The Daily Ticker: EP10: AAPL & NVDA Growth Potential – David Trainer

On today's episode of the Daily Ticker David Trainer breaks down the current stock price of both AAPL and NVDA to determine if buying these great companies at current levels makes for a good investment.

When this epoxide was recorded (5-3-23) AAPL was near all-time highs and scheduled to report the next day. And on April 18, 2023, NVDA received two upgrades and a price target raise of 100% by HSBC. (See article below).

David reviews optimistic scenarios, and likely scenarios for both companies.

It's fascinating to see the New Constructs analytics , the raw numbers (based on historical bests versus norms) for these two companies.

David demonstrates growth rates for both margins and sales to determine what the current stock price implies about future growth.

NVDA Articles:

https://markets.businessinsider.com/news/stocks/nvidia-stock-jumps-on-double-upgrade-and-100-hike-to-price-target-1032239370

https://seekingalpha.com/news/3957259-nvidia-stock-rises-hsbc-upgrades-pricing-power-ai

DOWNLOAD PODCAST RESOURCES

Pete Renzulli | Stock Trading Pro

https://stocktradingpro.com/invite

Visit our YouTube channel for training. Be sure to subscribe. https://www.youtube.com/c/StockTradingPro

Follow Me on Twitter:

https://twitter.com/PeteRenzulli

Contact:

[email protected]

Disclaimer:

https://stocktradingpro.com/disclaimer/

Could Trading Stocks Help You Become Semi-Retired?

Learn About The NY METHOD

Hey everybody. Welcome to Stock Trading Pro. Welcome to a new episode of The Daily Podcast. We actually have David Trainor here with us again. How's it going, David? Doing great. Good to be with you, Pete. Interesting day to be involved today. We obviously in the full swing of earning season last week or this week with JP Morgan and frc.

A lot of people talking about. It's contained, it's not contained. There's a lot of buyouts on the horizon from what we're reading in the news right now, but I think the big story right now and the big three things we're going to talk about today. First, we're going to talk about the FMC announcement that just hit, we'll touch on that a little bit some of the statements from Jerome Powell, but more importantly, I think probably what everybody's tuning in for is Apple earnings are scheduled tomorrow on May.

Fourth after the close. And then we're going to actually dive a little bit deeper into a stock that reported a little while ago and had a double upgrade and a 100% you heard that right? 100% price Target raise, and I'm talking about Nvidia. So I guess we'll start out with Powell very quickly and talk about what happened today with the.

Expected and really nothing shocking about this at all. For anybody who happens to be a day trader at this point, watching this nonsense going back and forth this afternoon it was about as crazy volatile with nothing going on for about two hours. And I know that's not your universe, just so everybody knows that.

David's more on the investing side of things. I'm more on the tape reading side of things. I actually have, as a part of my community in my personal trading plan, where I don't even touch this nonsense no matter what the volatility is. Everybody was waiting a baited breath on what he was going to talk about today.

And it really came down to, I think this was probably the biggest thing. Are they going to give some language around whether or not. A cut was coming at the very least, stop, and everybody was expecting that. If he says, stop, nevermind. Says cut. Massive bull rally expected. We got the opposite where he literally wouldn't commit to anything.

Do you have any insights or thoughts on that, David, as far as, do you really look at the macro picture at all or is it mostly just focused on with the actual earnings? No, we can't put our head in the sand on the macro. It makes a big difference. And it's certainly made a big difference in the last 20 years when we had enormous amounts of.

Of fed and fiscal stimulus just pouring into the economy. And it was we had to acknowledge that fundamentals just didn't matter a lot. And that's why we didn't create a zombie stock list until June of last year. And but our long ideas were always focused on fundamentals.

And look, I think Fed, I think fed Chair Powell woke up. A year or so ago and realized his legacy was going to be really pretty tarnished if he didn't do something. And I, and as soon as he started thinking down those lines, in my opinion, he recognized the need to raise rates, but to do so in a way that was different than had ever been done before.

Not to do it violently and quickly. Only to cause the economy come to a screeching halt and take a nose dive, which would mean they'd just have to turn around and lower them again, which is what has given rise to this whole by the dip mentality, which is nothing to do with actual fundamentals, just pure trading.

And I think you recognize that look, a slow, a slower, more deliberate approach was not only what would establish a better legacy and a lasting improvement to the markets for him, but also what was necessary to change behavior. Behavior that it, that drives a lot of inflation. And I'm talking about inflation and asset prices and inflation and investing in general, which causes a lot of capital chase after low returns and lose value, but still drive prices up.

And so I think that, that's the mentality that I think people are slowly coming to accept is that, yeah, we're bringing, he's been inching them up, but it's going to stay for a while. Because it's going to take a while for a lot of this really sticky inflation to come down. Unwinding 10 years of free money, for lack of a better way of putting it, it's not going to happen quickly.

It's interesting. You just made a really interesting insight about the speed with which he's doing it as opposed to crashing the market, getting it all over every single day in our community. And a lot of people that I speak to on social media, they're all talking about this is the most organized.

Bear market we've ever seen in our life when all you're seeing is all of these recessionary headlines and interest rates and employment and nothing is pointing towards a rally. But we're not crashing, which is the traditional bear market. Let's just get it over with. And quite frankly, I think from a big picture, soft landing, it's not really a soft landing it's more one giant nine month cushion.

At this point, we're just sliding sideways. I think it's probably the best, it might not be the best for short-term active trading, but from a bigger economic picture and not spooking the heck out of everybody, I think he's doing a great job from that perspective. 1000%. You said it a lot better than I did.

I think that's the smarter, better way to go. Because if you do try to reverse 20 years of mal-investment and low rates, you just, you're going to kill everything. You're like, it's like taking a hammer to an ant, and that's just not what you want. And so to do it in this more gradual way, I think also has a better societal impact in that.

I think it changes behavior long term in the way that we need to change behavior. Yeah. Inflation hasn't gone down in, in a dramatic way with the interest rates, but the interest rates haven't been dramatic either, so they're working in lockstep right now. I think the last time we had something super dramatic in the other direction was probably Paul Volker in the late seventies, early eighties, when, what was it?

I remember when I first got into the business and I was selling mutual funds, we actually would go into somebody's house. It was 18 and a half percent interest at a bank for a one year cd, and they gave you a grandfather clock. That's how crazy it was. Late seventies, early eighties at that particular time.

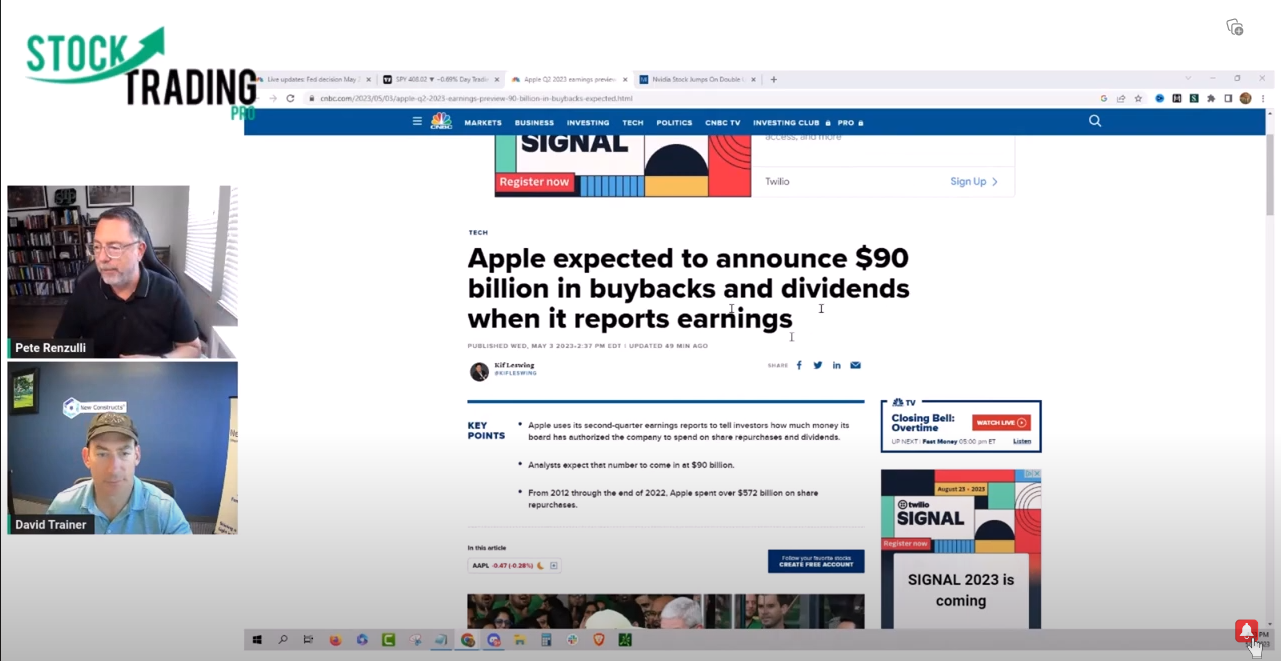

It was almost impossible. So anyway. All right, so let's hop into the next topic, which is apple. Apple earnings scheduled for after the close cn. B C here is reporting that in addition to reporting the earnings 90 billion in buybacks and dividends is what they're claiming is going to happen tomorrow.

Look, apple, I think, is notorious for going all the way back to Steve Jobs. This was like a big thing on the trading floors where he would always under sell what was happening and then they'd always beat it and he looked like a superstar. Seems like Tim Cook has that same playbook. Where are we now?

It's not that far from all time highs. Yeah, no. Yeah, Pete. I if you want to share my screen, Apple's a good example of good company, but not necessarily a good stock. I think you're right. I love it when management teams are under promising and over-delivering.

It's a smart way to do things. The stock price has really gotten expensive. And you can see here in our rating, look, the quality of earnings are great. 71% return on domestic capital is tremendous, right? Wow. And, but you get out here to the farther to the right and you see the valuation is really starting to kick up.

And I'm going to go in a deep dive on that here in just a second. But what I wanted to point out is that while this return on invested capital of 71% is amazing, if you go back over history, You can see that, it's actually not that good compared to what it was and it's in a pretty significant decline.

What was as high as 142.6% just a few years ago. I know. And deeper in the model. In fact, if we go to the model here and we go back to the metrics page and we look at return on invested capital, believe we can go back almost to 1998. And return on invested capital though for Apple when things really started going well for them was in the 300 ranges.

Wow. Look at this. 380%, 300, and it dropped a bit and then it went back up to the almost 300 again, and it's really been in a pretty significant decline ever since then. So what that means for the valuation. They said, I think we need to maybe be a little more sober about what the future holds for Apple.

It is a big business and it did have abnormally high returns on invested capital for an abnormally long period of time. So what I'm saying here, Pete, is don't get me wrong, Apple's amazing and 71% is amazing, but we are in a pretty much a structural decline. Competition is tougher and there's just not as many ways for them to wow the world with new products.

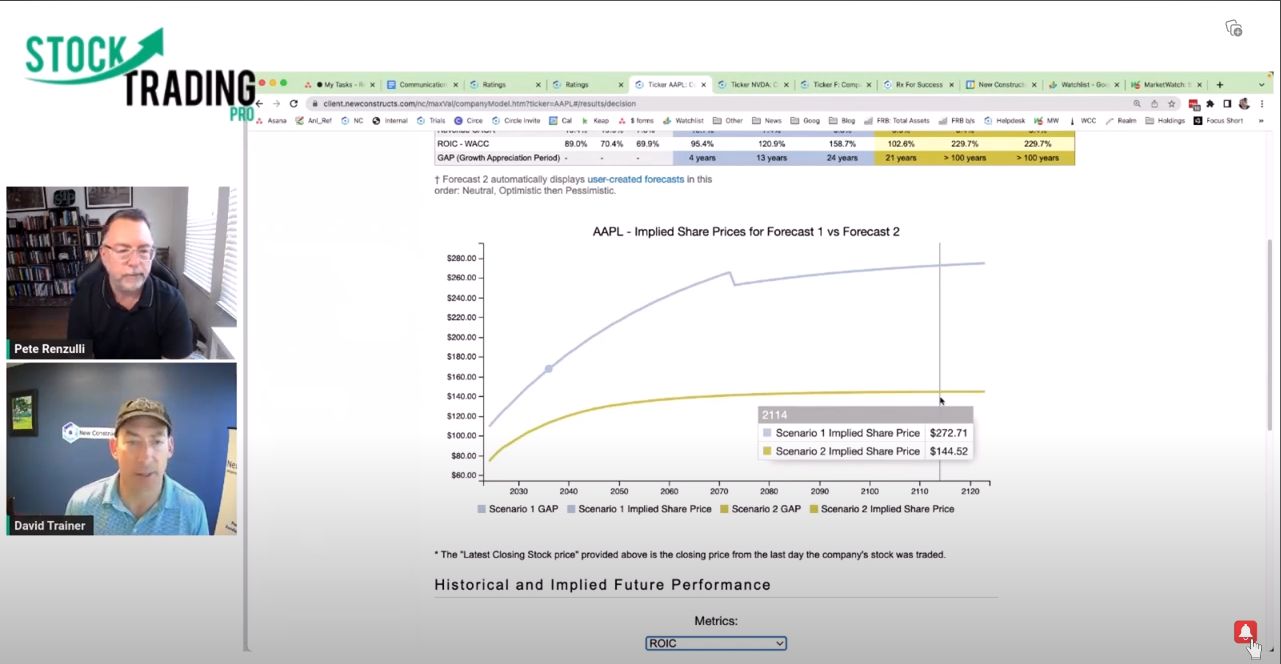

That's not to say they won't continue to be profitable. But how profitable does a stock price imply that they're going to have to be? So let's do some analysis on that. W when we run through our neutral and our default models we can't get to a DCF result that produces a value equal to the current stock price over in a hundred year timeframe.

Wow. Now I created a more optimistic scenario. That shows how they can get to the current stock price, how we can get to the current stock price for the 13 year growth appreciation period, which we talked about and defined in our last meeting or our last podcast. And that's really the number of years that the company's expected to grow profits.

So if you expect them to grow profits for 13 years, They got to do. With a 7.4% revenue growth rate and 121% return on invested capital versus cost of capital, now that's a meaningful improvement from 71% because the cost of capital for apples around six or 7% right? So this optimistic scenario implies a really big jump in margins, and I'll show you exactly what I mean when we go to the forecast page here and we can look at the implied margins for each scenario.

You can see here in, in the default scenario you got around 30 this neutral scenario, we could ignore that. I don't know why who put a zero in there. That's an accident. But you can see in my optimistic scenario, I jammed it up to 40% margins. And let's go back over time. All right. We go back.

Over the last six years, the highest margin we ever saw, 30, 31%, 31.4%. Wow. Going back even further, we got to 35%. Going back even further, we're in the negatives. We're in the single digits. This is the old apple. So 35% is pretty much the best ever margins, and we know margins were really good for Apple and way back in the day when they had those 380% returns on invested capital, right?

So a 40% margin while also growing revenue, right? Best ever margin by a long shot, right? Over the next, all the way out into the future, that's what's required to. Run a DCF that will get you a stock price remotely close to where the, to where it is today. And the, another key point here is that in, if you believe for the stock, it's going to have much upside from where it is now at 168 bucks.

You've got to assume either even higher margins or faster growth rate or longer gap. So if we go from 13 years to about 20 year gap, we're still talking only about 183 bucks a share. Just not that much higher than where it is now. Yep. So the big thing here then is we're not coming up with the projection off the wall.

This is the 40% is off the charts literally from what the stock has historically done in a very different environment when they were coming out with the iPad, the iPhone and all of those things. And now they're let's say I'll use my language, I'm not quoting it. The best company in the world right now.

Where are they going to go from here? It has to either be something dramatically different market conditions changing, dramatically different to get to those 40% margins, which would basically imply at this point, there's two different ways that people are investing. They're either investing for capital appreciation, stock price going up from where they're currently buying it, or dividends.

So based on. This basic analysis at this point, what we're, it's what we're essentially implying is the upside for growth, where you're going to put that on $160. Stock versus dividends. That's right. That's really what it comes down to. If you're looking to buy at 160, whatever it is right now, 1 68, 1 68, where's the upside?

And based on those margins, the upside. You got to really think about whether or not that's likely, that's the language that I use all the time, not definite likely. Is it likely for that to happen? Yeah. And I think when you look at a business that's as competitive as what they're in and where returns on capital have been in the past and where they're going, I would say, is it possible.

For a company, right? Everything's possible, but I You're right. That's exactly the way to put it, Pete. And that's what I believe that our, where we sort of synergies and our approaches here is that, you're putting it, in, in terms of more lay layman's terms. And I'm providing the math.

That says, here's, how to understand how likely it is, here's what they got to do mathematically, operationally to beat the current stock price. And that's actually what I love about the way you do things because you're not forecasting, you're saying what do they actually need to do to justify the current stock price?

What is the current stock price implying and then back backing that out to what it's actually done in the past in a very different environment. And that 40% margin is off, literally off the charts compared to back then to where we are now. So it's really something to chew on regardless of the dance back and forth that Apple will have as every stock does.

After the e P s gets announced and they talk about what they did, they talk about the guidance, they put flowery pictures on everything, it still comes down to what's likely going to happen. At the current stock price For as far as appreciation's concerned? Yeah. What kind of performance does the company have to achieve to do better than what's already baked in, and how likely do you think that is?

That's what every investment decision from a fundamental perspective boils down to Pete. And what's super interesting about Apple specifically is they've always been able to reinvent, right? They have all these other digital assets. Right now the only big, real exciting story about the possibility of Apple is a car.

And car companies are not exactly booming right now with ridiculously big margins. So adding an apple car is not going to increase the margin. So anybody who's got thinking like in the back of their mind, the apple car is going to change everything. No it's a giant computer. It's hardware. It's not downloading a song and they're getting paid for it.

Yeah, that's right. If you want to look at returns on capital for car companies, And they're not even that, you're talking signal digits. What's the ticker for Toyota?

We can edit this out, right? I actually haven't traded Toyota. Hold on. I can look it up. Yeah. PM. So t Toyota, the most profitable car company, one of the most profitable car companies all ever, yeah. You're talking single digits. And even if, I think we look at Tesla, so if everybody thinking the car, the apple car is going to change things, you got to really think about what the margins are in that, and even Tesla.

And we think this is a very inflated number, 25% because they've been cutting back on r and d like crazy. And some other things that are not exactly toward, you're, the returns on capital are lower if you're going to get into the car business for sure. Interesting. All right.

So without knocking anything going, Apple's the best company in the world who doesn't have something Apple in their house. Maybe 3, 4, 5 different things. It's not a knock on the company. We're talking about what's likely for the next appreciation if you happen to be buying it at the current price. And you really got to think that through.

That's right. So I guess we'll move on to the next super. What I believe is super interesting this news story that came out on Nvidia April 18th in my trading floor. We were reading it pre-market and we were like, are we seeing that? Correct? Upgrades of course, right? Not a big deal. Of course, that happens all the time, a hundred percent.

Hike to the price target now, just if somebody happens to be watching this at some point in the future or just, map out what NVIDIA's done for 2023. Basically, I believe it was a hundred percent or pretty darn, close to a hundred percent when this came out. In April. Yeah, about a 96% move prior to that.

I would say incredibly aggressive call. I don't know, but coming up with the numbers from where it was at that point, boy, I know AI is a hot story and chat, G p t is everywhere and there's everything that's going on with a ai. But that would put that stock at, almost, at that particular point that would put the stock at $550.

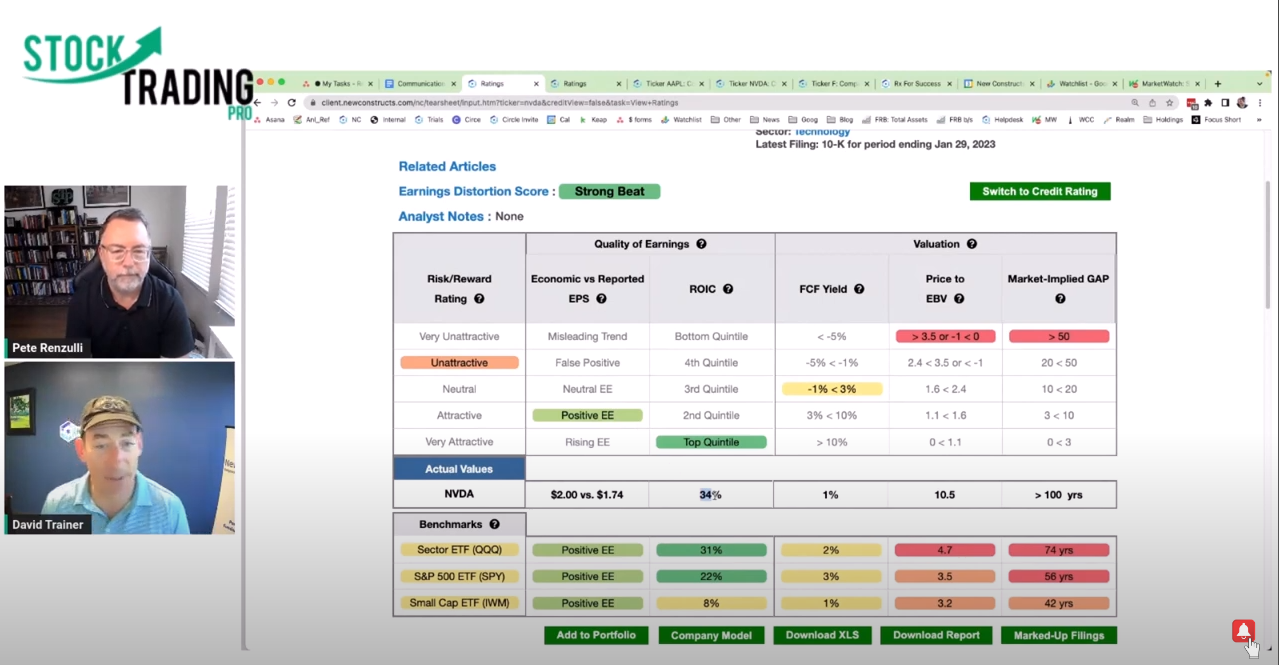

Double where it is now. Yeah. Pe I think we should do a similar exercise on Nvidia as we did with Apple, right? Let's get a sense of where the company's been and then how likely do we think it is that it will be able to achieve the performance required to justify a $550 stock price?

And I'm going to show you that. So let's start big picture, type in a ticker here and you'll get our rating. And it's similar to apple. In terms of being a good company, right? Now returns on capital at 34%. That's not 70%. It's half of where Apple is. But the valuation is more than double where Apple is in, interestingly, right?

This is really expensive stock, and if we're looking at historical levels of profitability, You can see we, it's on a downturn compared to where it's been in the past. Return on the Vesta capital is trending down as well. Get a super competitive business. I think AI is going to be attracting a lot of capital.

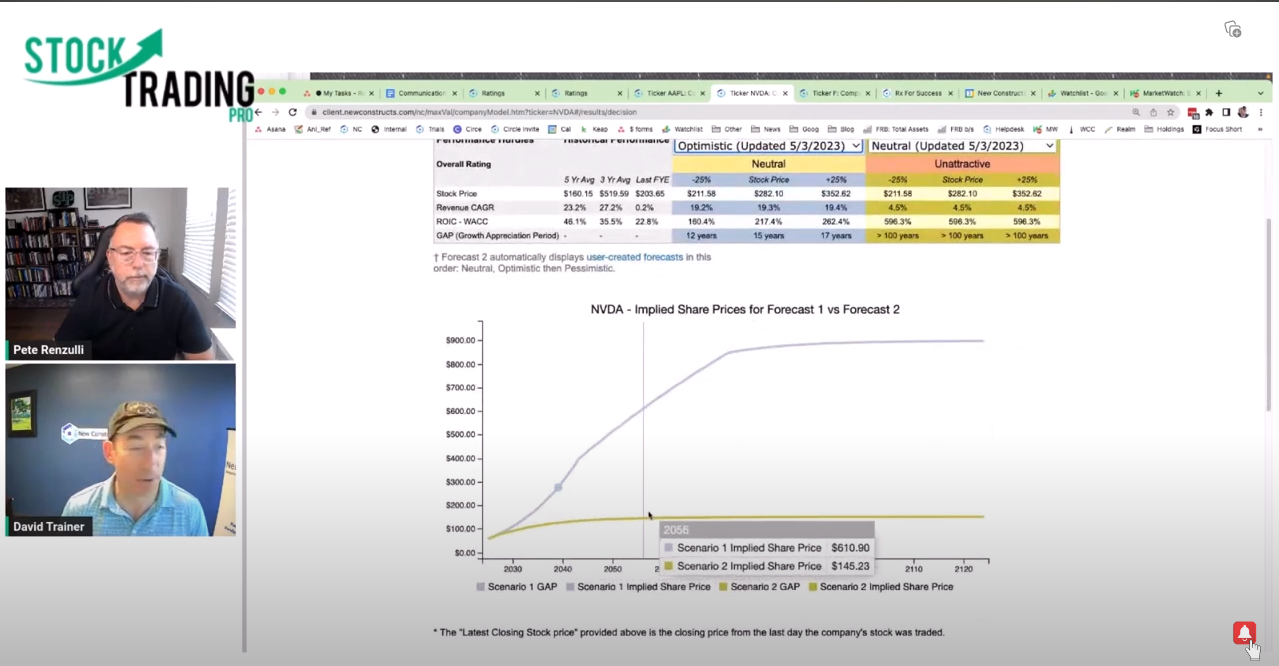

So let's dig in a little bit then on the valuation front. So I put together a couple different scenarios here. Let's see here. Optimistic and pessimistic actually, and neutral. So what I wanted to put show is that in order for us to, I'll compare these in a second, what's different here, but in, in, in order for us to get the model to generate a value equal to the current stock price and the implied price of five 50, I had to put jam in some really high numbers here and I want you to see how different the implied values are here.

This neutral scenario is a very realistic scenario. In fact, I'm going to show you it's best ever margins. And then let look at the, let's look at the summary here, right? Even in the neutral scenario, I'm sorry, the optimistic scenario here. What's got to happen, they got to grow revenue at 19%, compounded annually for 15 years, and they've got to improve their return on invested capital to over 205%, right?

210%. Sorry, cuz WAC is going to be about 7% here. Okay. 210% whack, I'm sorry, return on invested capital 210% return on invested. That's pretty huge improvement while also growing revenue. 20% compounded annually for 15 years. Wanna talk about likely, that to me seems pretty unlikely. So let's go through what I put into the model here.

Let's talk about David. I just want to take a step back just because we might have some new people listening for the first time. The 15 years, just to, if I'm wrong, correct me, is the growth appreciation period to achieve those numbers. Correct. Okay. Just want to make sure. Yes that's the number of years of profit growth baked into the stock price.

And so I want to walk people through what I did here for our neutral and our optimistic scenarios. Neutral. You've got consensus estimates going out for the next three to three to five years, depending on how many, how far out analysts. We have enough analysts to provide an estimate that we think it's an actual consensus.

And so let's start with neutral. 10 20, 20 16, 13. 10% still going out 10 to five six to 10 years, dropping down over time in a normal way that most companies do, right? On the other hand, on the optimistic side, I've got 20% put in here all the way out for 20 years. And then it drops to 10% for years, 21 to 25 and then 10% for 26 to 50 before going to where long term sort of real GDP growth is, which is what we knock these things down to in the long term.

And then, so let's then put that in the context of, now let's take a look at margins. So

scrolling down here to look at margins. Neutral margin and Okta's missing margin are the same, right? And so how much higher is 45 than what the company's ever done in the past? The highest number we've seen in the recent past is 38.8 or 39%. So let's go back over time and see what else we see going back over time.

So I think 38.8 is by far the best. We're going back all the way to 19 98, 99, we're single digits and negative for a long period of time, so a 45% margin is a pretty healthy number. So what does that mean in terms of the implied values per share? If we're going with just that neutral scenario a 45% margin with some pretty healthy revenue growth, we can't get to a price more than 150 bucks a share.

Wow. Even with a hundred years of profit growth and look at what the implied return on domestic capital spread is over that period of time. You're still talking about amazing returns on capital by the company, right? And we can go down here and we can look at past return on capital versus future implied return on capital, right?

Here's what the neutral scenario implies. Woo. Hey, return on capitals. Been here, pedestrian normal, we're talking extraordinary. Now let's take a look at this optimistic scenario. Again, similar levels of return on capital, but now we're going to marry that with like really high revenue growth for a long period of time.

What does that do for our chart? Whoa. This neutral scenario barely even registers. And so you see enormous amount of value creation. And the fact of the matter is, it's true. If they can generate these sort of incredibly high returns on capital while also growing revenue at a very high clip for a sustained period of time, you will create enormous amounts of value.

That's what the model shows us to Question, Pete, how likely is it right. I know you were on the street back in the day, David, we mentioned this in the past, what a hundred percent we're in the internet age. There's, everybody wants a click. What would possess somebody to put out a hundred percent price target?

Like what? What would some, like what would somebody rationally who puts that out there be looking at or be expecting, hopefully some investment banking business? That's the answer. Look I was, that's the answer. Look, you're not going to get investment banking business if you've got a sell rating.

You get fired for that. And so it's a boost to your career to do something that makes waves. And it's certainly a boost to your career if you can get the company to say, oh, I like those guys. They got a really high price target on us. Yeah. Kathy Wood is still doing that with Tesla. She has $1,500 on her the lifetime I saw her.

I feel like it's a laughing stock, like for every sophisticated investor. And I talk to a lot of people and I like different points of view, but I have not met anyone that really takes Kathy Wood seriously. And her and the models are a joke. It's like you put that out there, you're really going to show people that.

That's doesn't even make sense. But I guess it doesn't matter for raising assets these days. Yeah. She had a good, what was it, 2021 during the pandemic. But I think, Who didn't. Yeah. All they did was just dump trillions of dollars into the economy. So it was a no-brainer.

Yeah. Yeah. And again, we're not knocking anybody. It's more just having a conversation around what's realistic versus what's an interesting headline that gets people to click or YouTube thumbnail that gets people to click. We live in reality and a big part of what we do on my side, especially because we're on the shorter timeframe, we really have to be good with our timing.

You really have, part of what we don't like to set targets, but we don't, we always have an initial target, and the initial target is more built around the it's justifying the initial risk. We're not putting a limit on what the stock can do, but at some point you have to say, what does this stock normally do?

What does it likely to do based on all of the argument that we just put into the trade? And we'll put an initial target out to justify. The initial risk, but that's different than saying, I think this stock that's already up a hundred percent in a recession is going to double. That's a little bit aggressive in my opinion.

Yeah. And, and we're here to provide folks with a data and math driven narrative as opposed to a, I don't know what you want to call the other narratives. Hopefully get investment banking, business narrative, or whatever you might call. And you're right, Pete, this is not to, we're not here slander, we're just, I think my goal is always just to bring objective truth.

Yeah. Just calculations. And everyone who's a client and you've seen, and we're happy to show even more detail here, all these models, you can look through the actual math and numbers and calculation and recreate what it is we do. And I think that's one of the things that separates somebody as a speculator from somebody who.

Made a lot of money or had paper millionaire accounts in 2021, where professionals who really think this through, and I don't necessarily mean you're quitting your job to be a hedge fund manager, but somebody who takes this seriously. You, at some point you have to say what is likely to happen versus what in my wildest dreams do I hope happens?

And that's where you have consistent account growth, because you live in what's likely to happen. Based on the last eight quarters of increased sales or, whatever metric you happen to be looking at versus you just happen to really love a celebrity c e o. Yeah, no, that's, that's, I think long term.

Those of us who have fiduciary duties or care about preservation of wealth, we have to put, at least, keep one foot in the reality. It says, Hey, listen, I'm not just all in on, on this personality. I've got to have some decent objective math and truth in order to be sure that I'm actually giving prudent advice.

I'm making prudent decisions, fulfilling my fiduciary duties. And that's what we're here to help people do is to just have some guardrails on what's realistic and what's likely. Yep. So we just talked about two great companies. Like we're not saying the companies, there's a problem we're talking about at this price and what's likely to move next.

So I, I. Without putting it on the spot, David, obviously there's a lot of people would be watching this and be like tell me about a stock that is not beyond something realistic, and maybe next time we get together we can talk. You have zombie stocks, which are way out of the way out of the atmosphere.

Maybe next time next week call, we can have a conversation about a couple of stocks that. Have a likelihood at the current stock price implying that there's some upside to that, maybe that'd be a fun conversation to have next. Yeah. No, we published a couple of long ideas this week. I've got some, I could, we, I'm happy to do that next week, and we do that a lot as well.

It's the same idea, right? The stock price implies that profits are going to go down. And or grow at a super low rate. And we think it's likely that this, the profits will stay the same or maybe grow at a little faster rate than what the market implies. And that's what you want to buy. And it's just a risk reward analysis.

It's pretty simple. Yeah. That's the fun part of investing. We're basically building an argument for. Where is it now? What's likely, and whether or not buying right now is a good decision. That's really what all speculation comes down to. It's not so much timing as much as the, because risk is relative to the quality of the idea.

You can have a lot of great companies, but the likelihood of it moving in the direction that you want, that's a whole different story to justify the risk on the initial part of the trade. That's right. That's right. And look, if you can have some good math around that, then you're just going to be a smarter trader.

That sounds awesome. That's exactly what we're trying to do here. I like it. All right, David traitor, new constructs. Thank you so much for joining me here again this week. I love these calls. They're getting better and better each week. Thank you, Pete. I'm working on it. Have a great day everybody. We'll speak to you soon.

Bye.