Help! This profitable trade is boring me to death 12-16-22

Welcome to today's edition of The Daily Ticker

There’s too many confused people in the stock market. Losing much more than they should. It’s ugly out there.

Confidence shaken and wondering if stock trading “works.”

I’ll bet you think I’m talking about the bearish tone to the market. I’ll bet you think I’m talking about the tsunami of news and economic data and confusing earnings reports!

No.

I’m talking about your stock selection.

I’m talking about unforced errors.

I’m talking about the lack of respect you have for the profession.

Yes, trading stocks is a profession. That doesn’t mean you need to quit your job, it means you take the task seriously.

It means that you are putting in the time and effort in an attempt to take money from the smartest minds and algorithms in the world.

Many forget why we trade, why we opened a trading account, and instead chase excitement. They chase complicated (unreliable), they refuse to make plans and instead act spur of the moment expecting a consistent outcome.

Ah consistency, that magic place we all want to visit.

============================

After 23 years I’ll tell you where consistency comes from.

Rules.

The consistency you crave comes from making rules (a strategy) and then following them, all of the time.

Consistency does not come from the market. It does not come from technical analysis. It does not come from having 6 monitors and 20 indicators on your charts.

It comes from learning the mental side of the markets. It comes from a belief that every trade is feedback to improve on your next trade.

It comes from paying attention. Paying attention means going deep into your P&L and seeing what’s working and what’s not.

Which brings me to the inspiration for today’s commentary.

Yesterday’s coaching session, a hard working, passionate trader made a statement (for the second time) that makes you realize how easy it is to forget that we’re here to make money.

I’m paraphrasing to protect the innocent: “I had to do everything in my power to have the patience to hold that slow moving, boring stock that grinded in my intended direction, and was making me money…So I decided to jump into this news driven volatile stock and proceeded to lose money in literally one minute. Can you help me learn to trade the stock that just slapped me silly?

This trader has lost sight of why we’re here.

==================

You probably won’t believe me, but I trade the boring stocks that are easy to read. As do most professional active traders.

We do this to pay our bills. It’s not a hobby, it's a skill.

Many struggling traders have lost sight of the obvious, something taught in every trading book trading back to the early 1920’s.

Trade the market leaders.

Trade the stocks with predictable institutional attention. The stocks that match your current resources, skills, and risk tolerance. The stocks that match your current track record of profits.

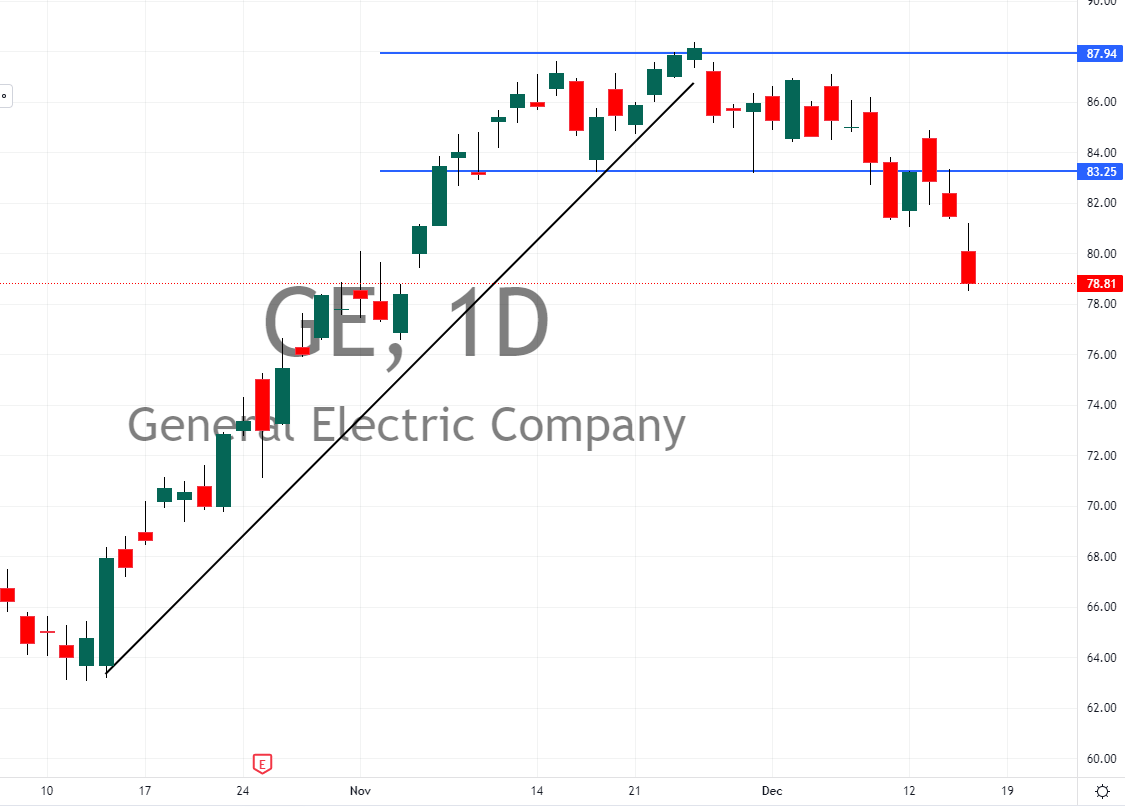

#GE. A boring stock. Slow moving for sure. But the stock that had most of my attention, and where I earned most of my P&L for nearly five weeks.

By the way, slow moving is subjective. When you get 5,000 shares of a “slow stock” the volatility ratchets up considerably as your P&L fluctuates.

Same goes for #BA. Have you focused here the last 2 months? I think the chart will shock you.

How about boring #IBM?

Mostly strong bullish candles for five weeks. Did you get some? Did you stay there?

Why do stocks move up and down? It’s because those with deep pockets and teams of research analysts decide to give those stocks attention. So when they do, so do I.

The very first thing I do each night when I start my 90 minutes of research is assess the market, and the sectors. I’m looking for easy money.

I’m working my way up the power pyramid (see below) to see how much order flow I can stack into my idea.

For six to seven weeks we discussed the Dow was the strongest index, and that industrials were leading the way. So that’s where my attention was.

The market leaders in the strongest sector, following the market.

Not much reason to look elsewhere, if that’s where the smart money had attention I gave it my attention.

For a while I traded #SQ, or #AMD every week. But when they became less obvious I stopped. I didn’t keep trading them, and then BLAME the stock or the market.

I simply paid attention.

So ask yourself this question heading into the weekend. Are you trading for excitement or to get paid?

You’d be shocked how many people make this glorious endeavor more challenging than it needs to be. Especially when it comes to indicators. Less is better. How many watches do you need to tell the time?

From a second coaching call yesterday a new phrase popped out of me from a trader who hesitates, and lacks conviction. We coined the term “earned conviction.”

How do you buy or sell without hesitation? Do the work.

How do you know when to hold good trades longer? Do the work.

Spend fifteen minutes searching for the smart money, the deep pockets, and make a plan to join them.

Earned conviction. My new favorite phrase.

Pete