Going The Extra Mile

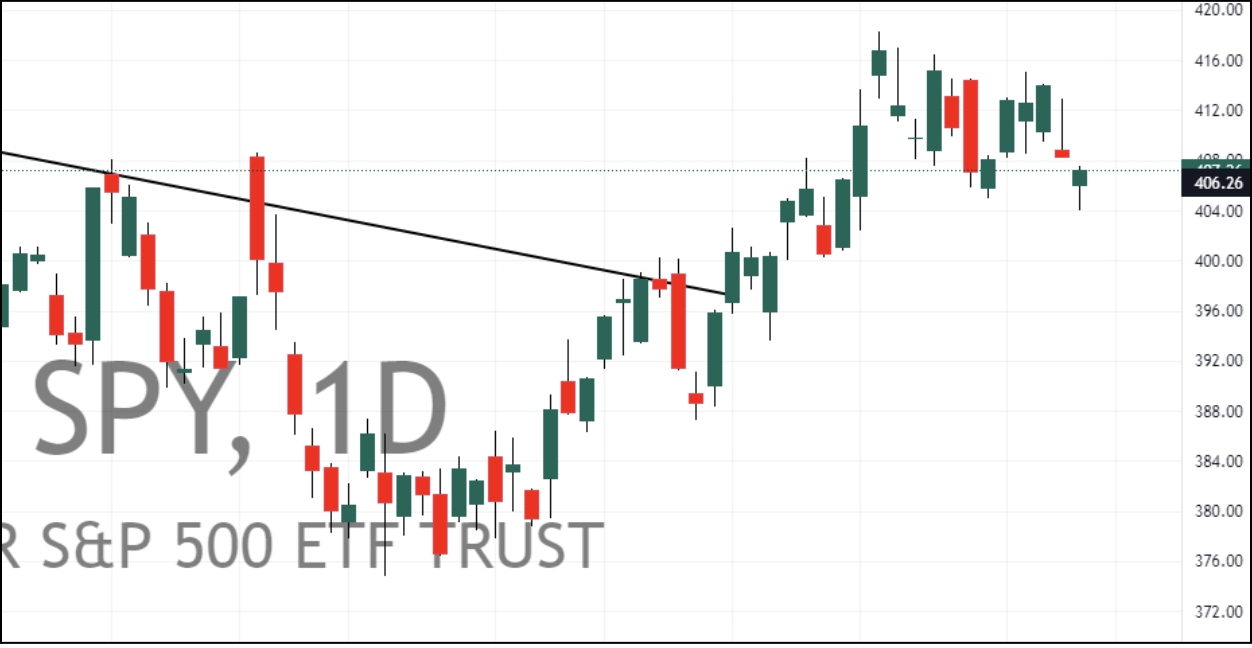

Last week proved why price action alone can be deceiving.

The SPY ETF opened lower most of the week and rallied into the close. The end of day rallies made stocks seem strong. But good traders look at more than price.

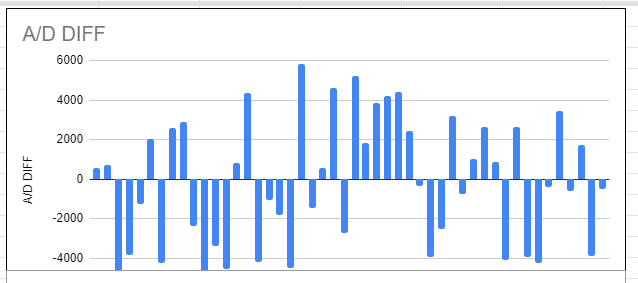

Volume certainly is going one extra step. You’ll get validation if there’s strong buying. But great traders don’t settle for weak arguments, that’s why they are great traders.

Each night our research team looks for data so that we can trade with conviction. If we find it great. We’ll trade bigger and hold longer. If it’s hard to find, we preserve capital, maybe even take profits quicker using our momentum profit maximizer.

Everyone cheered that stocks did not fall with an interest rate hike, less than perfect CPI and PPI data. But stocks didn’t rally either.

The advance decline difference showed six out of the last eight days were negative. This indicates the end of day rallies were not broad based. The majority of stocks declined.

When new members come into our community, the very first thing we do is host a live session to set up your charts. Knowing what to look at is worthless, if your software is not set up to show you what you need.

Part of that setup is focused on market leaders. Making lists of market leaders so that you can see deeper than the sector chart. Are tech stocks rallying and is #NVDA or #AAPL leading the way? Or are the secondary stocks having outsized gains while the large caps lag?

These are the things to notice. This is where conviction comes from. Conviction to be patient. Conviction to buy without hesitation, and most importantly, conviction to hold winners longer.

“I found a stock in a scanner…” is a weak reason and hard to have conviction.

Napoleon Hill said “The extra mile is never crowded.” That’s because few are willing to do that little bit extra.

Risking your hard earned money with five minutes of preparation is gambling. Hoping something good happens isn’t a plan. Are you going the extra mile? Only you know the truth. And I’ll bet your results are a perfect reflection of your current results.

Listen to your P&L. It tells you where you need to improve. We have access to amazing trading tools and data. Take the first step and the next will be revealed.

Today’s price action is important, especially if we see increased volume. The magic number for the SPY ETF is $400. Buyers need to defend that price to continue having bullish conviction.

Join our Boot Camp: https://checkout.stocktradingpro.com/products/ny-method-14-day-boot-camp/