Podcast | The Daily Ticker: EP6: David Trainer | New Constructs – A deeper look into the financials.

Today's episode of The Daily Ticker Podcast welcomes David Trainer of New Constructs to bring a deeper analytical look at stocks and a longer term view of the markets.

David also discusses the major different between "economic earnings" and the typical GAAP earnings that most investors are seduced into and the expensive problem it creates.

Episode Topics:

- Sector rotation: Out of tech and into healthcare.

- Macro trends at S&P 500 and sector breakdowns.

- David's take on Financial contagion. Is it over? Will this lead to a credit crunch?

- Bank earnings coming up. Any solid companies to like and why?

- Tesla reported solid delivery numbers but lowered prices, typically not a good sign for margins. The market seems to not like the news.

- A review of Tesla's stock price and what it implies about future growth.

- David looks at the financials of two other auto manufacturer stocks that look interesting, and possibly undervalued.

New Constructs

https://www.newconstructs.com/

"Core Earnings contains information about future performance that is incremental to Street Earnings."

HBS & MIT Sloan professors

Episode Downloads

1. Tesla Update: How This Stock’s Outrageous Valuation Could Destroy All Zombie Stocks

3. Macro Research: Economic Earnings vs GAAP Earnings Across the Entire Market & All Sectors

4. Macro Research: Price vs Economic Book Value Trends for the S&P 500 and All Sectors

Society of Intelligent Investors

https://www.newconstructs.com/society/

Pete Renzulli | Stock Trading Pro

https://stocktradingpro.com/invite

Visit our YouTube channel for training. Be sure to subscribe. https://www.youtube.com/c/StockTradingPro

Follow Me on Twitter:

https://twitter.com/PeteRenzulli

Contact:

[email protected]

Disclaimer:

https://stocktradingpro.com/disclaimer/

Could Trading Stocks Help You Become Semi-Retired?

Learn About The NY METHOD

Learn to Trade Stocks:

Enroll in our trading boot camp...

Join us 7:30 AM for the Stock Market Live Stream (Monday-Friday)

Be sure to SUBSCRIBE to our YOUTUBE channel and hit the LIKE button for updates.

Ready to Uplevel Your Trading?

Schedule an Interview with our team today:

https://stocktradingpro.com/stock-trading-pro-coaching-call/

🥇 Smart Money Tactics | Order Flow Trading

https://youtu.be/MOYNbC_HERE

🥇 Finviz Screener | Find the Top Stocks to Buy Now

https://youtu.be/K5JZNCWIhZo

🥇 Sector Rotation Trading Strategy

https://youtu.be/lcB83RcN23Y

🥇 Swing Trading Strategy | Candlestick Charts

https://youtu.be/2pmYj-Gqm1k

🥇 Tape Reading Explained

https://youtu.be/Jqup9n8BifM

Contact:

[email protected]

Disclaimer:

https://stocktradingpro.com/disclaimer/

These YouTube stock market live stream videos are for financial education purposes. It's up to you to consult your financial advisor to make the final decision before you decide which stocks to buy now.

The Stock Trading Pro mission: How to know what stocks to buy.

Hey everybody, it's Pete. Welcome to today's episode of The Daily Ticket. We have a very special episode for you today. We have David Trainor joining us from New Constructs. If you don't happen to know who David is, he has a fundamental analysis research company. David will get into that in a lot more detail today.

But boy, we have a lot of stuff to talk about today. On top of the fact that David is going to actually be inviting you to join something that is a membership of his for free, which is the Society of Inte. Investors. So some of the topics we're going to discuss today are money rotating out of technology and into healthcare and into a couple of other sectors we're going to talk about.

By the way David's going to talk about and break down macro trends from an economic earnings perspective. And he's got some documents that we're actually going to allow you to download. You'll be able to find them in the description of the podcast. David's going to talk about the financial contagion.

Is it over, is it contained just within. Individual regional bank sector, is it going to lead to a credit crunch, which is a whole other topic we're going to talk about. And also bank earnings. That's obviously coming up soon as I'm recording this. It's Thursday Bank earnings are coming out tomorrow. David does actually have a bank that he likes and he's going to give the financials on that as well.

He's going to break down what they did in the last couple of years, this specific bank, and going forward, what the earnings. And the price of the stock now are saying about the potential return on investment in this particular bank. And then we're actually going to talk about everybody's favorite stock. I believe Tesla is Tesla overvalued right now.

David's going to break down the expectations of what Tesla needs to do relative to the entire auto industry to justify. The price that it has right now, and then it actually breaks down two other auto manufacturing companies that are pretty interesting. So some of the downloads you're going to have in this is the Tesla's outrageous val valuation that is going on right now, a research report on the bank that we just mentioned.

Also something super interesting, everybody knows about earnings per. David breaks down something that I think is unique to his analytics, which is economic earnings versus gap earnings, and that vo earnings per share that everybody clings to when earnings come out. He's going to break that down for the entire market.

As well as all sectors. So we're really breaking that in. And then he is going to talk about price versus economic book values for the trends in the s and p 500 and all sectors. And again, don't forget, you can click the link in the description to join the Society of Intelligent Investors. David has a ton of in-depth research.

I really think you're going to enjoy this interview, something we plan to. Weekly on the on the daily podcast. So enjoy this episode and leave a comment if you have any questions. Thank you so much. Hey, everybody. Welcome. Welcome to Dr. Trading Crow. Today. On today's episode, we actually have David Trainor from New Constructs.

David, how you doing today? I'm doing great, Pete. Thanks for having me. For those of you that know who David is, new constructs, I would say fundamental analytics. I know that's very high level. Maybe you can give us a little bit more detail on that, and especially who you can help the most. Yeah, no new constructs is for every investor who cares about profitability and valuation.

Typically our clients or folks who manage 10 million or more. But we have services and capabilities to serve everybody across the investing spectrum. Think about us as a robo analysts, right? That's the way Harvard Business School referred to us when they wrote a case study a few years ago, because we're doing all that work like in the filings and the footnotes that nobody but a robot wants to do anymore.

So when I was on Wall Street, Pete that's what I, that's how I learned to do this work. But that was before the tech bubble came along, and then nobody really cares anymore about, about doing this kind of fundamental, deep, fundamental analysis. And the fact of the matter is these footnotes that nobody takes the time to read because they're buried in a 500 page filing really do matter.

Can you give us an example of a footnote that does matter? Maybe we know of, but don't even pay attention to something that matters that oh, you're not reading the footnotes. Gimme an example of something that matters. Man, here's a recent one. We parsed at AIG's 10 K and they report their loan loss reserve from going to from for going from 629 million to 39.8 billion.

Wow. And that's what's on their. But then if you don't go down to the footnote on loans and reserves, you don't realize that included in that balance sheet number is a non-recurring one-time game from a receivable that they, from a business that they divested from. And if you don't make that adjustment, you're going to show effectively a non-cash gain of 39 billion in your operating profit.

On the one hand, a machine would probably go through and say, Hey, I'm collecting that number. It is what it is. It's the number, it's reported on the balance sheet. Maybe it's right, but our system's smart enough to say, wait a second, that number does not make sense.

There's no way that the reserve would go from 629 million to 39 plus billion. And but you don't know that if you're not familiar with the footnotes. And it's even a footnote to the footnote. The footnote has a table that shows the reserves, like the true reserves without the bad number. And below that it says, note, we exclude 38, 38 dot something billion.

Related to the disaggregation or the divestiture of A I G F P and the receivable, blah, blah, blah, blah, blah, of that amount. And yeah, that's an example of a footnote. Harvard Business School actually in m i t Sloan wrote a paper that has a ton of examples because they prove in this paper that footnotes related to unusual gains of losses.

And this is stuff that affects earnings What I'm talking about, loan loss reserves, maybe that's a little obscure and maybe people don't wanna care about that, but anybody investing, most everybody cares about earnings, turns out reported earnings, street earnings adjusted earnings. Are not nearly as accurate as our earnings.

And the differences are very material by 20% or more on average. Wow. That's a giant difference. Wow. Yeah. And so the that's a sort of broader example. And it's not us saying it right. Pete, that's I think, I wanna make sure a lot of people in the research business there's some firms out there, they tout their own, they tot their own horn really well, almost to the, borderline of being illegal.

Actually I was going to ask you about that. The, where. We're about to hit into, and we'll talk about this a little more detail, the earnings parade on CNBC and everywhere else that's that's about to be unleashed specifically the banks, which we'll talk about in a second. What are your thoughts on earnings per share and how much weight everybody gives on just that one number as like the moment it comes out, ah, it's terrible, right?

But, look, we're, these, most of these firms are in the business of selling advertising or selling stock or selling a narrative, right? That's what it's about. This whole idea that, Jim Kramer is this, media icon when he is just, Oftentimes spouting nonsense, right?

But it's entertaining and it sells. And so yeah, earnings per share is the wrong number. It's an incomplete number. It's a manipulated number that's a strong word, manipulated. Give us an example. Yeah, look, there's all kinds of evidence, not just stuff that we've written, but you can look up all kinds of things.

There's a, I remember Market Watch ran a story about how CFOs admit that they fudge the numbers by 20% or more and that Wall Street ignores the fudge. And the fudge being, again, the inclusion of unusual gains and losses to make earnings look better than normal or worse. In bad times, companies make their earnings look worse than normal or than worse than true because kitchen sink effect markets are unhappy, sentiment is negative.

They just wanna go ahead and get all the bad stuff out of the way so that when things get positive, they can show things to be even better than they are and they can benefit from the animal spirits and irrational exuberance and had their stock go up a ton of a whole bunch so that they can in turn cash in on.

So we're right now on our side of things, it's probably a little bit shorter term than what you do on the investing side. We're seeing money clearly rotating outta technology right now. They're still in some bull order flow for 2023. And I think up at these levels, it's more, not that they're broken as much as where's the upside from here.

And so we're on our side. We're clearly seeing money shifted into healthcare in the. Four or five weeks. Consumer staples picking up just a little bit. We're still waiting on energy. After last week's opec announcement, they gapped up crude oil, hit that big wall, and they've basically been sitting there.

So we're really on our side. We're focusing on healthcare and energy for the next wave ending. Last year we had a really nice, amazing rally in industrial. Let's say October through January, tech stocks took over. So we, the way we look at things with sector rotation, we've pretty much been in a seven or eight month rally.

If you understand how to track and follow the order flow, and you're not fighting the tape, you're just following where the money is, what are you guys seeing on your side as far as some bigger picture stuff maybe. S and p 500 trends, anything along those lines? Yeah. First of all, I love what you do with order flow.

Why not look at the future if if you can, right? Have a, take a peek. I think that's a tr that's a tremendous asset. W we we do some cool macro stuff, so I'm going to share my screen here. And one of the things we do is we have ratings on sector.

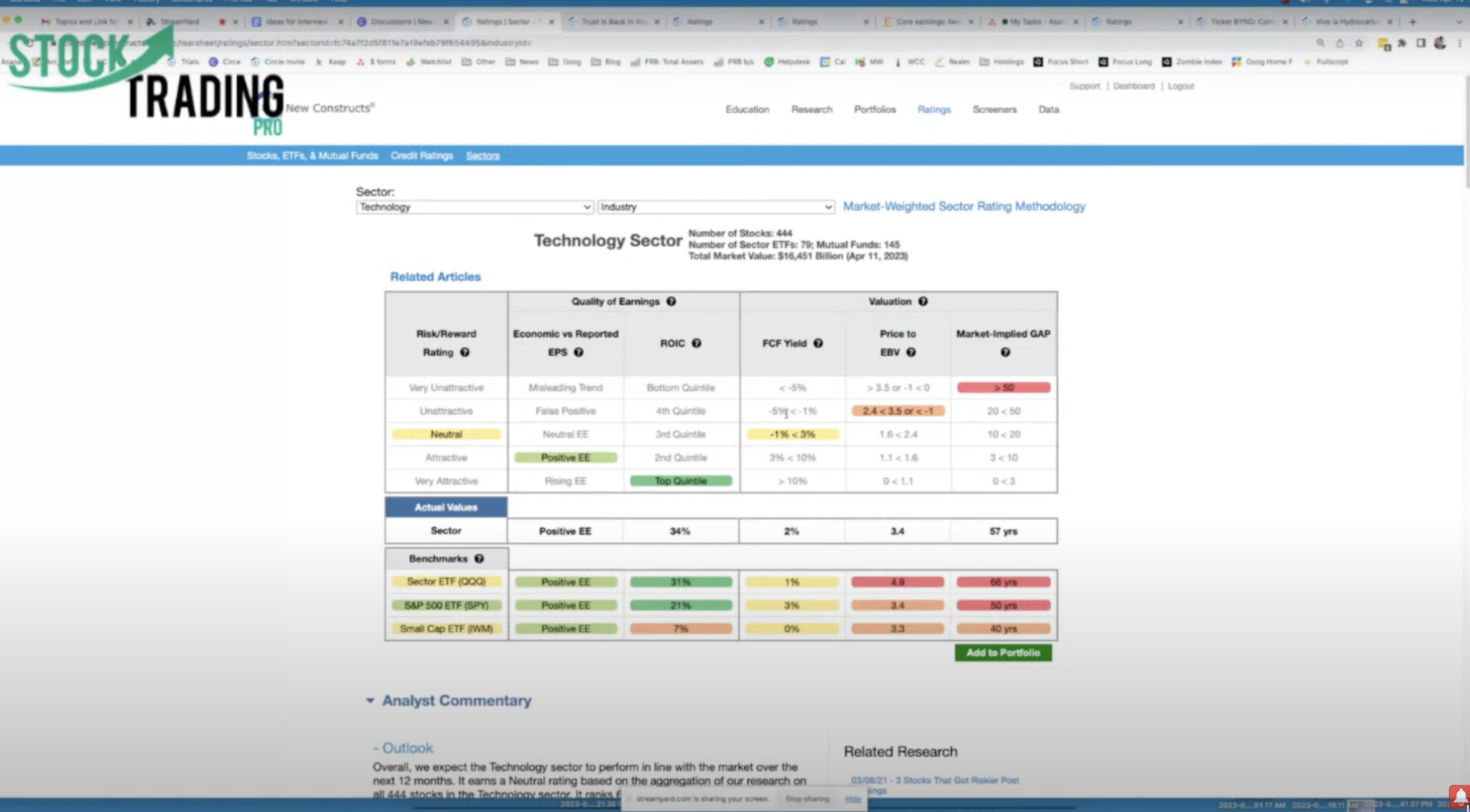

So you can see for the financial services sector and the banking services, it's an attractive rating. If we were to flip over to technology we're not going to see as attractive, right? The returns on capital are really high, but the rest of the sector stats are not good. Things have gotten expensive in technology.

And then we'll also look at trends, right? We can look at the return on invested capital across the entire market. This is our all. New constructs, 2000 stocks index. And then we can break it down further and say, okay, which sectors are looking the most interesting? So for example, free cash flow is making a good, strong move for a while here in the basic material sector, but it's come way down and it's flat.

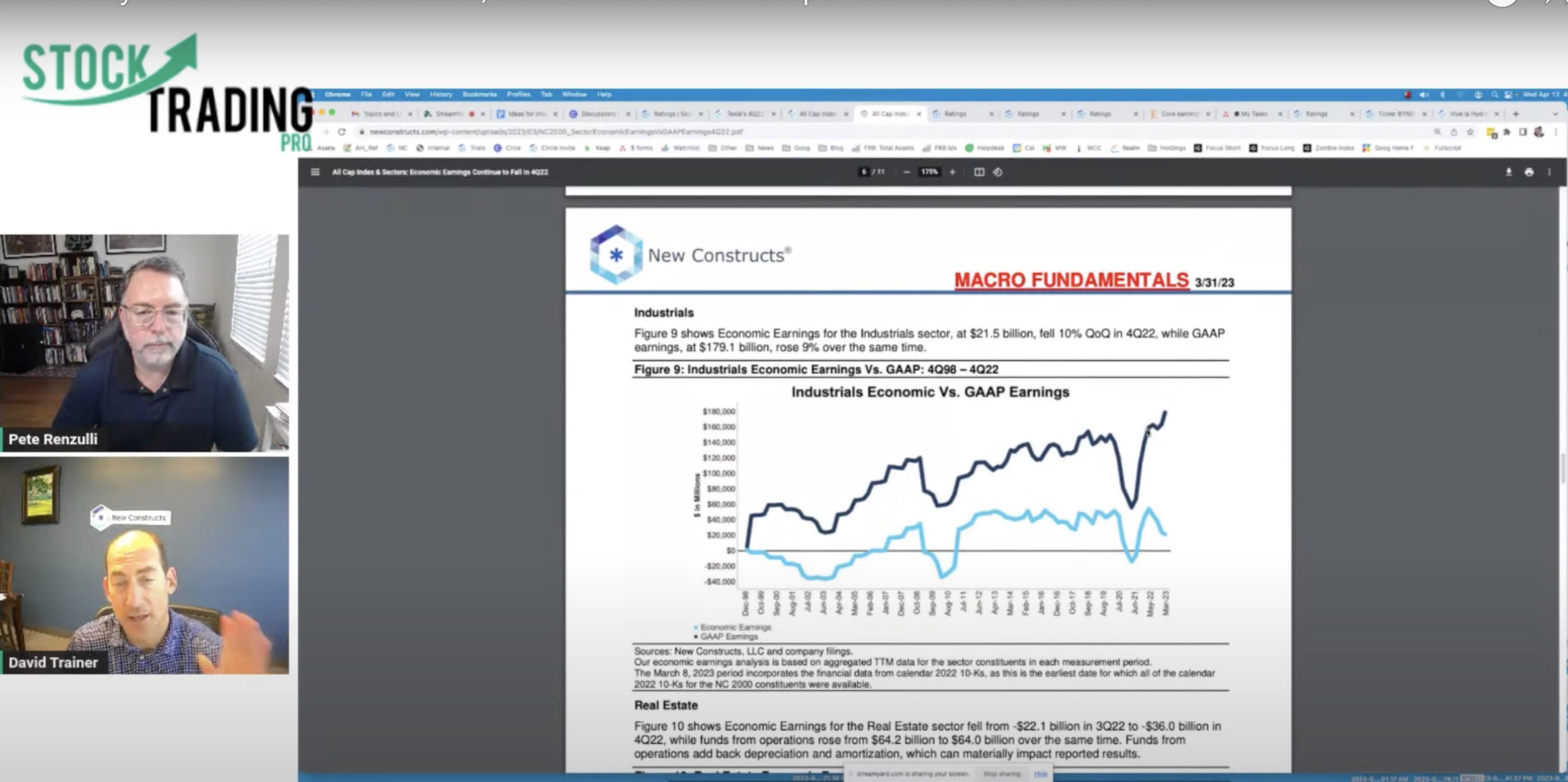

The technology sector, when you and I think this was anticipated going into last. It's also interesting to look at just how accounting earnings and economic earnings can diverge at the sector level. Here you see the industrials gap earnings looking great Pete, but the economic earnings taking a dive.

Could you explain that? Obviously you and I have had multiple conversations about that. David, can you explain the difference high level on what the differ those two different types of earnings? Yeah, absolutely. Gap earnings, accounting, earnings. As I was saying at the top, Pete, you can't, they can't be relied upon.

They're manipulated often. And whereas economic earnings it's our numbers, so it's not manipulated. We take out all the manipulation. That's what the footnotes are for. But in addition, we're taking it into account, the balance sheet side of the business. So just think for a second. If you have two businesses and they have the same earnings and one has got a billion dollars worth of assets and the other's got a million dollars worth of assets which one is a better business?

Obviously the one that has a lot less capital needed to generate its profits, right? So economic earnings takes into account the cost of the capital used to generate the profits. So it's just a much more robust and comprehensive number, and that's the number that we pay attention to a lot. The main driver in it is return on invested capital, and we put enormous amounts of resources into making sure we get the return on invested capital number, right?

That's one of the biggest things. If you don't mind me asking, what's the difference between return on invested capital and return on equity? Oh yeah. Return on equity. First of all return on equity is a very common and easy to get metric, which means you're probably going to be getting it from uns, scrubbed, or even potentially manipulated accounting data.

It's just net income over shareholder's equity. So you see it on a lot of websites. And so you're going to get a, you're going to, you're going to have issues with. Just a lot of manipulation and a lot of potentially erroneous data in general. But it's just net income. Again, that's your earnings number, and that's not a reliable number.

And then just shareholders' equity, so you don't really take into account the other part of the capital stack related to non-equity, that's debt in another long term liabilities. And then net income, again, being a manipulated number, return on invested capital. As we define it, is your net operating profit after tax divided by your invested.

And if you're on our site, you can get deep explanations on how we calculate Notepad and invested capital. Ernst and Young actually wrote a paper proving that we do that better than everybody else in the world. And in particular they compared our calculations to Bloomberg and Capital iq on a specific set of companies to just show how different our return on invested capital number is from the other firm's numbers.

And if you look at company numbers it's what we do, Pete. It's you could call new constructs.com re return on the vesta capital.com. We wanna get it right. Okay. While we're talking about earnings working our way through and balance sheets specifically obviously the financial contagion Exploded a couple of weeks ago.

It seems like they haven't really recovered, but there's a lot of conversations about we're going to fix F D I C and companies are going to taking care of that at the, in the sh the customers are going to be taken care of. It's now the balance sheets of the First Republic and S v B and seems like they just took everybody out.

Even Schwab got clobbered. I think it almost had a 50% haircut in that period of time. No, it's nuts. I think you had some phenomenally poorly run businesses and regulators asleep at the wheel. Silicon Valley Bank, their balance sheet was so upside down that it's hard to it's just hard to believe their chief risk officer left 10 months ago or whatever.

And they just, they were so sideways with what was happening in the market and telegraphed by the Fed raising rates. It's just hard to believe that the, their regulat. Overlooked it. I would imagine they're all going to be fired. Who knows? They're in California, so maybe they'll get raises, but but yeah, no, the regulators saw, they s they looked at the financials and anyone who's looking at their balance sheet would say, oh, wait a second.

You have all these super long term. Liabilities or investments that you bought with the super short term deposits. So that's dangerous, right? Cuz the deposit gets called, you can't call that money back. And then those investments were in 30 year mortgages, which by the way, we're going to go down in value when interest rates go up.

And in addition, you're going to see a lot less cash flows because prepayments were going to go way down. So it was like, Are you crazy? Even if you think there's a whiff of interest rates going up, you need to unwind some of that. They just leaned into it. Yeah, I heard that they didn't expect the num the rates to go up that quickly, but gosh, read a headline.

Everybody knew they were going to go up that quickly. Yeah, no, it was they failed banking 1 0 1 for sure. And so I think, sorry to get so nerdy in the weeds there. I can't No, that's okay. Do you think it's self-contained or do you think it's a bigger. Yeah I think that the, I think it's self-contained with respect to the bad banks and the bad businesses.

And by the way, we need to see a lot of bad businesses go out of business, Pete. We need to see a lot of bad businesses go out of business that's going to be healthy for us because the capital that's gone into things like Sweet Green and Silicon Valley Bank needs to be returned to investors so they can deploy it into good stuff, number one, number.

The one thing that's hard to quantify right is investor confidence. And it's the confidence in the bank that caused the bank run, right? That's a little bit squishier topic because you never know, like when people could get scared and start freaking out and making a run. But I think most, they're also blaming in our technology now that.

Because of the speed of information and the speed of which you can now get your money out of your account, they were blaming it on, it would've never happened in the old days because you couldn't have taken No, that many people couldn't have taken their money out at the same time. Oh, it's so true, right?

Like you can. Pour your money out with the click of a mouse as opposed to going and waiting in line and dealing with a teller. Yeah. And think about all the ways that like the old fashioned way and going to the bank, the time it takes you to drive there. The time it takes, the wait in line and the things the bank can do.

They're like, oh, sorry, smoke break. You know what I mean? Oh, one of our tellers is sick. Hold on. You know what I mean? Or sorry, we've got a fire alarm or whatever. Like all kinds of stuff to make the branch not give out money. But yeah, today's day and age it's scary how fast that can move.

Do you think is a little bit off topic. Do you think reserve requirements have to change? This is a, this, that's a deeper topic. So for one thing for sure, that's upside down is that too many of these financial firms and their executives in particular make money in the good times and the bad.

And they make a lot of money in the good times because they take more risk than they should be taking. And then when the bad times hit and they lose all their client and investor money, they walk away with bonuses. That's a problem. And I think one of the ways to address that is just to increase reserve requirements tier one capital ratio requirements so that they don't have as much capital to risk.

Just so that, they can't lose as much money, I'm just trying to handcuff these folks from, hails. They win tales we lose, heads they win, tales we lose. Cuz it's not fair. I agree. It's why I brought it up. Why don't you start to dig into it and I'm not, I'm not as deep into the financials as you are, but just basic math doesn't work.

That how little they can get away with having there and then what they could do with it just didn't make sense. No. So that's the other side. What about, do you like anything right now, especially on the banking side of things, cuz obviously financials are coming out this week, most of the big banks on Friday.

I guess maybe one thing before that, do you think that there's a possibility? Cause everybody's talking about, oh, interest rate. We had the C P I number come out today. Interest rate. Oh good. The dollar crash today we're going to lower interest rates. Let's even say they. I'm not going to go down the path that they're going to lower interest rates.

Cause inflation's still not even close to mck Kenny to that point. But do you think with this situation there's a possibility that interest rates come down, but there's still going to be a credit crunch? Where they're not going to be as eager to be loaning out the same amount of money. I think that's inevitable.

And I think that what the Fed is trying to do is to make this recession as shallow as possible, but they do need somewhat of a recession. And I think what they want is, as much as possible, more natural market forces to take capital away from the bad people and give it back to the good. So Wall Street had too much capital and a lot of individuals had too much capital.

And it's not that they're bad people, but they're making bad investments. And so to the extent that the Fed raises rates that, that raises the return requirement on your investment, right? You're not going to loan money out and expect a zero return if it's costing you 3%, right? So you raise that rate, and that's going to put a gating factor on it.

And I think the other major consideration is that as. Credit conditions tighten in general is what we've seen. Liquidity's gone down. Banks gotta be more careful. They their portfolios are stretched because they maybe didn't position themselves as well as they needed to with rising rates.

But they can't just go out there and just loan some company a bunch of money and assume that company's going to be able to roll it over with another loan and they'll get their money back. I think that's the bigger picture that a lot of people are missing, cuz obviously the market, especially tech stocks in 2023 like we just talked about, had that beautiful bullish order flow for the better part of three months.

Nvidia a m d. Pretty much those are the top two. Even Apple and Microsoft and Meadow are carrying us. Probably those five stocks made the NASDAQ seem a lot stronger than it actually was. And that was actually a problem as well. And I think a lot of people were leaning on that rally and saying, the recessions behind us, it's never going to, it didn't happen yet, and interest rates are going to come down.

But the f. Does it concern you at all? That it was loaded up on just that group of stocks and that same group of stocks that rely on borrowing money are going to have a hard time borrowing money. And I think a lot of people got ahead of what they think is over. Yeah, no 1000%. In our macro work, Pete, what we are seeing is that while the s and p looks fair, fairly stable in terms of cash flows, earnings free cash flow under the surface in different sectors, you're seeing a to.

A ton of carnage. Some sectors doing really ton of churn, some sectors doing really well, some sectors doing really poorly in terms of cash flow and valuation. And and this is a theme we've had for a long time actually, Pete, we call it the micro bubble. And there are parts of the market that are way overvalued.

And there are parts that are more rationally valued. And so I'm not looking to say that we're going to look at a, we're looking at a huge terrible crash and everything's gotta come down. But to your point, these sort of. Lead steer stocks like Nvidia and Apple and Meta and Google and some others, right?

Those tend to make the overall market look much healthier than it really is. And there are a lot of small stocks that smaller we got 32 stocks on our zombie stock list. So there's a lot that we think are going to go to zero. And that's a healthy thing. It's a healthy thing because that capital needs to be released from these money losing entities to go into money making entities.

That's better for society cuz when it goes into money losing entities, all this capital from investors around the country or the world gets siphoned down to a few executives and bankers and they go buy boats and villas and all these other little other investors are left. And their consumption goes down, and that cycle left unchecked leads to, potential economic disaster.

So we talk about bankers come out this week. Do you have any banks in particular that that you actually do like? Yeah, let me share my screen here. I talk to you about JP Morgan. We've written a couple of reports on JP Morgan. Look, I, when I first made this a long idea back in May, 2020.

One of the things I said when I put on our focus list, one of the things I said is like, this is better than an index fund Pete, because I think the index is a bunch of junk in it. Like to your point, there are a lot of these lead steer stocks that are driving markets in general and those lead steer stocks get more and more amount of money cuz they're ETF fun flows and all that and people just pile on.

It's a popular me too momentum trade that's rotten on the inside because the fundamentals can't back it. Whereas JP Morgan, this is just about as solid a company as it can be. It benefits from the bank contagion because it is so well respected. It's a super strong company, from every angle.

And then when you look at the valuation, which is what we like to focus on as part of our, all of our analysis, we can see here first, let me take a another second here. Talk. Profitability. But the fundamentals of this bank are the best in the business. We're Goldman Sachs has tended to have really high returns on capital.

So for JP Morgan to be even higher than Goldman Sachs that's a good thing. But then really, I like to talk about valuation. I think this is where we really help our clients. People love how we're able to boil this down. Is this big enough for everybody to see? Okay. Maybe you can make it just a little bigger.

It's clear, but a little more might help.

Okay.

So what we always like to do, Pete, with respect to any of our target prices or analysis, whether it's a long idea or a short idea, is help people understand how the past profits, right compared to the profits implied by the stock price. And if we were to do this for a sweet green or beyond meat or whatever, you'd see a bunch of negative stuff in the past and you see this huge spike up where ridiculous amount of profits are baked, future profits are baked into the current stock price.

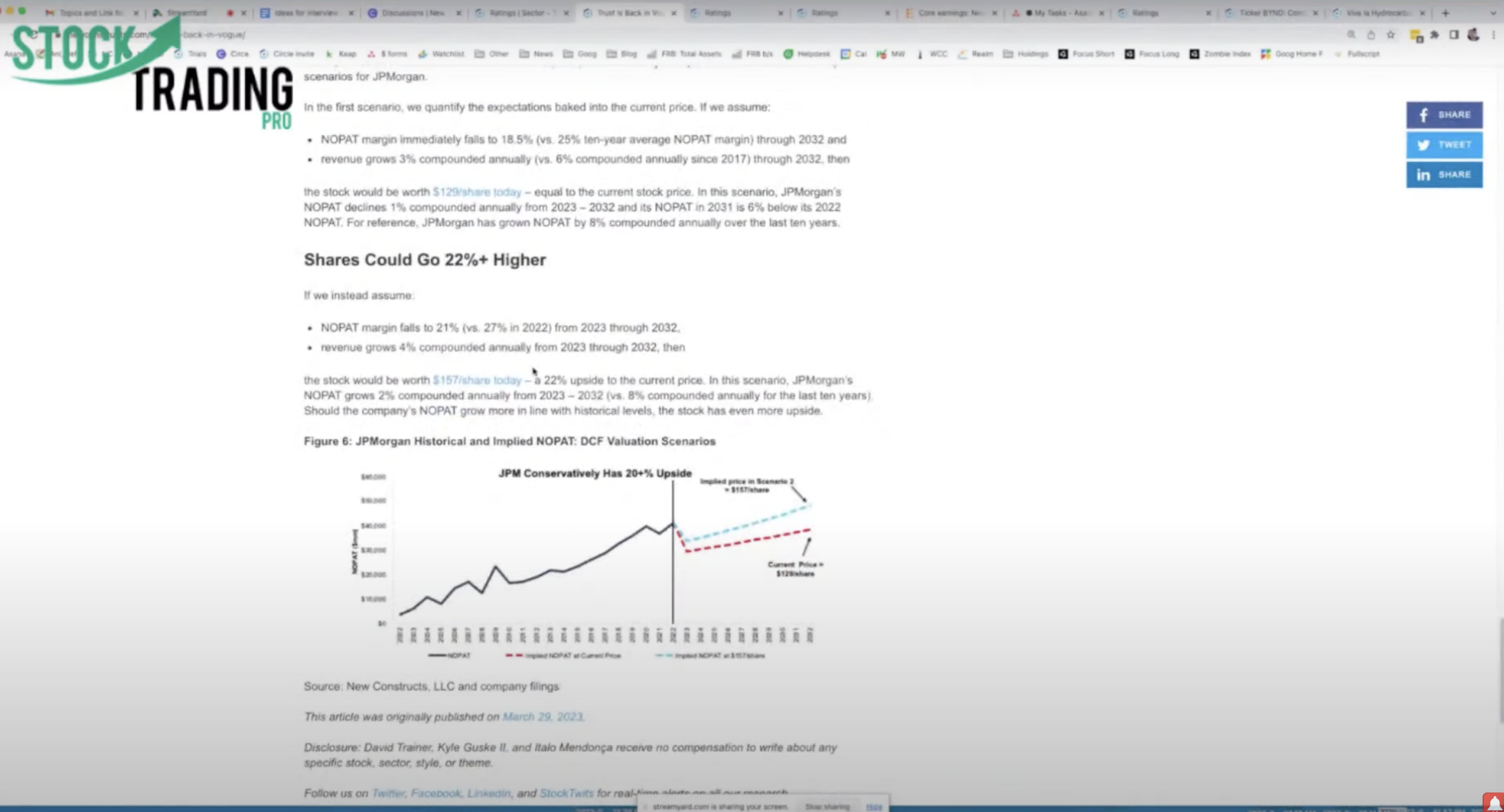

JP Morgan, it's the. You can see here at the current price of around 120 buck 29 bucks a share, which is where it was when we wrote this report. I don't remember where it is exactly today, but effectively the stock price is implying that JP Morgan profits are going to, are going to strongly or steeply decline and only maybe recover to where they were back in 2019 or 19.

So the current stock price is implying a permanent decline in profit. So then we said instead, why don't we assume, a bit of a decline. Let's just say JP Morgan gets hit by the recession, but they climb out of it a little, not quite a steep decline, and they climb out of it a little bit faster.

Then you're talking about 157 bucks a share, and I don't think there's another research firm in the world that will be this transparent with you about what it is we're suggesting is a good. Or smart bet. And when you look at it like, and we'll detail it even more, right? Our forecast suggests that the net operating profit after tax margin falls to 21%, and by the way, it was 27% last year, and they only grow revenue at 4% compounded annually.

This is for the next 10 years. That means the stock is worth 157 bucks today. And in that scenario, their profits grows 2% compounded annual. Over the next 10 years versus the 8% that it's actually done for the last 10 years. So even though we're showing 20% upside here, it's a very conservative outlook.

And anyway, I just, for my money, that's what good research is, right? Let's just put numbers out there based on bogus numbers. Let's give people something really sound and detail and mathematically rigorous and, On which to base their assumptions and to base their investment decision.

So you threw the word margin out there. So I want to hop into a different company that is obviously owned by the wealthiest man in the world, at least I think he's the wealthiest right now at the moment. Tesla. So I'm an entrepreneur. I've been an entrepreneur 37 years now. So soon as somebody starts talking about lowering their prices and having increased competition, my ears go up and I'm like, oh, that's not a good thing.

I don't care what's going on. That's not what you don't want to hear the company. Putting money into, we have more competition and we're also lowering our prices. And mar to me, the first thing was margins going down and the market's not liking it. Since that happened, even though the deliveries were higher, it's kinda oh, we're going to make it up in volume.

No you're not. If your margins are going down, your margins are going down. So let's talk Tesla a little bit and then maybe. Something around Tesla, if there's something else to discuss that you like instead, or in addition to maybe at this particular time. Yeah, sure. Let me share the screen here and I'll go to one of our last more in depth reports on Tesla.

Look, I'm not here to say that electric vehicles are bad or that Elon Musk is a bad guy or the Tuss is a bad company. I don't think that's the discussion here. The idea that the discussion is around what's the risk reward of owning Tesla. Is it a good fundamental investment?

And when you look at where things are going from a fundamental perspective, right? Market share is coming down quickly. And especially in the mature markets. So competition is going up quickly. And that's a big deal, right? So they're, the incumbents in aggregate are much bigger already than Tesla is, and it's not Tesla versus just.

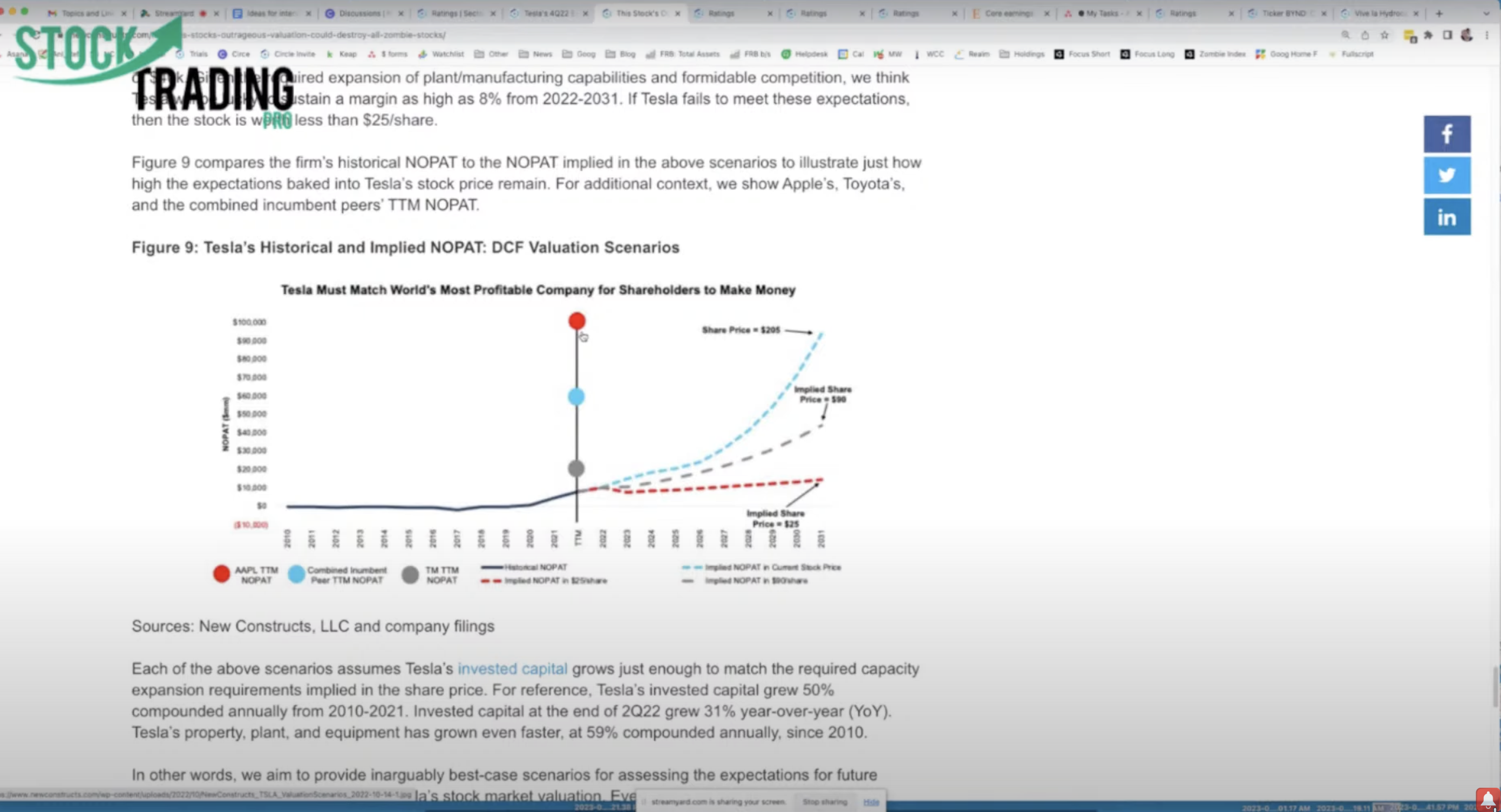

Or Tesla versus just gm, it's versus the world, right? But then let's let's cross that with where the valuation is. And we'll use our reverse DCF math here again, right? And one of the things we'd like to do here before getting to the money chart, which is terrific here, right here you can see little to no profits.

And then this is what they gotta do to justify 200 bucks a share. Look at that, right? And that's where Apple is. So if you believe Tesla's worth 200 bucks, you believe they're going to be as profitable as. I wouldn't bet on that In a car company. Yeah. And then this is this is what the implied profits are for different share prices.

So 25 and 90 bucks. Now, the more important thing to do when one of the more important things to, to take away from this kind of analysis is that we can reverse engineer what kind of sales, car sales are required to justify the price. And so we did that here in this analysis.

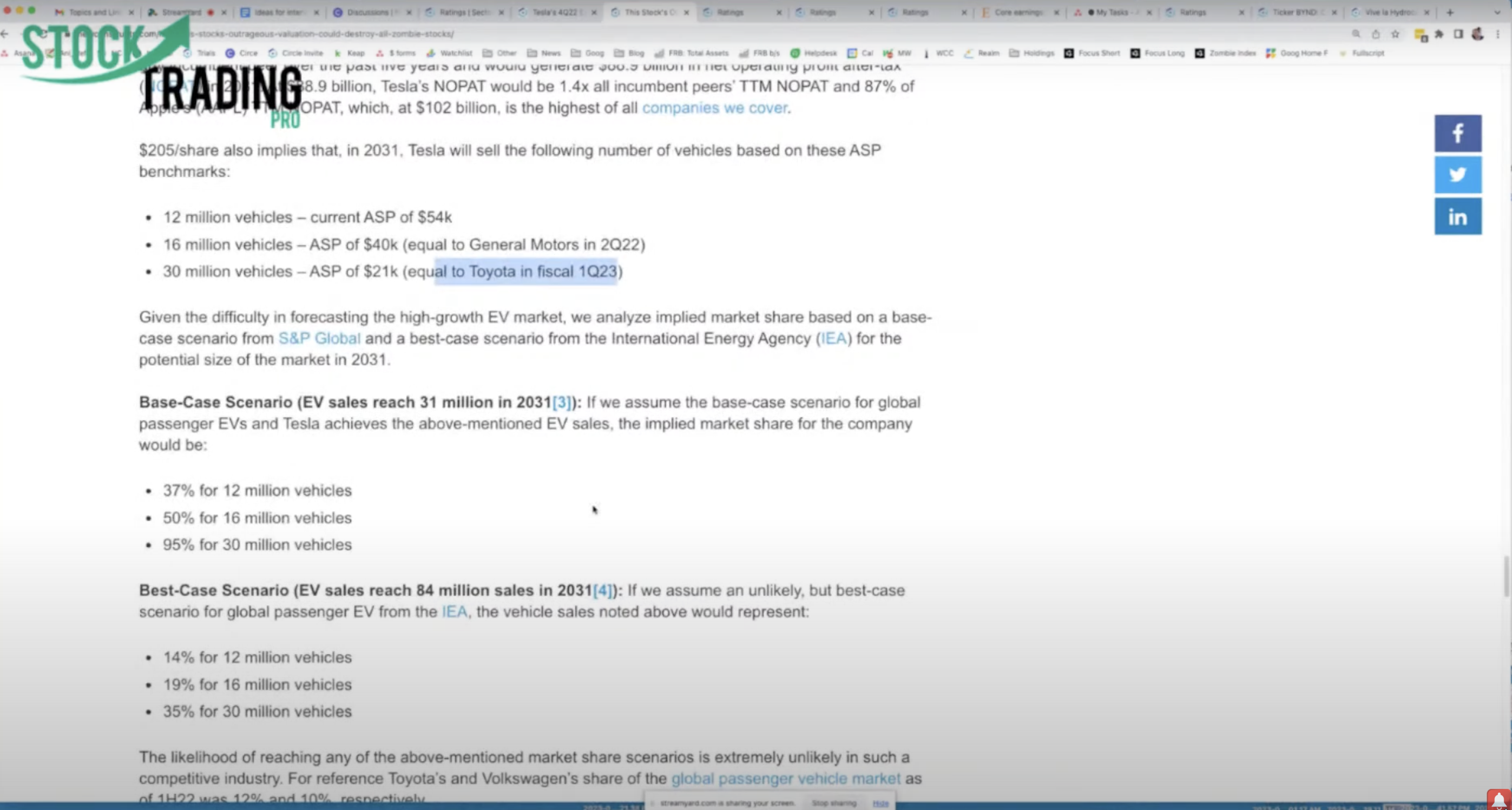

Where we analyze, like in order to justify the current stock price, what kind of vehicle sales are required by 2031. And and here we point out that for 205 bucks a share, that's 12 million vehicles. A year at an a s P of 54,000. And where were they in the last year or so? They're around a million.

Wow. 16 million vehicles at an ASP of 40 K, which. Which is equal to General Motor Motors, a s p, and then 30 million vehicles at an as P of 21 K, which is equal to Toyotas a s p. Those are some pretty big numbers. Let's get a sense of what percentage of market share those numbers imply more context.

And I believe the. The electric vehicle market by the International Energy Association or whatever the main association is looking for 31 vehicles, 31 million electric vehicles to be sold a year in 2031. So at 12 million vehicles, that means Tesla, current stock price implies they're going to be 37% of the market at 50, sorry, 60 million vehicles, 50% of the market, or 30 million vehicles, 95% of the entire electric vehicle market.

And that's where it just gets crazy, right? That's the base case scenario. The best case scenario for how many electric vehicles are sold you can see it's a big jump up. We're still talking pretty ridiculous levels of market share. I think the most amount of market share any one company's ever had of the global vehicle, of global vehicle sales market is Toyota.

I think they were at 10. It was 10% at one point. And it didn't. Wow, that's a staggering number. Especially looking at those now. Wow. Yeah. Giving them some context. Davidon. I just wanna go back one second cause I don't wanna assume everybody knows the acronyms you were using. A s P and D C F. Oh yeah.

Average selling price and discounted cash flow model. Okay. Okay. So that's that's Tesla. And where the price could be, should. What else might we wanna look at instead? Or in addition to, yeah. Some other stocks we, we like, GM is on our focus list and so is Ford. What we love about these companies is they're just the implications for their valuations are extremely low.

So GM is trading as if it's profits are going to permanently decline by 60%. Wow. I think Ford. Has only got 10% profit growth and over the remainder of its life baked into it. The other big thing to notice here is the free cash flow. You got strong and positive, free cash flow from Ford and gm, which you do not get in a Tesla.

Tesla's making things look good, right? Cuz they're con, regulatory credits and. Cutting down all their r and d. But if you look, if you break it down a little farther, Pete, and you look at free cash flow, Tesla is like burning a lot of cash. 2 billion in 2018. They did have a positive year in 2019, but they burned a billion in 2020 1.5 billion in 2021 and 2.25 billion in 2022.

So all this talk about profitability, not really true. Wow. And that's in stark contrast to what you get in terms of GM and Ford. And while people might say I don't care about that. It doesn't matter long term. Tesla's going to be great. I would say no. It's the opposite. When GM and Ford have this effectively war chest of prophets and at war chest of a profit generating machine, that just means they're going to be able to compete stronger for longer, right?

They can build out better facilities, invest more in r and. And grow their electric vehicle business over the long term in a way that Tesla can't because they don't have the cash flow. Wow. Certainly a different perspective for everybody watching this right now are listening. That's right. Before you had mentioned when we were talking about sector rotations, some sectors that had better cash flow than others.

Maybe we could finish up with any ideas in. Area, if you don't mind. Yeah. Let me go back to this is our Society of Intelligent Investors site. And we, this is where we pull out some stuff on our in our research. And we take a lot of questions. And so there's a section here on the s and p 500 where we're just looking at economic book value trends.

And I was saying that, Some, the s and p looks pretty normal or not too, not moving around a lot, but some sectors look really bad, like utilities. You can see the economic book value and just take a second. Economic book value is the no growth value of the business. So accounting book value is just that equity number of the balance sheet, and that's a pretty meaningless number these days.

Economic book value takes our net operating profit after. You divide by cost to capital. So it's a perpetuity value on that notepad number. Here you can see again economic book value plummeting for utilities, right? For industrials. Economic book value actually looking pretty good in the last quarter.

Health, it's actually coming down pretty. Technology coming down pretty strongly, real estate going down. So it's interesting to see there's a big dichotomy and if you are a client of our research, you can go on the site. And Pete, I probably should have had this up already so maybe you edit this out, but there's a section of our site where we look at fundamental market and sector trends.

And you can do a deep dive into any of the. Analysis we do across the entire market. So if you wanted to see economic earnings for all cap index and all of the sectors within that, you click on that report, click on that link, and then open this report. And it will give you a detailed breakout of how economic earnings compared to accounting earnings for the entire market.

And then we'll do a detailed breakdown on how that looks at each sector. So we start with basic materials. Consumer cyclicals looks the same, so do non-cyclical energy. Looking great. Pete? That's probably why you guys are rotating into it. Yeah. Economics and energy are tremendous.

While the valuation is still pretty muted, financials not so bad. Healthcare looks like it's turning over a bit. Industrials, again, not as bad as consumer cyclicals and non cyclicals, but. Turning over a bit. Notice how gap earnings are still looking. Great. That's a red flag. You gotta be careful. That means that some industrial companies are highly manipulating their numbers and some aren't.

We've actually, we traded a lot of Boeing in the last six months and it's basically been sideways for 15 weeks. Hasn't really moved. Caterpillar's getting hit a little bit harder right now. Yeah. Yep. That's a good example, right? Real estate, again a tale of two stories, right? Gap earning. OFF, which is more appropriate for REITs.

Flow funds from operations and then economic earnings. It's never really been very good. And then technology rolling over a bit too telecom. Anyway, you get the idea. We're going to break it down for you at a macro level all the way down to the micro level where we can break down individual stocks and understand free cash flow capital turnover, margins, all.

So David, what we'll do you, you showed a bunch of stuff on the site there. Obviously it's new constructs.com. We'll put all the links to anything that you wanna share in the description below the video that, so anybody could click through and take it a little bit of a deeper dive. And if anybody has any questions about a lot of the stuff or that David either spoke about today or showed, make sure you leave those comments below the video as well.

And we'll take those questions and that'll be a part of a follow up call. That's always the best ones when it's directly from people that are watching the videos. All right. So David, anything we didn't discuss today, especially with the earnings coming out on banks two days from now? People who know me are going to get a little bit annoyed by me beating the same drum.

And that is do your diligence. Don't just trust that the numbers you're pulling from one side or this side or another have actually looked at the footnotes. Understand if you're a fiduciary, you have a responsibility to understand the full picture and that means you are responsible for the footnotes.

They are after all disclosed. All right, so David Trainor from New Constructs. Thank you so much for being with us today and I really appreciate your time and I'll speak to you soon. Thank you, Pete. Great being with you. Thank you. Take care now. Thanks every.