Short Selling Stocks Explained

TRANSCRIPT: The Process of Short Selling Stocks.

A coaching question that is very basic, but I have never executed one. So this is where this is where we need everybody to have their thinking cap on. Cause we're gonna talk about short selling. And we're gonna cover both sides of moving in your favor versus moving against you.

Just for David and everybody tonight I built some fancy PowerPoints tonight. I would strongly recommend that once this video is done tonight and we posted up into the members area again, not necessarily tonight, but whenever you get a chance, and maybe we'll even pull it out, the section that I'm about to cover on the next slide, which discusses short selling.

And getting out of the short sale as it moves in your favor in both against you. So I first, I want to make this admission, for lack of a better way of putting it. When I first learned about short selling, it was literally when I first started trading because the market started going down quickly.

It was after the dot com boom. So I understood short, startling, quickly. But I want to tell you this cuz I'm a, I'm just a regular person like everybody else here. I had a hard time understanding it. Like it was very hard to be like, I don't understand getting out on the offer, getting out on the bid, and if it moves higher, how you get out.

So I'm gonna try and simplify that for you tonight. But the point that I want to get across is if short selling and exiting short selling is confusing to you. That's normal. So please be nice to yourself. , it's not easy to understand the first couple of times. However, once you do understand it and you understand was brought up here, which is the mechanics of it it you'll get it.

I'm just imploring you. The next slide I think is gonna help it quite a. But there is certain stuff that we need to discuss first. So first off, here are the buttons on what is my etra platform, but they're all the same. So you buy a sell, you stock it, you buy a stock, and you sell it to get out of it.

When you short sell a stock where you're anticipating the stock going down to get out of it, you cover it. So even though sell and short, you're doing the same thing, you're actually doing a different type of trade. A sale is getting out of an order you bought a short sale is entering a new trade, and you get out of that by buying it back and covering it.

So I'm gonna cover this in a lot of detail now. So David brought up a good. Understand the concept in general, but confused on the stop losses and the use of cover trades I see in the platform. So these are the actual buttons that you would be considering to use. But now we need to discuss some very important terminology.

Now I know Ragu had mentioned before, but adding the lingos so this section that I'm about to cover, In the order flow masterclass. So I just want to make that clear. And it's a very important section on direct access trading. Direct access trading. Okay, so bid is where you advertise to buy. So remember, everything I'm about to talk about right now is in the context of understanding, exiting and trading short sales.

Okay. Exiting and trading short sales. Okay. Yeah, Parker and Chris saying that, TD is a seller buy. I've actually seen that before. They automatically do it on their side where they mark it as a short sale versus a sale. That's actually common. E-trade might be one of the last few that does it that way, but I thought it was kind helpful to everybody.

I wanted to walk step by step through buy sales short cover. So thank you for that though, by the way. So BID is your advertising to buy, and advertising is very specifically used. An offer, which is sometimes known as the ask price. So you'll hear it as the bid offer or the bid ask is where you're advertising to sell.

Now here's the next couple of things. The next couple of bullet points are probably where you're gonna want to take a screenshot. Okay? So let's say the bid is 49 0 5, so those are people advertising to buy on the bid, and the offer is 49 10, and those are people advertising to. So the bid offer is 49 0 5.

By 49 10. That's the language you would use as a trader. This is also known as the level one quote, which is generally the aggregate of all of the people advertising to buy at 49 0 5, and all of the people advertising to sell at 49 10. And just to throw a little bit of something else in there, is the difference between oh five.

And 10 is known as the spread. So this stock, this fictitious stock has a 5 cent spread. Generally speaking, not a hard and fast rule, but generally speaking, stocks that trade less liquid, so less average shares per day have a wider spread to protect the market makers and. Because if the spread was too close and the stock didn't trade, they would actually be on the wrong side of a lot of trades.

So just as a side note there, what's important is, I want you to sound smart at the barbecue, is you know that your stock has a 5 cent spread or a 10 cent spread, that kind of thing. So why is that important? And I'll tell you why. So let's just say for argument's sake, and I believe this happened to Matt about two weeks ago, we discussed this in a stock that wasn't that liquid.

So let's say you bought this stock at 49 0 5. Let's say you advertised on the bid with a limit order. Very important about that. Limit order 49 0 5. And now the stock starts going up. Now you can advertise at, let's say it's now at 49, 20. You now advertise to sell. Up here at 49, 25, and as long as it goes up there and somebody's willing to buy it from you, you advertise to sell.

They buy it from you. And you made the difference between oh five and 25. So I know Jeff Jeff was, who was it? I'm sorry. Fred. Fred was scalping Tesla today, but he was doing it for much wider trade. So those are both limit orders. But here's the opposite side of that trade, which we're gonna talk about right now.

You can buy on the bid. or buy at the offer. So let's just say for argument's sake, you're looking at the stock and it's 49 0 5, and you're like, oh my gosh. Inside five minute candle peaches called it out. This must be the greatest trade since sliced bread. I have to buy the stock right now. And you try and buy the stock and you advertise at 49 0 5, which is exactly the high of the inside candlestick.

But now the candle goes up a little bit and now it's now the bid is 49. Oh. Oh 7 0 8 0 9 10. So now it's 49 10. So what was the 5 cent offer? Now it's 49. 10 by 49, 15. And you're like, I gotta get in this trade. Somebody just said something really important. I have to get in this trade, but I keep advertising it.

I'm not getting filled. Now you have a choice to buy it actively from somebody else who's. that's buying at the offer. Now, you could buy at the offer with a limit price. And I have a video on this in the tape reading section as well. So I'm covering it again though because it's important, especially what we're gonna talk about next on short selling.

You could buy at limit order instead of trying to buy here and it's going up. You can place an order for a limited order to buy at 49 10, and you'll get 49 10, or. Now I hardly ever use market orders unless it's a stop order and that kind of thing, but I'm not talking about stop orders right now.

So does everybody understand you can buy in the bid by advertising? If the stock starts to go up and you don't think your bid is gonna get filled because it's going up, you can then buy actively. At the offer and take these shares. Now, how fast these shares move and how many shares are available, which is liquidity.

Remember, 2 million shares per day. That's one of the reasons pretty much I can get in or out where I want to. That's one of the reasons I have that liquidity number. Now we're gonna look at the other side. You can sell on the offer, meaning you're gonna advertise here, right? We said advertise to sell or sell at the bid.

To those who are actively. Excuse me, actively advertising to buy. So let's do this in a little bit of reverse, right? So let's say you bought it 49 0 5, and I'm sure this has happened, right? It goes all the way up to 49, 25, and now you advertise on the offer at 49, 25, and all of a sudden it starts going down.

You're starting to see a red candle, oh my god, coming down. Now you're advertising at 49, 20 49, 18 49, 17 and it. Fallen like a rock on you and you're, you think, okay I'm not gonna be able to advertise. Nobody's gonna gimme my price and it's going down in the other direction. So what do you do? You actively sell those shares to people who are advertising to buy, and what's the language for that?

It means you're hitting the bid. It's a very famous terminology. You're hitting the bid to get out of that trade. So you're actively selling shares when it starts to go down to get out of a trade. Generally speaking, and again, I'm gonna keep this high level just for this conversation.

If this is all the way up here, let's say it's at 49, 25 still, and you have now moved up, your trailing stop to break even at 49 0 5, if this starts coming down and your stop loss gets filled, that's going to hit the bid at either a market order or a limit order to actively sell those shares.

When this limit price gets filled, it places an order to sell. To the bid, so we needed to cover that right there. And yep. Gary is, the offer is also known as the ask, so we needed to cover that to be very clear. So I would strongly recommend you take a snapshot of this. If not, I'm gonna give everybody the slides later anyway.

So here's why. Now we're gonna get into the short selling aspect of it. So let's just say for argument's sake, and David Zerbe brought up the question. Let's say he wants to sell short a stock that's $50 right now, let's say in his mind he thinks the stock is going down for whatever reason. Let's say it's well offered on the monthly, offered on the weekly, offered on the.

Hourly candles negative, and we're below the opening price primo situation, and there's room to go. If that stock goes down, he makes money. That's why this is green. So green is good. If you're short selling, you want it going down down is profitable for a short sale, same as buying a put option, you're seeing it go down.

So if the short sale is at 50, And it goes all the way down to 49. There's a dollar difference between those. So if he sold the stock short at 50 and gets out of the trade at 49, and we're gonna use the language in a second, there's a dollar in between the, from where he shorted it and where he covered it.

So he makes that dollar. So as price moves lower, you can place a limit order on the bid to cover for a profit. So remember before we said sell short is entering the. Covering means you're buying it back. So remember what I just said about limit orders and advertising on the bid. So while this is going down, it's a profitable green arrow, right?

But the candlesticks will be red, right? So you got red going down. As it's going down, David can place a limit order at $49. So while it's going down, people are hitting the bid. Remember on the previous slide? Hitting the bid, right? Actively hitting the bid as it's going down cuz they're panicking, it's going down.

So he's gonna advertise at 49, waiting for somebody to come and hit that bid and sell it to him so he can cover that short sale. But now the part I'm gonna discuss is the piece that I was confused about when I first started learning it. So I'm gonna, I'm gonna do my best to give a solid. Walkthrough so you can watch it a couple of times.

Now that's the best case scenario, right? You short it here, it goes down. You place a limit order on the bid and somebody sells it to you so you can get out of the trade. But what happens if prices start to move higher? So let's say you place the limit order at 49. Now it's 49, 10. 49, 20, 49, 30. He can't get out of this anymore because if he advertises, he's chasing price up.

And we've all seen that. What does that look like on on the charts? It's probably now bid, right? It probably went offered. Bam. Now all of a sudden the stock is well bid, and now David's chasing the price higher, right? You can't place a limit order or a market order at the offer to cover for a profit up to.

So as this stock is going high right now, we just said it's 49, 10, 20, 30, 40. So as long as it's between 49 and 50, he could now buy it back at the ask actively anywhere between here and here to cover this for profit. As long as it's below 50 and 49, he'll make. So I want to go back here again because it's important.

So if you could imagine this, it went down, he tried advertising here, and all of a sudden the five minute candle went well bid. So he's trying to advertise it on the way up, and he's not gonna get filled because they're buying it here actively. So now it's going 49, 10 49, 20, 49, 30, and he's chasing it up.

Here he is never gonna get filled because there's active buying and it's going higher, right? So now let's say this is 49 40, just for argument sake. So let's say it's 49, 35. By 49 40, he's screw this, I'm outta here. I want to book the 65 cent profit on the short sale. He'll now actively get out on this side by buying shares that somebody else is offering.

To exit his short sale. And again, I just, I can't emphasize this enough. This is one of the most challenging, confusing things that we will ever do together. If you trust me on this. This is once you need a little bit of repetition, but once you do, and trust me, I'm not bringing this up haphazardly. The market is in a different tone it right now, and I think everybody knows that.

So as long as he is chasing it up, he's probably not gonna get filled on his limit order. He could try, he could certainly try, but let's say it's going up to 50, place a limit order or a market order. Now again, I very rarely use market orders because I'm trading liquid stocks. I usually lose limit orders.

And if you'd be able to get out. Now, here's what he doesn't want to have. Here's the opposite. Now, if he shorts the stock and it starts to go up, we all know that's unlimited risk, right? Cuz that can go to infinity, right? So what happens now goes all the way up between 50 and 51. Now it's becoming a losing trade from here and as it keeps going higher.

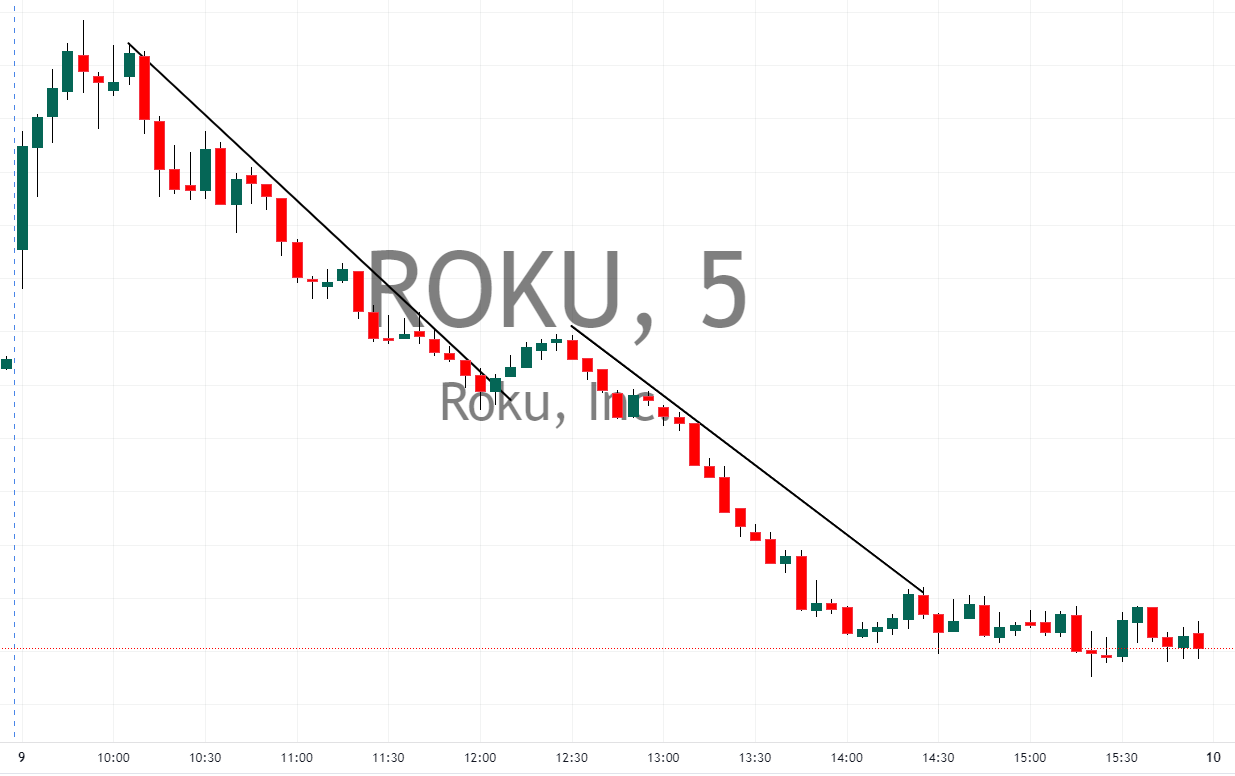

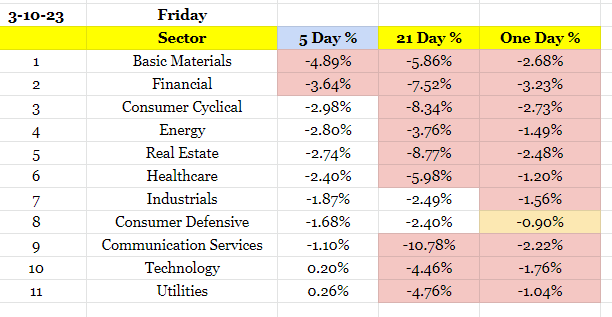

So as prices replace a limit order or a market order at the offer to cover this position for a loss. Yep. So it could be a short squeeze. It could just be, look, think about what we had this afternoon, right? The spy was breaking down again later in the afternoon. Let take a quick look at the chart, right?

If we take a look at I'll just pull it up really quickly because this is probably the best example. Looking at the shorter timeframe right here, right? You might have been like, okay, this is bouncing and I'm gonna put on a short sale here because we have resistance here and had a hard time getting through there.

Maybe you can even do it here because now it's well offered. Let's zoom this out a little bit. You're like, okay okay, rally here. Done. You still below the opening price? I'm gonna shorten it here. So this is the situation that we just talked about here, where it's 50 and it doesn't roll over.

It starts to head back up, and that's where now he's chasing price higher. He's not gonna be able to advertise cuz it's running away from him and he's got to actively get out of that position. So I just can't emphasize this enough. Short selling takes a couple of brain cells and uninterrupted brain cells to really understand this, and I'm telling you, it is so worth your time.

You have no idea, and I forgot who asked it last week, but it was a brilliant question. And it was in reference to should we be making lists of stocks to trade on both sides of the market.

And heck yeah, that's normal trading , where you have a watch list of longs, a watch list of shorts, and you have them sorted by changing the opening, depending on whether it's a long or a short.

Heck yeah. So each and every day we're most likely gonna have trades on the long side and the short side. You'll be picking the stocks that are in sync with the market for the easier trades. But if the market rolls over and or does the opposite like it did today if you had a bunch of short sales coming into today and the end of the day the market rallies, we was talking about trading a lot of those other stocks long this afternoon.

I think eBay Later in the day as well in sync with the market. So this is a good example of what we're talking about here. I look I just can't emphasize this enough. You need to watch this. Karen Simmons actually reached out to me today. She was walking me through how she was thinking about short selling and I congratulated She's getting out of her comfort zone now.

She's realizing the market conditions are changing. So very important to learn this. This is real market scenario. Now, I want to say this, and I say this in all sincerity, if you are not comfortable short selling, That's one thing. And you don't have to if you don't want to if it's just like one of those things you're like, I'm just never gonna get it.

That's fine. That's okay. I'd recommend you learn, I'd recommend you give it a shot to learn. I'll just throw that out there. But I also know a lot of people that don't like to show itself cuz they think it's unAmerican. Why would I want to set bet against American companies, that kind of thing. I understand that too.

I don't have that problem if a stock's going down, I'm hitting the bid and I'm getting short if I can make money. But just so everybody's clear, and this is like an advanced conversation most of the people you. Probably 95% of the active traders you'll meet, 95% probably are long only, and just looking for spots to buy.

And I absolutely know that in our community, just from conversations and seeing how people are trading, there's nothing wrong with it. But you need to be super disciplined not to fight a bearish environment. You're much better off being in. And waiting at the least for well bid candlesticks if the majority of stocks are going down like we've had for the last week and a half or waiting for some minimum criteria, like we said, pre-market going into today.

Wait. Don't buy until at least we see well bid candlesticks. Luckily we got Roku today that, that was a really nice payday for a lot of people right out of the gate. David, good question. I'm sure a lot of people had the same question.