is like you put in different scenarios for profit and revenues, right

You get very different implied values per share. In this pessimistic scenario. I can't get to 127 bucks for, in a hundred years. That's what happens for a lot of these really expensive stocks. If I go to neutral, It's six years. And if you want to change that, you will go to the forecast tab in our section, in our model.

And you'd come in here and you'd say, okay I'm going to put something else in here. And you can also get the exact inputs, right? So let's ate, let's update neutral to be something more realistic. So you've got 4.5. Keep it the same as consensus. 3.2 and then three out farther. And then Consensus has got 12.8.

I'm sorry. Yeah, consensus is more like 12.8%. Margins have been much lower. In the past.

They did make it up to 21.8 a long time ago, but we're bit in a different era for ibm. So let's go with s. Just to be different from the default, but not as high as the neutral. So we're giving 'em credit for some really high margins here. The point of this analysis is that we don't really need to be picky about this either.

We can do an infinite number of scenarios, right? We save this off and it's going to take us about, it's probably going to take 30 seconds before this shows up, Pete slow. But we save this off and then we're going to be able to see the results of a different forecast scenario. The valuation of the stock.

And that's the part I think is so interesting, is that you can put in your own numbers whatever you want. And a lot of times when I'm doing this with clients, we put in outrageously optimistic just to see what that means, or outrageously pessimistic for stocks. We like to see oh wait, if we assume a worst case scenario and the stock still looks cheap.

Man I think there's a lot of safety in that, a lot of margin of safety in that if I assume a best case scenario for the future and the stock still look expensive. I probably don't want to be in that stock. Maybe I short it, who knows? So how would somebody, or maybe for the next call, David, maybe next week, we can take a look at some stocks that might have very realistic numbers where the terminology where maybe it's undervalued at that particular moment that we're looking at.

Yeah, Pete, let's, we can absolutely, that would be a long idea. Stock. We should talk about some of those. Okay. We publish publishing a new long idea this week that we can go through and do that exact kind of analysis. JP Morgan is similar to that, but the I can share my screen on the new scenario for ibm.

And what you see here, everyone is that remember the default scenario. And we put the same revenue growth numbers in for the neutral scenario, right? We made them the same, we just made the neutral scenario have a better margin. So you can see profits are higher sooner, right? Implied share prices are higher, sooner.

And so your market applied gap is about half or 10 years because you're saying, Hey, ibm, we're going to say it's going to grow the same but I believe it's going to be a higher profit margin. And you can see here that even though you're only looking out 10 years, you're still looking at a 1.8. R Y C minus wax spread as opposed to 1.7.

And your growth rate over that shorter time period is a little higher because in the out years, the revenue growth rate was going down. So when you're looking at 22 years, you're going to have a slightly lower average revenue growth rate over that timeframe. So it's just a quick example of how to use the model to understand the impact of different assumptions.

And Pete, to go back to your point, this is the, I think this is the fun part of investing when. Have all this conversation around what new product, what new strategy, what new store f footprint what new delivery model is going to help us grow profits? And you can link those conversations back to, okay, this is what the margins and revenue growth has got to be to justify the price.

Now link me back to the product strategy or the distribution strategies that's going to help you get to those margins and growth. Yeah, that, that stuff because I'm an entrepreneur for now, almost 40 years. So that kind of stuff is really what I geek out. Maybe we'll do it next time. David is we'll pre-plan, maybe if you have a couple of things or maybe just one that we can go into depth on the long side.

But we've mentioned Michael Porter and competitive advantage a few times. Maybe I'll create like a slide or two where we'll give it a little bit of context for everybody on what the five forces mean and how that those triggers would affect whether or not the growth projections have a chance of being there or what could possibly change 'em.

I think that's a fascinating thing, whether it's mar competition new products, All those kind of things were what, however it ends up affecting the company. I love that kind of stuff because you start, you read a headline differently now, like I, I've been so fixated on Tesla lowering their prices. Since the delivery number a couple of weeks ago that I was telling everybody in my community, that is not good.

I don't care how much you love Elon Musk, and you obviously can look at him with admiration for every, he's the richest guy in the world, so obviously only so much you can that's a good thing. I don't know, but lowered lowering the prices and you're start now we're starting to see the margins coming down.

That's not good. And again, everything we're talking about is for educational purposes. It's up to everybody to make their own. But those are reality of what's going on right now. And that's not even, that's not even factoring in the wave of competition that where nobody wants a lot, there's going to be a lot more choices than paying 75, 80, a hundred thousand dollars for an ev.

Yeah, just to have. A certain logo on there and what's going to be interesting to see how that plays out as well. Exactly, yeah. And maybe you can ask your community for some suggestions or requests if we can do this reverse d DCF analysis on some of the stocks that they're interested in. I've, I can easily go through our focus list and give you some long ideas where expectations are low.

Okay. You know what, I'll run it through my community. We'll get a consensus. We'll make everybody vote, and I'll give you the top two and you can take it from there. Beautiful. All right, David, thank you so much. Really appreciate it. Yeah, my pleasure, Pete. Thank you. This was great. Have an awesome day.

Thank you everybody.