How I Made A Small Fortune Trading Stocks

Join Our Free Trading Group:

Visit this page to become a member == >

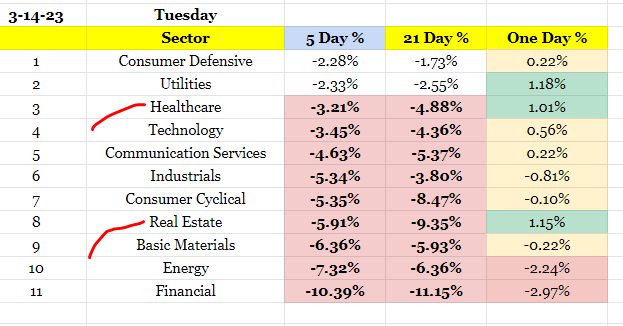

As the markets deal with the SVB fall out, some relative strength under the hood.

Last night I commented that we are likely to see a sideways day today at worst, a short covering rally is possible. Not a major reversal of the recent bearish order flow, but a rally.

Is this predicting? No. It’s tape reading.

What’s the difference? Predicting is asking where stocks will be in a week. Tape reading is asking what they are doing now.

Predicting is a nasty habit because it gets you thinking into the future, it blocks you from paying attention.

Predicting doesn’t allow new information.

Which is why so many people have a hard time managing trades. They only see the end. The winner. So anything other than the prediction, isn’t really happening. (In their mind)

So let’s discuss an example of tape reading.

/ A large list of healthcare stocks stopped going down, many closing higher and above the open.

/ A large list of healthcare stocks traded into exhaustion type price action and volume (typically the end of the current move because the large volume spike and energy candles represent the end of the order that created the momentum.)

So good traders will ask: “What does that mean?”

/ It means the reason the sector declined for several months is likely over. But that doesn’t mean we start getting long. Yet.

It means we ask for more proof. So we say, okay cool, but can you close net positive, with a higher high, a higher low, and near the high of the day? And can you do it on increasing volume?

Five pieces of new information from the next daily candle. We’re not predicting, we're building an argument for a trade. We’re doing a lot of “if - then” stuff.”

Those two simple words, “if-then” have made me or saved me a small fortune.

They always have me prepared. Rarely surprised, but always ready to make a decision.

A two word phrase that separates winners from losers.

-/ If my stock moves against me quickly, I will scale back my shares, but not get out.

-/ If the stock begins to move back in my favor, I will buy those shares back.

-/ If my stocks move a certain percentage in my favor I will add half the amount of shares I have now.

-/ If I have a winning trade but the sector is not in sync with my idea, I will trail my stop loss tighter.

-/ If my breakout fails, I will get out. Because real breakouts follow through.

-/ If I have a winning trade and the sector lights up in the same color as my stock, I will use a wider trailing stop loss because order flow is pouring into my idea. It’s time to hold this potentially big winner.

-/ If stocks trade below the daily 50 SMA I will not buy them. If I am already long, I will exit.

The list is incredibly easy to make.

Those who take the time, will find trading easy and fun. Those who continue to look for the magic answer, will always struggle.

You’ll struggle because you’re more invested in being right, than making money.

One of my favorite trading quotes is ”When you know what you’re looking for, you’re never lost”

This is how profitable algorithms print money.

They know what they want, and what they don’t want.

And then they take action. No second-guessing, they simply take action. Try it, I’m willing to be it’s a game changer for you.

By the way, the easiest way to build your if-then list is from your trading journal.

Make observations and then jot down the right action.

You’ll be SHOCKED when you see the results.

Pete

Learn to Trade Stocks:

Enroll in our trading boot camp...

Join us 7:30 AM for the Stock Market Live Stream (Monday-Friday)

Be sure to SUBSCRIBE to our YOUTUBE channel and hit the LIKE button for updates.

Ready to Uplevel Your Trading?

Schedule an Interview with our team today:

https://stocktradingpro.com/stock-trading-pro-coaching-call/

🥇 Smart Money Tactics | Order Flow Trading

https://youtu.be/MOYNbC_HERE

🥇 Finviz Screener | Find the Top Stocks to Buy Now

https://youtu.be/K5JZNCWIhZo

🥇 Sector Rotation Trading Strategy

https://youtu.be/lcB83RcN23Y

🥇 Swing Trading Strategy | Candlestick Charts

https://youtu.be/2pmYj-Gqm1k

🥇 Tape Reading Explained

https://youtu.be/Jqup9n8BifM

Contact:

[email protected]

Disclaimer:

https://stocktradingpro.com/disclaimer/

These YouTube stock market live stream videos are for financial education purposes. It's up to you to consult your financial advisor to make the final decision before you decide which stocks to buy now.

The Stock Trading Pro mission: How to know what stocks to buy.