The Daily Ticker 12-14-22 | FOMC Day or Judgment Day?

The Market 12-14-22 | Fed Day

The stock market continues to glide into what I call a bullish echo.

The direction remains obvious, but new trades become less likely to succeed. It’s like when you’re driving a car and you ease off the gas pedal. You’re still going but the power vanished.

Cliches become cliches because they are true. There’s a saying on Wall Street that’s a cliche, “The smart money sells on the way up, into the rallies.”

November 10, 2022 stocks exploded after bullish CPI reports leading many to hope the Fed would start to taper the heavy interest rate hikes. The DOW closed the day 1,200 points higher.

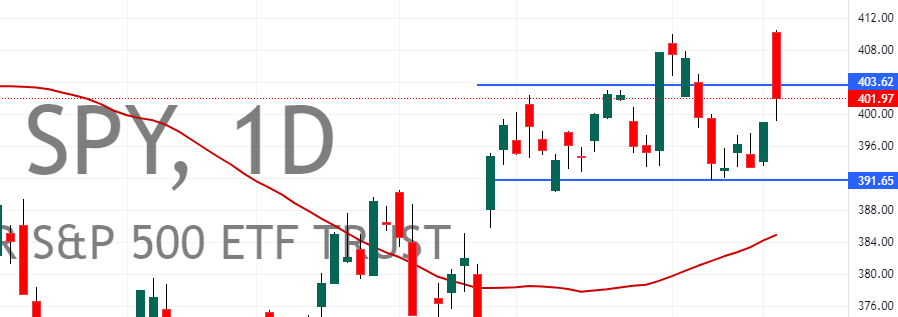

And that day began the current five week trading range.

Twice since then, the S&P 500 shot higher only to melt back into the range. Stocks are stuck in a PCOT (potential change of trend) which is where money goes to die.

Money allocated to the markets without a clear bias has drained more trading accounts than Netflix has swallowed our downtime through binging.

When smart money needs to dump stock they attract the public with one time-tested strategy – higher prices. As prices rally, and headlines support the advance we enthusiastically buy at the market looking for the big win.

When they fail we look for new headlines to support our thesis. But we never learn. Jesse Livermore called it the “Daily Dope” for a reason.

When smart money wants to accumulate (or continue doing so) they do it without attracting attention. When they believe the future is bright, they “hold the bid” and don’t let price fall.

When heavy volume breakouts fail, they are dumping stock. Not loading the boat. Such as November 30, and December 13.

Many are excited that the CPI data showed the Fed’s actions are “working.” What they failed to accept is that you don’t reverse ten years of free money in a few months.

The economy and the business cycle isn’t an algorithm that we can switch on and off when we want. They already tried that with quantitative easing. Which proved the markets can’t stand on its own without zero interest rates.

Which brings us to today and the final FOMC decision for 2022. 50 basis points is priced in. The 2PM announcement will bring volatility, and then the real story unfolds.

About 30 minutes after Jerome Powell begins interpreting the depth behind the numbers. And gives careful clues to the next wave of interest rate decisions.

That’s where the market Gods decide what happens next.

Many are mistakenly taking 50 basis points with the excitement of a rate cut. It’s not. It’s a rate hike. Keep that in mind.

The market needs separation from this trading range. Until then we need to pay attention and take “what’s available.”

We can’t complain “My trades aren’t following through! Why oh why doesn’t this system work anymore?!”

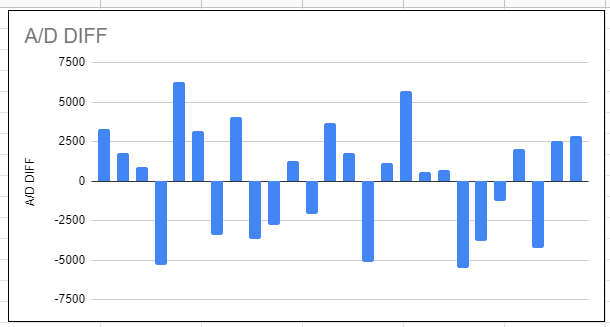

It’s not the system. Look at this image of the advance/decline line for the last 30 days. Does that look like there's a dominant side?

We can’t complain. We need to think long term, let the market do it’s thing, and when the road opens again we’ll step on the gas.