Podcast | The Daily Ticker: EP7: Risk, Volatility And Sector Rotation

Today’s topic is easily one of the biggest trading mistakes holding you back from seeing your trading account move higher month after month.

Once you understand this aspect of trading everything changes.

It’s about risk.

Inexperienced traders mistakenly believe that risk is about volatility. It’s not.

Risk is not simply about how fast or how much a stock moves.

Risk is a measure of the probability of profit. Volatility is simply the speed of that probability.

And the mistake traders make is believing that risk and volatility are the same thing. The critical error this leads to is incorrect position sizing.

This topic has multiple implications but today we’re going to tackle the most actionable.

Pete Renzulli | Stock Trading Pro

https://stocktradingpro.com/invite

Visit our YouTube channel for training. Be sure to subscribe. https://www.youtube.com/c/StockTradingPro

Follow Me on Twitter:

https://twitter.com/PeteRenzulli

Contact:

[email protected]

Disclaimer:

https://stocktradingpro.com/disclaimer/

Could Trading Stocks Help You Become Semi-Retired?

Learn About The NY METHOD

Learn to Trade Stocks:

Enroll in our trading boot camp...

Join us 7:30 AM for the Stock Market Live Stream (Monday-Friday)

Be sure to SUBSCRIBE to our YOUTUBE channel and hit the LIKE button for updates.

Ready to Uplevel Your Trading?

Schedule an Interview with our team today:

https://stocktradingpro.com/stock-trading-pro-coaching-call/

🥇 Smart Money Tactics | Order Flow Trading

https://youtu.be/MOYNbC_HERE

🥇 Finviz Screener | Find the Top Stocks to Buy Now

https://youtu.be/K5JZNCWIhZo

🥇 Sector Rotation Trading Strategy

https://youtu.be/lcB83RcN23Y

🥇 Swing Trading Strategy | Candlestick Charts

https://youtu.be/2pmYj-Gqm1k

🥇 Tape Reading Explained

https://youtu.be/Jqup9n8BifM

Contact:

[email protected]

Disclaimer:

https://stocktradingpro.com/disclaimer/

These YouTube stock market live stream videos are for financial education purposes. It's up to you to consult your financial advisor to make the final decision before you decide which stocks to buy now.

The Stock Trading Pro mission: How to know what stocks to buy.

The first is the most exciting, when we have directional volatility. It’s CRITICAL that you recognize this and earn more.

You simply can’t make reasonable profits when the situation offers everything you could possibly want.

Risk in this case is “lower” because the edge is strong, obvious and if your timing is good, excellent reward potential.

In situations like this, the right play is to trade bigger, or hold winners longer. If you’re good, both.

This is when unreasonable profits become the goal because volatility and edge are in sync. So when probability is strong, risk becomes reasonable, despite volatility.

Generating smaller gains in this moment is a big mistake, and can only be solved by ruthlessly reviewing your P&L relative to market conditions.

Sometimes a profitable week means you underperformed if the market offered more.

Moving along to the silent killer of trading accounts that nobody talks about.

Low probability trades. They’re often masked by our ego in the form of lower share size. We make ourselves believe that lower share means lower risk.

Such a HUGE mistake. We make trade after trade with a smaller position size justifying “lower risk” because of lower share size. We convince ourselves that we’re managing the downside.

But we’re actually throwing money away. Dollar by dollar the small losses add up and while our conviction moves lower and lower. After a string of losses on the mediocre ideas we begin to doubt our edge.

And then the search for more or different indicators takes over our weekends.

In our community we call these moments of price action “where money goes to die.” Light volume, directionless and bored are the enemies of profitable trading.

The problem for many is they recognize it too late. Looking at your account hurts and your confidence shaken and you ponder how to stop it.

You ask “How can I prevent these losses? How can I stop myself from throwing money away?

At the highest levels you spot it before it happens. You have an edge that shows you what perfect trades look like, and you don’t trade.

For those new, or unable to stop it, after watching your account go south you eventually admit these low probability trades are the reason you’re not getting paid.

Learning to spot better opportunities is insanely obvious, but are you actually doing it?

And more to the point, are you NOT trading when probability is low?

These golden keys can turn around a losing account pretty quickly.

Volatility can be contained through proper share size. But it's the edge, probability, that separates the winners from the losers.

In the long run you’ll never find consistency if you can’t spot the problem in the moment. Now that you know, it’s time to pay attention.

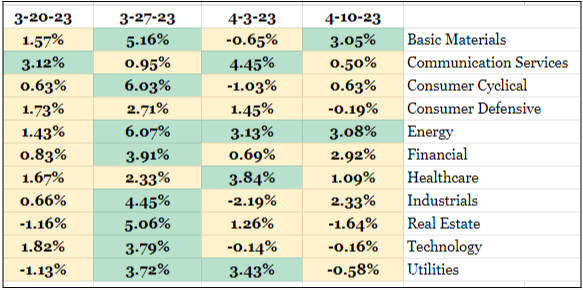

Sector Rotation

Technology stocks produced the largest number of stocks with stacked order flow. We’ve witnessed order flow rotating out of semiconductors and into #PANW #FTNT and #VMW. #MU and #AAPL closed near breakout levels as well.

Financials…After reporting last week, bank stocks outperformed, and traded straight into bullish echoes #JPM #C. Other momentum stocks to note include #V and #MA.

Healthcare produced nineteen stocks with bullish stacked order flow. A few near optimal entries include: #ISRG #AZN #SYK. The #JNJ pause looks solid for a new swing trade, be aware of the scheduled earnings on April, 18.

#UNH pulled back after reporting setting up a snapback trade. #CAH, Cardinal Health tops the list for trades on Monday. An inD at a major breakout level.

Basic Materials produced a few breakouts last week. Stocks include #SCCO #FCX (copper) #AEM #WPM (gold) and #TECK #LYB.

Southern Copper #SCCO cleared major resistance setting up a new swing on the pause.

Consumer cyclical recorded the highest total. Home builders #DHI #LEN #KBH #TOL, and hotels #MAR #HLT are in play.

Still waiting for the bulls to push #KMX higher after a bullish gap. The stock price continues to hold the daily 50 SMA. One stock of note that made the IBD list of top stocks includes #CROX.