American Express Co AXP Earnings Report Plus Ray Dalio

American Express Co AXP Stock Chart Before Earnings 10.18.19

What's in Store for American Express (AXP) Earnings in Q3?

American Express Co.’s (AXP – Free Report) third-quarter 2019 earnings results, scheduled for release on Oct 18, are expected to reflect a well-balanced mix of spending, fees and loans spread across geographies and customer segments.

For the to be reported quarter, the Zacks Consensus Estimate for earnings is pegged at $2.07, indicating an increase of 10.11% from the year-ago reported figure on revenues of $10.97 billion, implying an improvement of 8.17% from the prior-year reported number.

zacks.com/american-express-axp-earnings

Three company earnings reports that are better than you thought — and three that are worse

Based on certain criteria, there are reasons to get excited about equities, but seen another way, the numbers look downright nasty.

Here are three companies that seemed to win high marks in their recent earnings report that may actually be setting off warning bells, and three more that initially stumbled but could be worth a look.

marketwatch.com/three-earnings-reports-better

Ray Dalio says the world is in a ‘great sag’ and echoes the 1930s

Hedge fund owner Ray Dalio said the global business cycle is in a “great sag” and the world’s economy holds at least two parallels to the 1930s.

Speaking a CNBC-moderated panel at the IMF and World Bank annual meetings in Washington, D.C. on Thursday, Dalio said it was now too late for […]

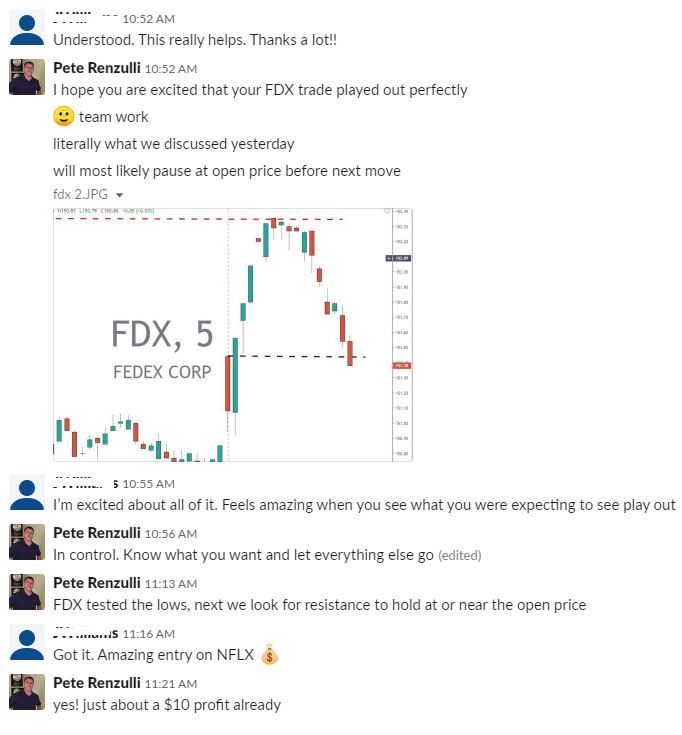

Yesterday I had a follow up session (see image below) with a private coaching client. In real-time we traded two stocks from his game plan that we mapped out the night before.

One trade was a short sale, one was a long (earnings play).

The interesting thing about the trades was timing and price action. For the long trade the stock had positive earnings and spiked over 8% after hours, opened higher and then began selling, and selling hard.

Our game plan for the day was to be a buyer of the stock, but the stock kept trading lower. He kept asking... "Are you still looking for a long?" My answer was an emphatic yes.

Still moving lower. He kept asking "Now?"

First few times, "Not yet, has not triggered yet."

Then we got the entry signal. and boom a $10 move. As soon as we were filled I started mapping out what we need to see next as possible targets.

"If this happens, I plan to do this..."

The short sale unfolded according to plan. We saw the price action we needed, executed and the trade played out for a solid $2 (plus holding for today's open)

I have two man points here; this client is working hard, very hard at improving his skills, he asks a lot of good questions and comes prepared. And he took action.

Second is the timing and preparation. Doing the prep, and ONLY trading what you planned for is a skill of a pro. You don't short sell a stock you planned to buy. That's broke amateur stuff. You're chasing price action.

The timing aspect. Even if you have a good plan, you still must force yourself to wait for the signal. You can't get anxious and enter too early, you mess up the reason to accept risk. You mess up the profit potential.

He waited. and got paid.

The results are great, but the part I'm most excited about is the control for him. There's no better feeling in the world than owning your results.

The stock market doesn't give us money, we plan for it. Getting paid is skill, not luck.

Have a great day.

Pete

Facebook Inc FB Stock Chart 10.18.19