The Daily Ticker: EP8: The Miracle Trading Plan You Need To Know

What if you could learn trading, with lower risk, faster account growth and with much less stress? Well it's possible, and you can do it even with a small account.

It's not only possible but it's just smart.

When I started trading in 2000 I was taught to find a good trade and get size. “It’s better to have one big position…”

I believed it, the guy sounded smart and he was persuasive. It’s bullshit. Here’s why-

Trading is about probabilities, not whale hunting. Sure it sounds great to hit a big trade, and then brag about it. The problem with this advice is risk and sample size.

You are accepting incredible risk on a one-shot trade. This guys focus was on the profit side, and how much we could potentially earn if that one trade worked out. It was basically all-in.

A huge problem with this concept, especially for new traders, is that you don’t have enough experience to make that decision.

In today's episode we explain how to get control of your trading and let your edge do the heavy lifting. We also break down sector rotation with a few new ideas.

Pete Renzulli | Stock Trading Pro

https://stocktradingpro.com/invite

Visit our YouTube channel for training. Be sure to subscribe. https://www.youtube.com/c/StockTradingPro

Follow Me on Twitter:

https://twitter.com/PeteRenzulli

Contact:

[email protected]

Disclaimer:

https://stocktradingpro.com/disclaimer/

Could Trading Stocks Help You Become Semi-Retired?

Learn About The NY METHOD

Learn to Trade Stocks:

Enroll in our trading boot camp...

Join us 7:30 AM for the Stock Market Live Stream (Monday-Friday)

Be sure to SUBSCRIBE to our YOUTUBE channel and hit the LIKE button for updates.

Ready to Uplevel Your Trading?

Schedule an Interview with our team today:

https://stocktradingpro.com/stock-trading-pro-coaching-call/

🥇 Smart Money Tactics | Order Flow Trading

https://youtu.be/MOYNbC_HERE

🥇 Finviz Screener | Find the Top Stocks to Buy Now

https://youtu.be/K5JZNCWIhZo

🥇 Sector Rotation Trading Strategy

https://youtu.be/lcB83RcN23Y

🥇 Swing Trading Strategy | Candlestick Charts

https://youtu.be/2pmYj-Gqm1k

🥇 Tape Reading Explained

https://youtu.be/Jqup9n8BifM

Contact:

[email protected]

Disclaimer:

https://stocktradingpro.com/disclaimer/

Hey everybody, it's Pete. Welcome to today's episode of The Daily Ticket. We're going to break down sector rotation today, give you some of new ideas. It does look like the market is slowing down just a little bit. The s and p 500 hit that resistance level. So heading into April 19th, 2023, it looks like we're going to see a little bit of profit taking.

However, what I want to talk to you about today, I'm going to start out with is what I call the Miracle Trading Plan. I got a question for you. What if you could learn trading with lower risk, faster account growth, and with much less stress? It's not only possible, but you could even do it with a small account.

Not only possible, but it's just damn smart. First, I want to start out talking about what actually, the reason is that we place trades. Let's define what it means to have an edge. An edge means something happens most of the time over a larger sample size, so that means that if we have a track record or something that's back tested, I prefer, quite honestly, I'm not really a big simulated traded person.

Maybe you can back test it a little bit, but let's say that you have a track record with real money. Okay? An edge means most of the time it happens, sometimes it doesn't. So that means every time that you place a trade that matches your edge, that higher probability outcome, there's a good chance.

It's going to move in your favor. All right. Then there's a whole bunch of stuff after that, which is trade management and that kind of stuff, and how you manage your profitable trades, making sure you kick out the losers to make sure the math works right. However, we want that definition of edge. Most of the time it works, sometimes it doesn't.

Okay. When I first started trading, I was taught to find a good trade and get size. Now, we were doing a lot of ECN rebate trading back then, but we were very much taught it's better to have one. Position, and quite honestly, I believe that the guy sounded smart. He was persuasive, and quite honestly, it's bullshit.

I'm going to tell you why trading is about probability is not well hunting, not going for that one giant trade. All the time, especially for new traders. And that's really the point that I want to try and get across here. And I just want to define new as somebody who has not yet achieved consistent probability, let profitability not has not achieved consistent profitability.

Look, sure, it sounds great to hit a big trade and then brag about it, but the problem with this advice is risk. And sample size. You're accepting incredible risk on a one-shot trade. Yeah. Yeah. I know you're going to be disciplined on their losses, but if you're a newer trader, you're, you don't think that way yet.

The goal is to learn trading, to develop your skills. This guy's focus, who gave me that suggestion was on the profit side and how much we could potentially earn if that one trade worked out. It was basically all in, we were all in on every trade. A huge problem with this concept, especially for new traders, is that you don't have enough experience to make that decision.

How is a new trader supposed to know what a great trade looks like? And at that stage, we're still learning how to read the tape and place orders, never mind understanding when we should be accepting bigger risk and putting more money into a trade. The second dimension to this BS advice is sample size and experience.

New traders should seek experience and feedback when you start, not profit. Look, I know that sounds counterintuitive, but hear me out. How many positions do you trade at the same time? If I told you that a month from now we're going to significantly reduce your position size, but you will be 10 times further along in your trading skill level to the point where you are scary, predictable with being able to produce positive p and.

I'm going to tell you how I came to this epiphany on my own. A few years back. I started using a software that forced you to build a list of stocks before you could run scans on those stocks, right? So, you need to actually create fake positions. So I bought a hundred shares of every stock to build the quote unquote portfolio.

And then within a month, the 100 share positions showed me a positive p and l of $4,375. Yes, that's the exact. And I have to be honest, I wasn't paying attention to the p and l because that wasn't the reason, I built the portfolio. But I was stunned. My mind started to race, and I started to say, how is this possible?

All of these years? I was trained to need big position size and turn that into big winners and that kind of stuff. But a deeper look into the positions I saw there were winners and losers. Now this is the key, but the total was positive. I was pleasantly shocked, but it brought up so many more question.

So I wrote in my journal, if trading is about probabilities and probabilities are founded upon having an edge, let's purposely trade to a larger sample size of my best trades. Let's take every trade that matches my criteria for only 100 shares. The results were, quite frankly, mind blowing, but not in the way you're thinking, yes, I made money, my stress level was gone.

Think about that. Think about that. My stress level going down, reducing my shares, and producing consistent p and l, isn't that really what we all want in the first place? I no longer felt naked watching one position. No longer every uptick or downtick was life or death. And think about this. I'm sure you experienced this right now, if you're cutting your profits short, you're probably focused too much on the p and l and not on the trade itself, which is what we want.

We want the skill of learning how to trade and trading big size every single trade. You're not learning, you're just focused on that moment of p and l, and our goal is to make better decisions so we can eventually get to the point where we can then understand when to push your position size. Ironically, what we actually want is that consistency.

So in the beginning, you need to actually learn how to trade so that you are around long enough to understand how to trade bigger and when to hold longer. But if you're constantly pushing that share size and only focused on the p and l, you're not actually learning. You're just focusing on the result and not the process.

Which is what reducing those shares down to a hundred per trade at the beginning is what I call the Miracle Trading Plan, without even doing anything different than you're probably doing now, other than position size. So the odds were my favorite because I understood tape reading and order flow and how to put the right trades on, but I was also speeding up my probability cycle by executing what I called a batch of.

Perfect trades, 10 trades that match my strategy and boom, putting them on without hesitation. Now, I hate to use gambling analogies for trading because it goes off in so many different directions, but in this case, it's spot on. Look, think about it. Why do casinos have thousands of tables in slot machines?

They have a small edge, and they want that edge to play out as often as possible, and that's really our goal in trading. Look, I'm not saying you should start trading six to 10 positions at once today, right away, but start out with. Instead of just taking that one position, letting that play out, think about this.

If the definition of edge is allowing the trades to play themselves out over a larger sample size, and most of the time that's going to work, even if you go from one position to two of a hundred shares, you're actually doubling the speed at which your edge will pay you done properly. It's your edge that does the heavy lifting for you.

So look, think about the definition of edge and say goodbye to stress. And guessing he doesn't know it is a guess either. That's actually a big part of this as well. Think about how many times you are afraid to put on a trade or you're hesitated because you didn't know if that trade was going to work.

Get, that's no longer an issue. Now when you do this because you don't, nobody knows if each of the next trades are going to work. We only know over the next larger sample size of good trades that over that larger size. Results are predicted, predictable can, if it's a good idea and if it matches an edge that's back tested or proven with a real track record.

So over, over a large sample size, your results are predictable, provided you cut your losses and understand how to manage size and manage your winners. But what's interesting is that the definition of edge and applying. More trades where you're actually trading more to make more. In my experience, this is the quickest and most reliable way to accelerate your trading skills and ultimately grow your trading account.

So again, I just want to really bring this point home. Trade by trade, even in the context of a good idea that matches your strategy, trade by trade, the results are random, and You think about the last time you put on two trades that looked exactly the same, one trade did exactly what you thought, the other one went in the other direction.

Same exact trade, same exact strategy. That's just the edge playing itself out. But you put too much negative focus on the ones that didn't follow through for some reason. I have no idea why, but this is really given a bad wrap on breakouts. Breakup breakouts don't work. Breakouts don't work. They're just a part of the strategy.

They're a part of the sample size. So really just think about this and I want to leave you with this part before we get into a little bit of sector. The way to accelerate your skills, use the Miracle Trading Plan of 100 shares and trade more often. Don't hesitate when your strategy gives you a good idea.

Put it on and think about the larger sample size of allowing the edge to play itself out. I promise you it will be one of the most lives changing. Trading decisions you could possibly make because now you're actually going to be focused on learning how to trade and letting your edge do the heavy lifting instead of trying to predict if each and every trade is going to make money.

And quite honestly, worrying about each and every trade and whether or not they'll make money, each trade doesn't need to make money. Each trade over a large sample size is a part of that edge. So, sector rotation today, obviously Wednesday, April nine. Th look. Technology cooled off a little bit, but they have some good ideas.

We've got some new breakouts today. If you haven't been watching the Solar Sox, they're absolutely perking up. Probably e NPH is at the top of that list for us. And phase energy. Apple's still breaking out, Oracle's still breaking out, and even a old school dude called Dell grabs some bullish order flow that was previously focused on amd.

AMD seems to have cooled off a little bit. But it's the almost unbelievable news for Nvidia yesterday that should have had your attention, a double upgrade and a hundred percent higher price target. That, quite frankly, almost sounded comical, but it was real, and the stock got some bull order flow.

Industrial stocks are catching a bit again, this time without Boeing and without Caterpillar, which carried the market probably the whole end of 2022. Right now, we have C X T R E X. And Raytheon rtx, we can throw B L D R into that list as well. Both, all though, all four of those stocks have actually had some bullish order flow since March.

But let's face it, the leader of the pack remains ge. If you didn't see what we put out yesterday, GE has not closed below. General Electric has not closed below the daily 20 periods. Simple moving average for 2023, which is now going on three months plus 19. Has not closed below the 20 period. Moving average through all of the back and forth.

Talk about recession and everything. Just an absolutely amazing stock right now. Another three consecutive well bid candlesticks closing near the highs, higher highs, higher lows. I can't remember the last time I've seen a stock with this much. Persistent buying and zero profit taking is just absolutely amazing, and it doesn't have to be a high priced, volatile stock.

It's just continuing to go. And this is really where understanding order flow and tape reading can really make a big difference for you. Where you're not guessing, you're not predicting, you're not forecasting, you're just saying, what is happening now in which stock is doing exactly what I wanted to.

And GE can say that, gosh, almost going all the way back to October of 2022. It's just amazing. Wanna slide over a little bit maybe talk about financials a little bit. Since digital assets are in the, technically in the financial sector, crypto stocks, I don't, I haven't traded crypto myself, Bitcoin or anything like that, but I do actively trade crypto stocks, especially mining stocks.

Mera, marathon and Riot, R I O T A, low price for provided some amazing percentage gains, the last four. And since digital assets are gaining our attention, two stocks that are in this area that I typically trade are a mess right now. SQ Block and Coinbase, they're digesting some bearish news and without a bias.

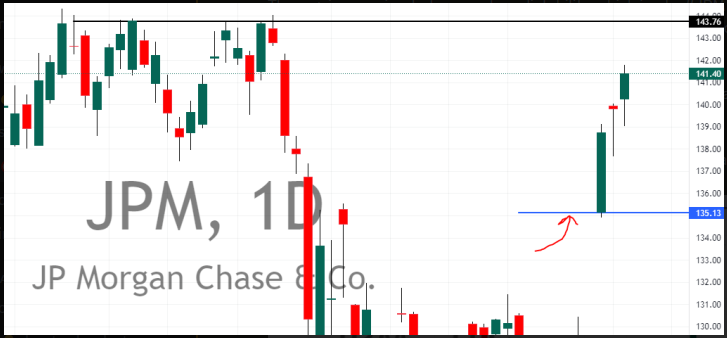

So, it's a fortunate rally that we're seeing right now in Merit and Riot. They're actually up some pretty big percentage gains. Marrow is actually up 20% in two days. And for a 10, 10 to $13 stock, you can get some decent size in there. So, the games are nice, but we want predictability, which is the next thing we're going to talk about, which is JP Morgan and Citigroup, they have to be on your radar every earning season.

We outlined a plan to trade stocks after their report. I just think it's a much, much easier way to trade that unpredictable volatility. And JP Morgan produced another well bid day that closed near the high. Now three consecutive days after earnings. Gosh, learn this setup and start planning your trades.

It's just an easier way in my. And the way I trade it to trade earnings instead of watching all the back and forth, the nonsense as the algorithms digest the news as soon as it comes out. So that's what we got heading into Wednesday. Welcome and thank you for joining us in our community, and I hope you're enjoying these lessons in the daily ticker.