The Daily Ticker 11-22-22 | 2022 Stock Market Prediction

Tuesday 11-22-22 | The Stock Market

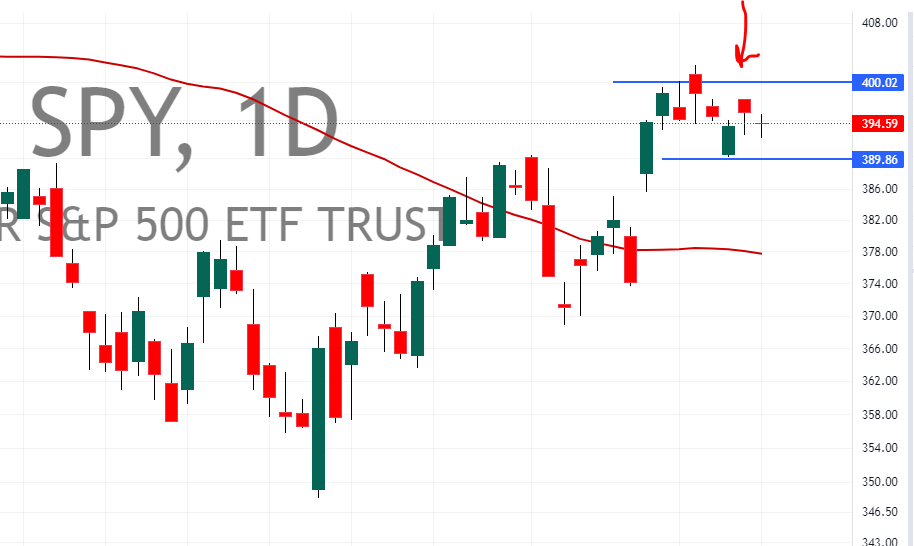

Stocks are stuck in an eight day trading range, basically $390-400.. We’re moving up the power pyramid to find ideas with conviction.

So the #SPY ended the day with a melted candle, in the middle of a trading range. An indecision sandwich.

Yesterday produced an interesting day of price action. The VIX trended down virtually the entire day, but the TICK and the advance/decline were as neutral as a vanilla ice cream

A chart like this in the VIX typically serves up a massive bullish day (The VIX moves inverse to the markets)

But it didn’t rally. As a matter of fact, the large cap tech stocks traded lower with conviction most of the day. #GOOGL leading the pack lower.

Top that off with the fourth consecutive day that new lows outpaced new highs.

The stock market needs a new catalyst, most likely the Fed minutes on Wednesday. This is where rookie traders don’t pay attention, and throw money away. The market is order flow bearish, the tape is bullish, short term neutral.

To elevate our trading game, we need to read the room and act accordingly. The correct play is cash flow mode right now. We have some solid ideas, but with the big picture so muddled, I’m looking for pockets of opportunity, and taking the quick win.

By reading the room we’re taking what’s available, get sector specific, and protecting capital. The disconnect between the VIX and the rest of the market yesterday was weird. Very weird to see the VIX down near 20 (22.46), which to many is a sign that bullish swing trades are the right play.

Is it just me or is that weird? Or is the 2022 bear market done, and we’re begun the reversal higher? Not going to happen without the big dawgs joining the move.

Throw in the FTX debacle, which is only going to get worse, and we’ll have everything possible in the price action blender.

Can industrials, energy and financials carry the market higher, as they have the last six weeks? Is that likely with the aggressive interest rates behind us and the price of crude oil going lower?

The market looks into the future, and with the Fed most likely ready to raise by 50bps, and not 75, the VIX is signaling a rally, but the internals are not agreeing.

Waiting for one side to blink for the next big move. Be patient, grab the dimes, and protect your capital.

I’d be surprised if we’ve seen the 2022 bottom.

Pete