BIDU Decline Sets Up New Trade | GS Earnings Report 1-15-20

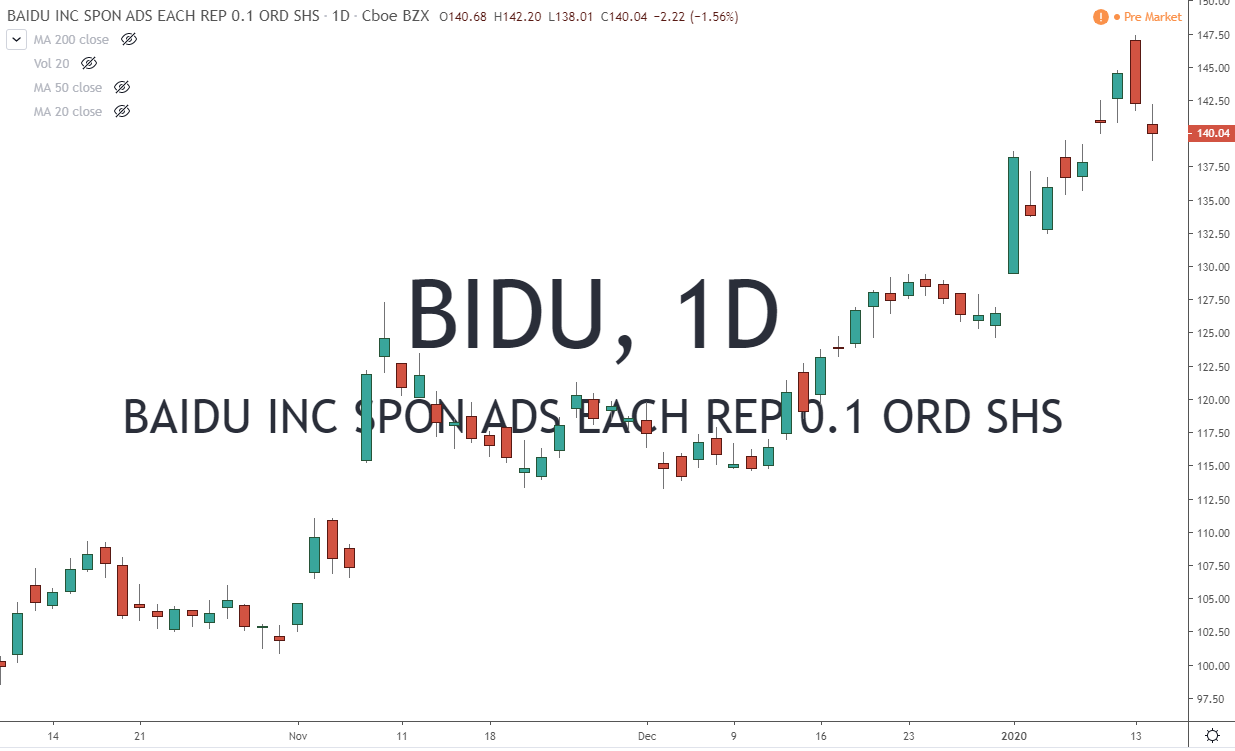

BIDU Baidu Inc Stock Chart 1-15-20

Yesterday's melted candlestick (small body) combined with well-offered price action (lower lows and lower highs) created an opportunity to initiate a new long.

BIDU Baidu Inc has declined for two days setting up a momentum trade. I'm game planning to be a buyer on a lower open looking for a 10 point rally.

My game plan is to enter the trade in two stages. My first entry is a test of the previous days low. My second entry is a push lower to the $137.50 area.

Because I am "working the order" I will be bottom heavy in my shares. Meaning I will look to buy a greater number of shares if my second entry target is hit. If the stock opens higher I am letting it go.

Have a great day.

Pete

PS. A quick lesson about managing your winners as they grind higher. If you believe your stock is near a top, or getting tired -- many professional traders will move up a trailing stop loss instead of exiting.

This means you continue to be in the trade as it moves higher, but get stopped out on a decline. Predictions of tops, capitulation and such should be traded with continued profits in mind. Using a trailing stop allows you to earn more but also be prepared for a decline.

A moving average crossover can help make this easy to manage as well.

Expert’s #1 Play for 2020: Unprecedented Currency Shift, Next Bull Market

Billions of dollars are pouring into one long-ignored asset Goldman Sachs expects will soar in the first quarter of 2020.

Go here to see hard-asset expert’s #1 way to play this massive shift before it turns into a runaway train.

Goldman Sachs Earnings Preview: Strong Earnings Beat On The Cards For Goldman?

The decrease in revenues coupled with nearly identical expenses compared to the previous year should have weighed on Goldman’s net income margin and reduced the EPS figure to $22.24 for the year.

Goldman Sachs is scheduled to release its Q4 and full-year 2019 results before the market opens on Wednesday, January 15.

forbes.com/goldman-sachs-earnings-1-15-20

UnitedHealth fourth-quarter profit rises 16.5%

Earnings beats will give the record rally credibility, market bull Sam Stovall predicts

CFRA Research’s Sam Stovall expects the market’s record rally to earn its street cred. According to Stovall, the process should begin this week as the nation’s biggest companies report 2019 fourth quarter results.

“We need to actually see a positive jump for the fourth quarter of 2019 and then start to see some optimistic guidance for the coming quarters[…]”