Revealed for the First Time Since 2007. 93 Year Old Trading Secret Left Behind on the Floor of

the New York Stock Exchange

Everything Changed February 2007-

IT WAS THE SAME STOCK MARKET, BUT THE VIEW WAS DIFFERENT

Why the Rich Get Rich and the Poor Get Poorer

The story you are about to read is true. None of the names were changed to protect the players.

If you’re on the wrong side of break-even, shut off your cellphone for the next 20 minutes. Your view of trading and the stock market is about to change.

The charts won’t change, but what you’ll see is different.

For over 93 years those who understood order flow, profited handsomely by interpreting price action revealed on the tape. I’ve been told by clients that tape reading gives them a “second sight.” Everything changed when they elevated from chart reader to tape reader.

When you see what’s was missing, and you see behind the tape, trading will never be the same.

Many traders hear “tape reading” and think it reeks of old-school methods no longer valid in today’s 24 hour, global market. These same traders risk precious capital on trades they see on Fast Money, Jim Cramer or on StockTwits.

Maybe you’re one of them.

Much of this story is from my prop firm, Keystone Trading Group, and after, my work with the largest prop firm in the United States.

You now hold the wisdom of millions of managing those executions and billions of shares traded. At our peak Keystone had nine offices around the world and over nearly 300 traders.

What you seek is now in your hands. The rest is up to you.

Are you ready right now, right here, in this moment, to abandon what has not worked? Or are you comfortable in your current level of success?

What is your current burning desire? When you visualize success, what does it look like? Why do you want that goal?

During my journey, I have committed or witnessed every mistake conceivable. Those mistakes are the foundation for a level of success I could never have imagined.

Those who succeed, eventually learn to answer the one question that leads to powerfully effective trading. Eventually they see that everything else is nonsense.

The Turning Point

The market changed dramatically February 2007.

The New York Stock Exchange introduced hybrid orders that exposed the specialist to virtually unlimited shares through electronic executions. Prior to this change, there were restrictions.

Since the specialist manually controlled the stock through the orders in his (her) “Open Book” quotes were needed to create a fair market. What was once a limit of 1099 shares on one side of the market every 30 seconds, became unlimited exposure.

**History lesson– The former order was known as the DOT or SDOT system, “direct order turnaround.” It was a way for us to trade at a specialist quoted price. Similar to the NASDAQ SOES system (small order execution system. The restrictions meant I could only buy up to 1099 shares every 30 seconds from the specialist using a DOT order.

I could SELL immediately, but if I wanted to buy more shares from that quote, I needed to wait.

The new Hybrid order was implemented on February 24, 2007 and the specialist was now exposed to unlimited executions against the quote. It became impossible to keep up the quotes manually.

To give some context to how this change affected active traders, I have a friend Rob, who traded only “listed stocks.” (NYSE with the specialist) His strategy was to watch the specialist quote, and the prints on the tape, and follow them until the flow of trades changed.

If you were on our trading floor, you would often hear “the specialist was stepping up or stepping down.”

This meant Rob found a large order that was moving a stock.

Rob was trading over a million shares per day… Within 7 months he was no longer an active trader. The specialist quote and prints were now harder to read, they were computerized using algorithms.

As 2007 wore on, the once hallowed grounds of the New York Stock Exchange was now a studio to broadcast market updates. What once was over 5,000 people buzzing in the purest sense of capitalism, is now a digital flow of automated bids and offers that adjust quotes faster than you can blink.

Trading off the noise of the crowd was gone. It’s now a silent hum of co-located servers where speed and distance are the new edge.

I never traded on the floor, but the guys I met said the crescendo of noise on a busy day, was magical, and a privilege they will never forget.

A Fortunate Encounter

Blaggards, NYC

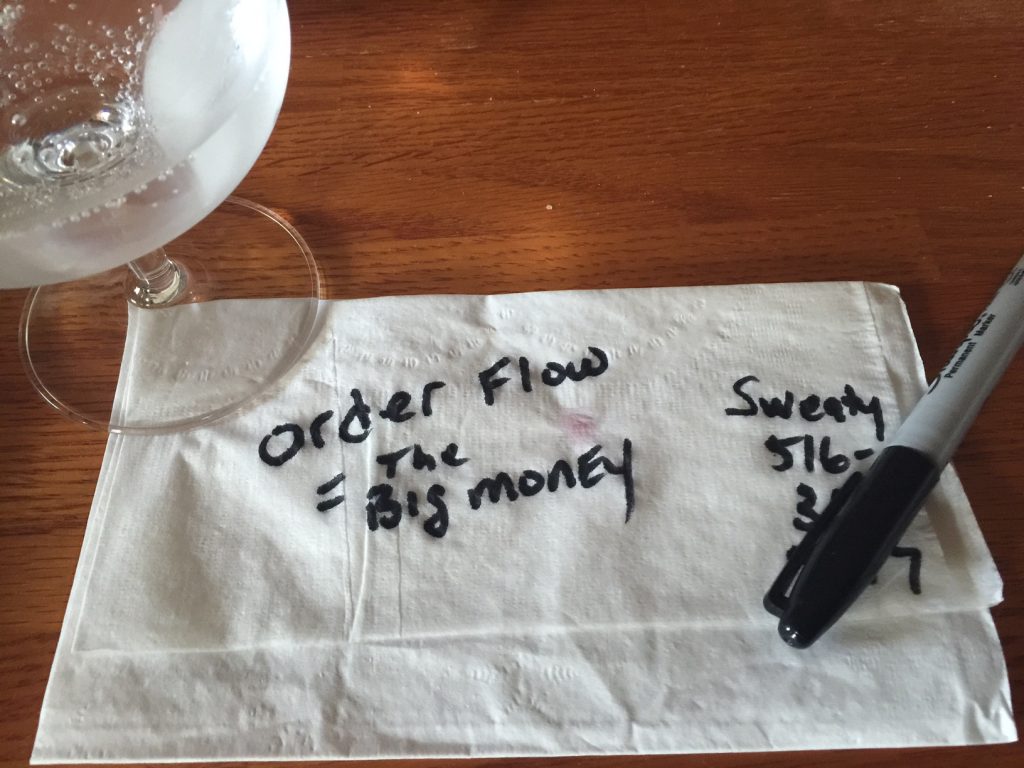

It was October 9, 2007, about 90 minutes after the market closed. I was enjoying an adult beverage at Blaggards, on 35th St, between 7th and 8th avenues.

A quick glance at my Blackberry, I saw that the market was at new all-time highs. “Where did the Dow close?” the guy sitting next to me asked. “14, 164, an amazing day for the history books, but trading it was tough. May through October was choppy, it’s nice for TV, but we need it to pick a direction” I replied,

He reached out his hand and said his name was Bobby, but everyone on the floor used to call him “Sweaty”. Of course, I laughed as I shook his hand. He said 'it’s not what you think'.

Art Cashin

“One day about 20 years ago I walked onto the floor wearing sweat pants. All day long Art Cashin kept calling for SWEATY on the speaker. The name stuck. Ask almost anyone on the floor, and they know who Sweaty is.”

He asked where I traded. I said I own a prop firm next door, 450 7th avenue, above Citibank. “We have a few offices and about 175 traders right now.”

“Interesting,” Sweaty said, he kept talking but I couldn’t stop thinking he looked like Pat Riley with a fake tan. “Do you have room for more traders?” I have about 20 former colleagues from the floor of the NYSE trading from home, and they hate it. They need to get out of the house.”

“What’s your office like?” he said. “Mostly filled with day traders right?” I said yeah. Sweaty replied-“OK, cool. If you give us a good deal, my guys will teach you about order flow. How we worked the big orders.

We’ll show you what’s going on behind the tape, and in exchange, you show us how to use your fancy software. Most of us are dinosaurs, still adjusting to life off the floor. Should be a good deal for both of us.”

I told him I needed to speak to my partner, but I would give him a call either way. He gave me his number and walked out without saying goodbye. It was weird, from start to finish, but worth a meeting.

Lessons In Reading the Tape

Moose was a clerk for Bank of America. We made a deal, and before long, we also had Joe Coco, Bill T., Kyle, Jerry, Forrest, Greg, Jim D. Jim T., the Connolly brothers, Tim A. and Rich V.

Once they saw we knew our stuff, word spread and we had 25 former New York Stock Exchange specialists, clerks and brokers trading in the office.

“Seems like your traders are pretty good at trading momentum" Kyle said to me over lunch, "you gave them a solid strategy for trading swings over three to five days.” “Yeah" I responded, "we developed Saturation Plays a few years ago. It’s been our bread and butter, a great strategy for cash flow.” “How does it work?” Bill asked.

I told them that essentially we stalk price and volume over a 2 - 6 day period. The goal is to identify when institutions are active, and when they step aside. It’s not dependent on the longer term bias, it’s pure tape reading over that short window.

As the market alternates between buying and selling pressure, our objective is to enter as this pressure “saturates” in a value area to buy, and “saturates” in a profit taking area to sell or sell short.

When the market opens, we monitor three specific levels that determine today’s tape. Once the strategy is locked in, the trader will always know what expect. The most powerful aspect of the trade is anticipating the opening price action. We know exactly what to expect the first 90 minutes, and the correct levels to trade.

Each day we plan ten to fifteen trades. We only need two or three to unfold as planned, to make consistent money. Many amateur traders believe the opening hour is confusing, and too volatile to interpret. The Saturation Play gives our traders confidence on the open, because when the “expected” happens, they literally planned for it.

They are taught to let everything else go. It’s really a thing of beauty when you learn to read the swing. “What happens if a lot of trades trigger at once?” Sweaty asked. They are trained to flawlessly take every trade. Our traders understand the system makes money over time, so you can’t cherry-pick the winners.

Trading doesn’t work if you only take some of the signals.. Once a trader gets used to the Game Plan, it’s actually easier to manage five positions than one. You aren’t watching every up-tick or down-tick. You manage the aggregate of the positions. The only way a traders gets in trouble, is if he doesn’t exit the losers.

Building a Profitable System on Simple Math

The Origins of Ten Perfect Trades

Everything starts with stocks that close in the top or bottom ten percent of the range. These setups have a 90% chance of following through in the same direction the next morning. But, they have only a 50% chance of closing above the previous day’s high (for a long), or below for a weak close.

Put simply, a strong close with a higher opening has a 50% probability of failing, when combined with the Saturation Play setup. The trigger without the setup is worthless. When you add the entry criteria, the trade is a thing of beauty.

Saturation Plays are designed to capture the move from the low to the high, or from the high to the low. The key to the trade is knowing whether or not you should expect the high or low to be made first each morning.

Once you know the setup, the opening play and the projected entry price, the trade is just a matter of placing limit orders at the correct price to begin working the trade.

The secret to the play is defining your bias and never deviating. You can’t fight the tape. There are day the momentum runs longer than usual, but it simply sets up the same trade the next day. Take your accepted loss and move on with your day.

You come into the day as a buyer, seller, or looking for a short sale. You don’t flip-flop during the day.

“What’s the trade objective?” Moose asked

Best case scenario is to hold to the close, but truth be told, when you have multiple positions that are profitable all at once, your P&L can explode pretty quickly, it can be hard not to book profits.

We need to add some element that tells us when to get aggressive with our hold time, and when to exit into momentum.

“Maybe I can help with that, said Greg, you need to add a bigger view of the tape.” Greg the quiet one, blurted out. He was a specialist for Vandy from 1996-2007.

Taking Order Flow Deeper

Working order flow was a balance between making a fair and orderly market, with taking the wrong side of the order flow to provide liquidity. If there was an imbalance and the stock had an unusual supply or demand, we were on the wrong side of that trade. It was our responsibility to fill those orders.

Once the order flow slowed down, we could trade out of the position or even earn profits if we accepted the risk. Your trade needs a component that shows you when to trade with the momentum and when to fade it. When to add to positions and when to exit into momentum.

Greg went to the whiteboard and drew out this phase of market action viewed from the specialist perspective. It was close to the Saturation Play but we didn’t consider this last piece.

“Stocks-in play, Greg continued, tip their hand. A large buyer or seller will try to get shares as quietly as possible, until they can’t. Greg drew the candlesticks on the whiteboard. You this this, stay away, it’s chop city, you see these, in this order with this type of close, you are trading with the order flow.

Generally speaking this type of flow can last from three weeks to 3 months.”

But here is where everyone messes it up. Most traders only watch price. They watch how much they are up or down in the trade. A stock moves against them and they are focused on price. You need to read the tape, not just the price, and the tape includes how many shares traded at that price.

“From what I hear in the office, a few of your traders are getting stopped out of profitable trades and not sizing up on the winners. They find winners but get scared too easily. Every up-tick and down-tick is life or death.”

They get stopped out on price because they can’t read the tape. Everyone reads charts, including CNBC and such, but very few read the tape. Think of it this way, maybe this will help you explain it tomorrow…

If you buy one share at $10. Your demand and commitment to the idea is $10. If I buy two shares at $10, my commitment and demand is $20.

The price is the same, but the tape is telling a different story.This simple example explains why the public is always wrong. They only trade price.

You need to monitor it on these two time frames. (more whiteboard stuff) That’s what we did on the floor. When we needed a view of the tape, outside of our own order flow, this is what we monitored.

Reading the tape must include the action of the volume. It is not price action, but volume – – the amount of money, the supply and the demand – – which best tells the story. Tape reading determines if institutional activity currently favors the buy side or the sell side, the supply or demand.

Do not forget that every purchase of a share of stock means also a sell. Our job is to determine the balance of the supply and demand: whether the demand is greater than the supply, in which case the price advances, or the reverse.

The action of the volume tells us of the supply and demand; price merely denotes the value of the volume!

One last thing to consider is tracking the volume on a daily basis. Order flow is not going to jump off the page and bite you in the ass, but when you study a handful of stocks, you can learn the tape quickly.

Institutions Marketing Stocks for Sale: Order Flow on the Tape

== >> The beginning of the mark up is orderly. Not attracting attention yet.

== >> Just prior to “A” the first attempt to market stock for sale is completed in a $4 trading range. Price falls quickly during the few days of “A” but there is too much stock for sale. We need higher prices and more “second chances” to get a hot stock at a better price. Think of spot “A” as the movie preview. It gets your interest in things to come.

== >>Area “B” is the marketing machine at it’s best. New high prices that violently decline and give you another chance to buy. The wider the swings, the more attempts at a new high, the more lemmings drawn to the buy button before the coming decline.

Is that legal?

Yes. It’s just institutions marketing what they need you to see and believe.

Big money can’t buy or exit large positions without your help.

Tape readers see distribution.

Chart readers see “action.”

Order Flow = The Smart Money

What exactly are Institutions?” In trading terms, I’m talking about major financial institutions. Hedge funds, mutual funds, pension funds, the big players who need to earn returns to keep their jobs.

These players account for an estimated 67% of the volume in the stock market on any given day. Smart traders benefit by tracking their order flow.

The term order flow comes from market makers and specialists receiving large orders to work. The better price they got for the order, the more order flow they got. The more order flow, the more they made in commissions.

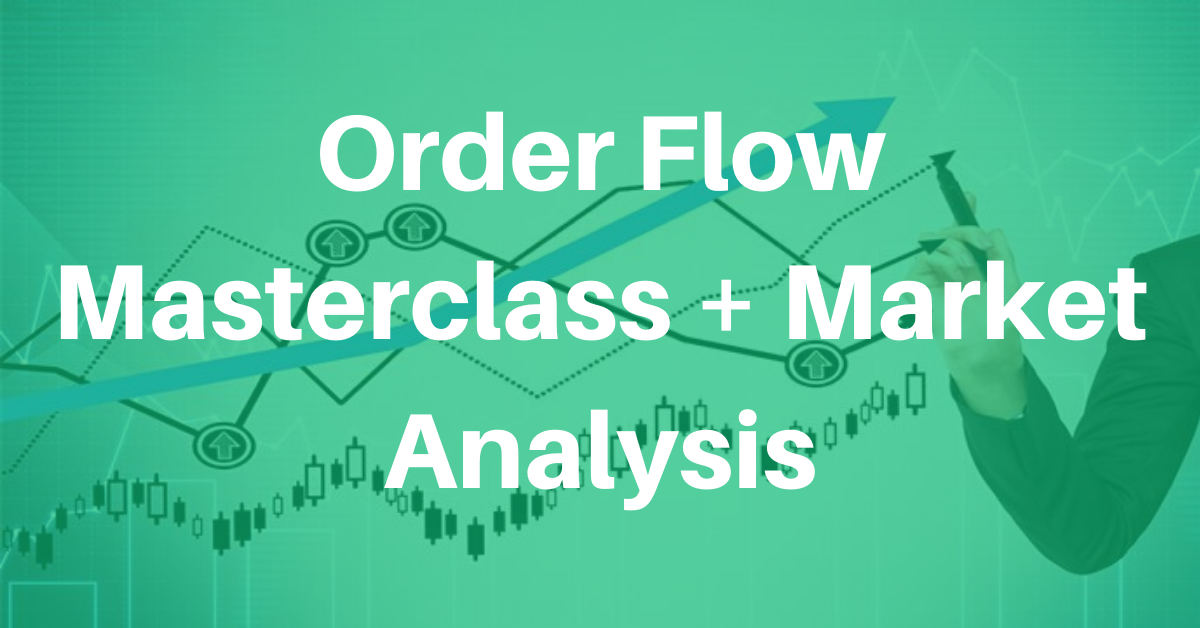

YOU GET OVER 20 HOURS OF

PROFESSIONAL TRADER TRAINING

The Order Flow Masterclass and Market Analysis Stacking System: Step-by-step process for reliable wins.

- Trade Expectation & Developing the Edge.

- Institutional Order Flow & the Smart Money.

- Trend Analysis & Multiple Time-Frames.

- Chart Patterns & Potential Change of Trend.

- Market analysis, sector rotation and market internals

Professional Trading Tactics: Entries, Exits & Trade Adjustments. The real money is made between the buy and sell orders.

- Between Entry and Exit = Trade Management

- Entry Tactics & Patterns

- Profit Targets & Trailing Stops

- The Stop-Loss, Scaling Out & Planned Re-entries

- Trading Momentum & Order Type Review.

Trading Plan Blueprint: How to Trade Operate a Trading Business. Get organized so you'll get paid.

- Trading as a Business. Developing Strategy

- The Trading Plan. Decide how you want to compete.

- Money Management & Risk Management

- Searching for Trade Ideas & the Game Plan

- Assessing and Applying Probability Risk & Reward

Street Smarts: Required wisdom you need to succeed The quickest path to trading success is through knowledge. Make your life easier and swipe my experience.

- Core Knowledge & “Street Smarts”

- Long-Term Goals & Main Challenge

- Short-Term Objectives & Obstacles

- Defining Probabilities, Risk and Leverage

- Candlestick Charts: Price Action DNA

Pro Mindset: The tiny change in the way you think that makes you a winner or a could have been.

- Think Like a Winner Mindset

- Mentor Advice Stories of Success & Failure

- Discipline & Commitment

- How to Improve - Feedback & Outcomes

- How Winners Focus On the Process