Rediscover A 93 Year Old Trading System That Still Works Today.

Revealed for the First Time in 10 Years-Impossible to Find, 93 Year Old Secret Buried on the Floor of the New York Stock Exchange —

Everything Changed February 2007-

It was the Same Stock Market, but the View was Different

If today’s trader has access to more technology, more charting solutions and more information than any point in history – why aren’t those advantages translating into more money?

This report examines why the modern trader is underachieving and introduces the obvious solution, found in the least likely of places…

What separates this information is that it’s based on real people. Real people, real money, real traders. Traders just like yourself. The lessons were experienced through my own eyes.

This isn’t a research report. It’s a story. A story about you with an unfinished ending.

Sixteen years of experience gives me a unique insight into why some some traders finally break through to six-figures and more. My career as a proprietary trader, mentor, owning two trading firms in NYC, and my ten years as a trading educator, is now in your hands.

I’ve worked with complete newbies scared to place an order, and those earning a reliable million dollars per year. There’s nothing I haven’t seen or done, and the biggest lesson is that working myself to the bone, wasn’t the answer.

Join me today, and eliminate years of searching for a Holy Grail that doesn’t exist, and see why it isn’t necessary for massive success.

To The Modern Chart Reader

To most of the world, trading is a joke.

It isn’t a career. It isn’t a real job. It isn’t a way to have security.

It’s a hobby, a diversion, a phase that’ll come and go. Sure, you can get licensed, but don’t count on that to make you any money. That’s no guarantee.

Try telling your family or friends or coworkers you want to quit your job and make money trading. They’ll smile politely and ask, “Does anybody really make money from that?”

Yes, they want you to have dreams. Yes, they want you to chase them. Yes, they want you to succeed.

But they also want you to be “realistic.”

If you really want to improve your life, you should go to college, buy a franchise, or even go into sales, not hang all your hopes and dreams on the market. Nobody can make money trading.

Can they?

Why the Rich Get Rich and the Poor Get Poorer

The story you are about to read is true. None of the names were changed to protect the players.

If you’re on the wrong side of break-even, I’d recommend shutting your cellphone for the next 20 minutes. Your view of trading and the stock market is about to change.

The charts won’t change, but what you’ll see is different.

For over 93 years those who understood order flow, profited handsomely by interpreting price action revealed on the tape. I’ve been told by clients that tape reading gives them a “second sight.” Everything changed when they elevated from chart reader to tape reader.

When you see what’s was missing, when you see behind the tape, trading will never be the same.

Many traders hear “tape reading” and think it reeks of old-school methods no longer valid in today’s 24 hour, global market. These same traders risk precious capital on trades they see on Fast Money, Jim Cramer or on StockTwits. Maybe you’re one of them.

The Traders Path

Through these pages I hope that my payments to the market Gods become your rewards. Through my passion, my empathy and my experience, I seek to crunch the cost and time of your learning curve by 200%.

Your greatest obstacle as you journey the traders path is the truth. I have mentored traders since 2003 and the main reason most remain amateurs, is a reluctance to admit where they are starting.

A denial about their resources is the main culprit.

This journey is not just about risk capital. It’s about “screen time,” how much you already have and how much you plan to give.

It’s about risk tolerance. It’s about previous education, it’s about investing in continuing education. It’s about having an open mind to learn from mistakes.

The market gives us valuable feedback. Most don’t listen until its too late. Through these pages I will show you the brilliant simplicity of tape reading. The tape knows everything. It’s never wrong. If you’re struggling, the tape will show you what’s missing.

The only barrier between you and anything a trader could desire is one simple fact: Your trading today is the result of what you see, not what you know. Something so important yet misunderstood.

We spend our days searching for the one thing that’s missing. But everything we tried fell short. And so we buy another book or read another blog, or even attempt to see a trading psychologist! Some finally give up and doubt it’s possible.

The answer you seek, the great mystery, is to simply understand what’s on the tape.

You now hold the wisdom of millions of managing those executions and billions of shares traded. At our peak Keystone had nine offices around the world and over 250 traders.

What you seek is now in your hands. The rest is up to you.

Are you ready right now, right here, in this moment, ready to abandon what has not worked? Or are you comfortable in your current level of success?

What is your current burning desire? What is success when you visualize it? Why do you want that goal?

During my journey I have committed or witnessed, every mistake conceivable.Those mistakes are the foundation for a level of success I could never have imagined.

Those who succeed, eventually learn to answer the one question that leads to powerfully effective trading. Eventually they see, everything else is nonsense.

The Learning Curve

Feeling Close for Six Months

June 16, 2000 felt like Groundhog Day.

Another break-even, boom or bust week of trading. It’s Friday afternoon and I’m exhausted. Maybe my Dad was right, maybe it’s time to grow up, and maybe I should finish that resume. My feet are on auto-pilot and take me to Borders Books on 7th Avenue next to Penn Station. “Here we go again, I whispered, another cappuccino seminar at the bookstore.”

At this point I was trading for six months. Every day I felt close, but I just couldn’t get past break-even. I knew how to read charts. I was actually pretty good but every day at 5 pm I said the same thing, “I just need a system. It’s the only thing standing in my way of making steady money.”

I work hard. I scan hundreds of charts each night. I know it’s not me. I can do this. I just need a system.

All trading books preach paying your dues. They call it trader tuition. I paid with losses, I paid with time and I paid with stress. Nothing gave me a return on investment.

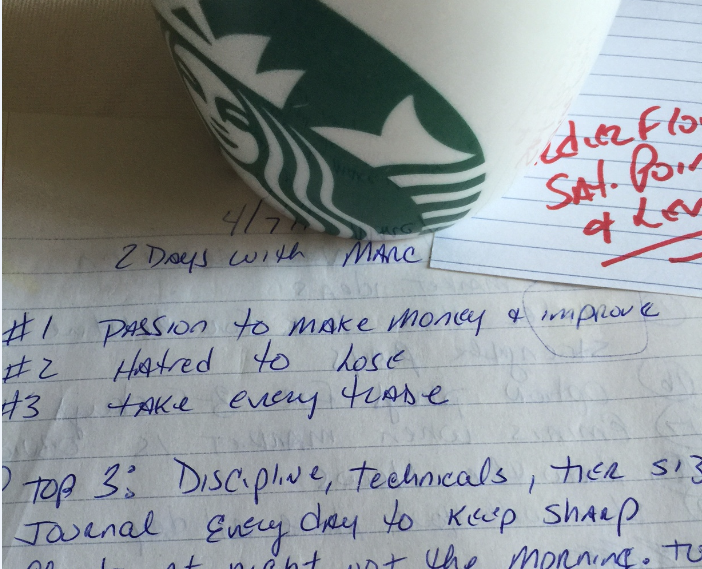

Working harder made me feel good, but it wasn’t the answer. One day sitting at Starbucks, I finally found a clue. It was the one thing I wasn’t doing. I wasn’t paying attention.

This is the quote that popped out of my notes:

“There is nothing like losing all you have in the world for teaching you what not to do. And when you know what not to do in order to not lose money, you begin to learn what to do in order to win.”

— Edwin Lefevre 1927

Did you get that? You begin to learn!

The clouds vanished and the birds began to sing. I knew there was nothing wrong with me. I simply needed to pay better attention to what worked and what didn’t.

I just need to be disciplined…

Stopped Out:

How being Disciplined Almost Ruined Me

Discipline is good, discipline is smart, discipline nearly drained my account. Get a plan! You need a trading plan! My trading plan was a recipe for getting stopped out of every trade. I guess this is what a punching bag feels like. I’m following the “rules,” but I’m still losing money.

My friend Bobby who was a NASDAQ market maker for First Boston gave me a clue.

He said “It’s trade management not trade predictions. Learn to work the order a little but be disciplined in your risk management. Never lose more than you planned, but don’t be stubborn with your entries or you’ll drive yourself crazy and get stopped out of every trade.

As long as the tape is obvious, work the order. My institutional clients scale in and scale out, learn to do the same “

Bar-by-bar I reviewed the trades. They all look good but I didn’t understand what Bobby meant by an obvious tape. At this point I wasn’t losing much money. I stopped the bleeding by doing less of the stupid stuff, but commissions, software fees and small losses slowly drained my account.

Discipline helped. But it wasn’t the answer. I became very disciplined at taking losses… Something was still missing. I needed a few big winners to pay for all those small losses.

How a $795.67 Profit Can Make You Feel like an Underachieving Loser

Finally. A profit three times my accepted loss per trade.

I can super-size my lunch today! Self-confident isn’t the right description as I strutted my way to Angelos deli on 42nd. It was more like relief. Looks like ol’ Pete has this trading thing all figured out. Paid my dues and all that stuff.

Imagine you get back to the office and you step into my shoes…

You get back to the desk and light up the screens, log in and see your stock is now $1.83 higher than when you sold it. You think – Great I just left almost $2,000 on the table- as your hand tries to squeeze the mouse into a million tiny pieces.

You didn’t miss the trade. As a matter of fact, it was a great idea. The stock did exactly what you expected. You just, well, blew it. You cut your profits short. You’re booking too soon because you’re afraid to give back P&L. You’re afraid because you need the money.

New traders sweat the losses. Newbies need each trade to make money. We need it to validate what we learned and to prove that our system “works.” Every losing trade chips away at our idealized vision of trading for a living. Losses to a new trader speed up the dreaded clock that ticks faster and faster towards getting a “real job.”

To a trader beyond break-even, but not yet six-figures, winning trades can be your ultimate doom. It’s worse than losing money because you’re too far into it to quit, but too far away from earning a real living. You’re in the game, performing OK, but you’re underachieving.

It’s all on you. You’ve had some success, you’re on the right track, you’re not getting paid.

You’re getting better but you feel worse. It doesn’t make sense but it’s the truth. You decide to go to the gym because a workout helps you think better…

“How do I know when to hold winners? Better yet, how do I know when to add to winners? Maybe that’s my problem. Maybe I need to add more often to winners. That’s what the big traders in my office do”

Building Positions like Andy and Marc

The big traders always add to winning trades. Maybe that’s the answer.

I could see their positions. The light blinks and my computer beeps. There was one trader who stood head and shoulders above the rest. He wasn’t well known outside the industry but he was THE MAN. I sat at his desk for two mornings as a favor to a friend.

I wrote ten pages of notes but he moved so fast on the keyboard I couldn’t tell what he was trading. When I first met Marc he had two things on his charts. Candlesticks and volume. Nothing else. My monitors looked like something from NASA. I think at one point I tried every indicator imaginable.

It was like speaking a new language. “Stochastics, fibonacci, Elliot Wave, GANN and MACD…” I sounded great at Thanksgiving, but when my brother started talking about getting a raise plus a bonus, I went in the other room to watch football. I was happy for him but I didn’t want to be a part of the conversation. If we calculated my pay by the hour it would have been embarrassing.

Andy was a little different. He was calm. You never knew if he was up huge or down huge. A true professional. Andy was a “relative strength” trader. He had big positions on both sides of the tape. Marc was “long only.” It was rare to see him short He once told me that if a stock traded lower in a $7 down trend, he was long the $1 rally…

The common trait between them was adding to winners. Marc said he always pressed his winners. After getting to know him, there’s no doubt this is what made him great. Andy too. Success leaves clues. It didn’t take long for me to test my new theory. I was winning more often than not and a profitable trade unfolded the next day.

All systems were a go.

The winning trade paused and gave me a second entry. I followed best practices and added less shares than my original entry. Here we go. The trade looked good, today’s trend was solid and the stock had above average volume. I have every reason to feel good about adding to my position.

The stock started pulling back, no big deal, that’s expected. Stocks don’t go straight up or down. Candlesticks on my 15 minute chart turned red. Institutional supply was now stronger than when I entered. No big deal I thought, this is how Andy and Marc make big money so I needed to stay the course.

Add to winners, that was the plan.

The stock pulled back to my entry point. Trade over, I took a “flat” on my first entry, and lost money on my second. I needed to ask Marc what I did wrong. Reading my journal and feeling these emotions again I don’t think I was angry. It was more of a feeling of doubt. I’m a rational person but I was starting to doubt I could do it.

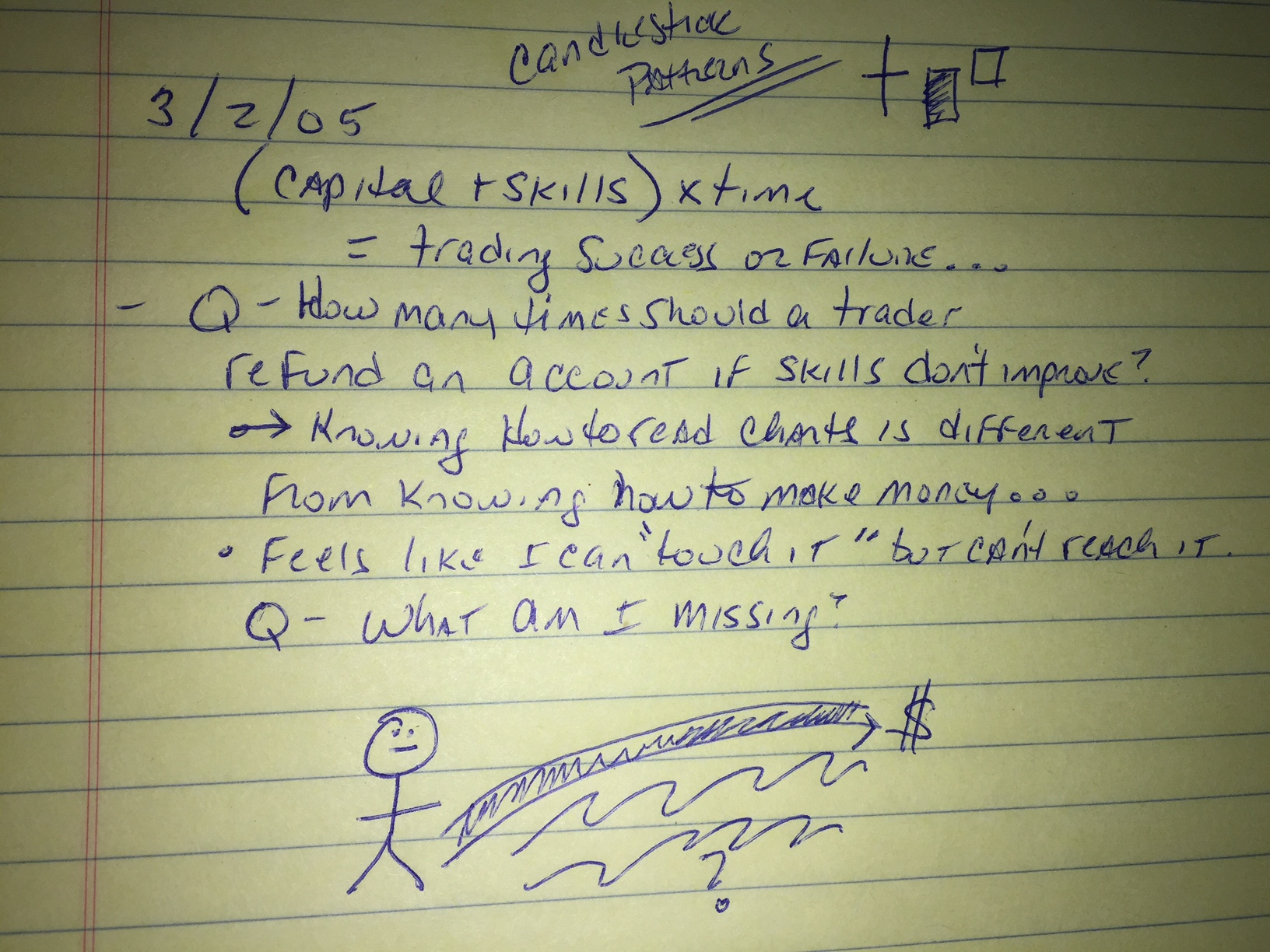

At this point I knew virtually everything there was about chart reading. I wasn’t losing money but I couldn’t get paid. I believed in my heart I could do it, but at some point you need proof. Hope doesn’t pay the bills. Every day in every way I felt like I was just “one thing” away from my dreams.

When I tracked Marc down I asked if I could buy him lunch in exchange for picking his brain. We walked past the New York Stock Exchange on the way to get chicken parm heroes. He took me to a place that was downstairs, had one oven and 3 tables. Only in NYC would someone open a food joint in about 300 square feet of space.

I explained the trade and here is his answer:

You’re right I’m always pushing my winners. He asked me a question I didn’t expect.

“How long has the stock been “well-bid?” How long have institutions supported the bid? How many days in a row was this the case? Modern tape reading is about order flow and knowing your saturation points. Those two criteria dictate your trade management.

When you know how to read the tape, you know how to manage the trade— before you enter.

Chart Reading: The Problems and Limitations

Chart readers never fully grasp what they see which is why they never get past break-even. They go in circles for years looking for an answer that’s staring them in the face.

Chart reading is analysis. Tape reading is the money.

In the long-run, our edge is order flow but in the short-term stocks trade around saturation points. Areas where you can expect buying or selling to start or stop.

The closer your stock gets to a saturation point, you shouldn’t add more shares. The likelihood of follow through is lower, so you don’t add. It’s still a good long because you’re trading with the order flow, but it’s more of a cash flow play.

So we’re trading with the order flow, but trading around saturation points. I only add when my stocks are close to the value areas. If you can’t see these points on the tape, you’ll end up making too many break-even trades.. Break-even trades make break-even traders.

This is why a lower open in a strong stock is a great play. The opening price action is further from the saturation point, so your profit potential increases.

It sounds like you added to a stock later in the cycle… You shouldn’t have added. You need to know your saturation points to set the trade expectation. A good place to start is with your stock’s average true range.

The big picture was starting to get clear…

Chart Reading Lessons

When we begin, trading seems so easy. Read the charts and place a trade. Take a profit, take a loss and move to the next trade.

It doesn’t take long to be a master chart reader, maybe a month if you work hard. Looking back, that should’ve been a screaming red flag, but it wasn’t. We choose to ignore how fast we “mastered” trading.

The market quickly teaches what we don’t know, and it’s lessons are expensive. We hold losers too long. We hope. Hope doesn’t work. This translates into lost opportunity. We freeze and do nothing, this saps our confidence for the next trade.

We hesitate on entries and hesitate on exits. We no longer trust the charts. Suddenly each bull flag looks different because the previous one lost money.

We minimize losses but it’s not enough. Losing less, is different than making more. To pay for the losses we need to press our winners. The problem is we don’t know how.

A part-time job is looking more-and-more likely. It’s the right thing to do, but would be a blow to our ego, and all hard work. It sucks, but maybe driving a limo won’t be so bad.

We make one last attempt to turn the corner. We try to hold longer, trade bigger, trade multiple positions and add to winners…

A strong desire to rehash information cycles through our head. This ends with us talking to ourselves. But we can’t answer the question. We don’t have all the variables.

We blame our discipline because we know everything, but we can’t get paid. The fact is, we’re right. We know everything about charting, but we don’t know how to make money.

Boom or bust. Make money three days in a row, give it all back on the fourth. We get lost in constant planning and develop an obsession for clues.

At this point we almost know too much. We deeply believe we are only “one thing” away. One tool, one indicator or one book. We scour hundreds of charts each night but the results are the same-we have mastered the art of not losing money.

The Reality of an EXPERIENCED Break-Even Trader

At this point we are watching the same trading movie over-and-over, hoping the ending is different. We need a new way to change the ending.

If you’ve had a similar experience and made it this far, congratulations. Most people give up. All billionaires say you need to love what you do. Most people don’t understand the concept.

You need to be crazy in love with the idea, crazy in love with possibilities, crazy enough to think different. So crazy that you believe in yourself, no matter how many obstacles.

So crazy you never give up the search.

You have paid your dues. One of my favorite Napoleon Hill quotes is “The invisible guides are watching your effort, eventually they say – pay him – he won’t quit…”

Today you have a choice. Are you open to a new way? Or will you continue paying for the same movie getting the same results?

When you’re ready, that quiet voice inside whispers “take one more step”. It’s not magic but you finally see what to do. You finally see it’s possible, you finally see chart reading is only the first step.

Making money requires an edge. An edge that becomes your strategy, and your strategy becomes what you believe in. It requires a belief in something we can’t control. A belief in probabilities.

But what causes probabilities to work? What makes you trust and follow your edge? How does an edge make you money?

Let’s take the next step and find out…

The Turning Point

The market changed dramatically February 2007.

The new York Stock Exchange introduced hybrid orders that exposed the specialist to virtually unlimited shares through electronic executions. Prior to this change, there were restrictions.

Since the specialist manually controlled the stock through the orders in his (her) “Open Book” quotes were needed to create a fair market. What was once a limit of 1099 shares on one side of the market every 30 seconds, became unlimited exposure.

**History lesson– The former order was know as the DOT or SDOT system, “direct order turnaround.” It was a way for us to trade at a specialist quoted price. Similar to the NASDAQ SOES system (small order execution system. The restrictions meant I could only buy up to 1099 shares every 30 seconds from the specialist using a DOT order.

I could SELL immediately, but if I wanted to buy more shares from that quote, I needed to wait.

The new Hybrid order was implemented on February 24, 2007 and the specialist was now exposed to unlimited executions against the quote. It became impossible to keep up the quotes manually.

To give some context to how this change affected active traders, I have a friend Rob, who traded only “listed stocks.” (NYSE with the specialist) His strategy was to watch the specialist quote, and the prints on the tape, and follow them until the flow of trades changed.

If you were on our trading floor, you would often hear “the specialist was stepping up or stepping down.” Which meant Rob found a large order that was moving a stock.

Rob was trading over a million shares per day… Within 7 months he was no longer an active trader. The specialist quote and prints were now harder to read, they were computerized using algorithms.

As 2007 wore on, the once hallowed grounds of the New York Stock Exchange was now a studio to broadcast market updates. What once was over 5,000 people buzzing in the purest sense of capitalism, is now a digital flow of automated bids and offers that adjust quotes faster than you can blink.

Trading off the noise of the crowd was gone. It’s now a silent hum of co-located servers where speed and distance are the new edge.

I never traded on the floor, but the guys I met said the crescendo of noise on a busy day, was magical, and a privilege they will never forget.

A Fortunate Encounter

Blaggards, NYC

October 9, 2007, about 90 minutes after the market closed. I was enjoying an adult beverage at Blaggards, on 35th St, between 7th and 8th avenues.

A quick glance at my Blackberry, the market was at new all-time highs. “Where did the Dow close?” the guy sitting next to me said. “14, 164, an amazing day for the history books, but trading it was tough. May through October was choppy, it’s nice for TV, but we need it to pick a direction.” I replied

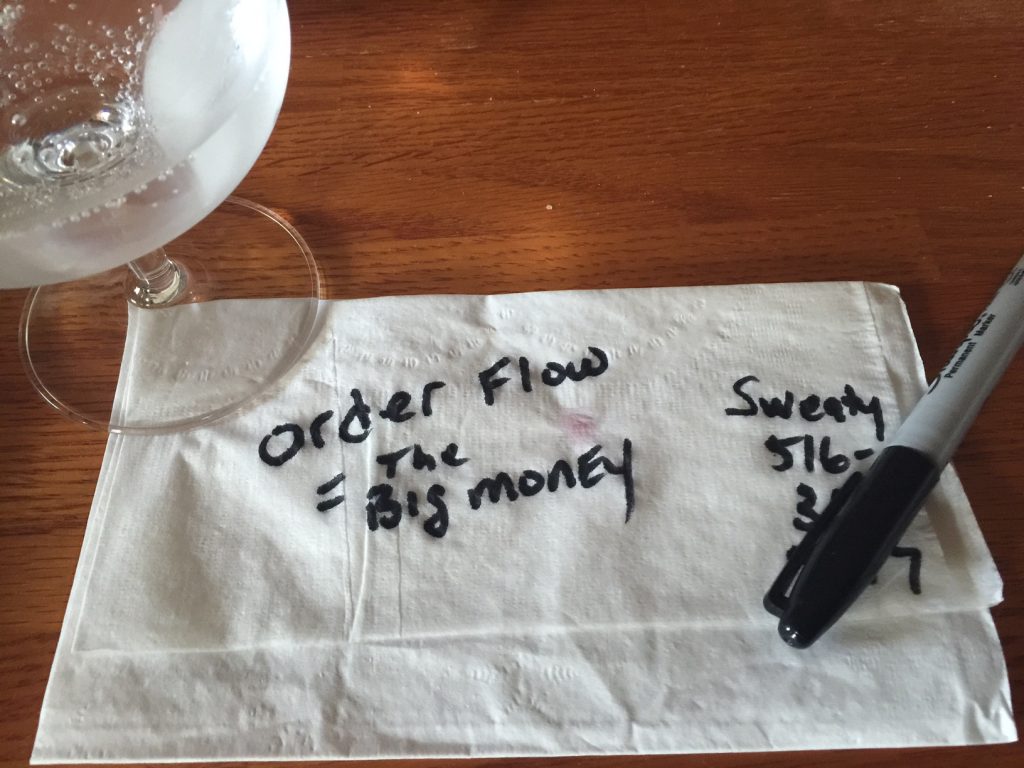

He reached out his hand and said his name was Bobby, but everyone on the floor used to called him “Sweaty.” Of course I laughed as I shook his hand. He said it’s not what you think.

Art Cashin

“One day about 20 years ago I walked onto the floor wearing sweat pants. All day long Art Cashin kept calling for SWEATY on the speaker. The name stuck. Ask almost anyone on the floor, and they know who Sweaty is.”

He asked where I traded. I said I own a prop firm next door, 450 7th avenue, above Citibank. “We have a few offices and about 175 traders right now.”

“Interesting,” Sweaty said, he kept talking but I couldn’t stop thinking he looked like Pat Riley with a fake tan. “Do you have room for more traders?” I have about 20 former colleagues from the floor of the NYSE trading from home, and they hate it. They need to get out of the house.”

“What’s your office like?” he said. “Mostly filled with day traders right?” I said yeah. Sweaty replied-“OK, cool. If you give us a good deal, my guys will teach you about order flow. How we worked the big orders.

We’ll show you what’s going on behind the tape, and in exchange, you show us how to use your fancy software. Most of us are dinosaurs, still adjusting to life off the floor. Should be a good deal for both of us.”

I told him I needed to speak to my partner, but I would give him a call either way. He gave me his number and walked out without saying goodbye. It was weird, from start to finish, but worth a meeting.

Lessons In Reading the Tape

Sweaty showed up a week later with a guy name Moose…

Moose was a clerk for Bank of America. We made a deal, and before long, we also had Joe Coco, Bill T., Jerry, Forrest, Greg, Jim D. Jim T., the Connolly brothers, Tim A. and Rich V.

Once they saw we knew our stuff, word spread and we had 25 former New York Stock Exchange specialists, clerks and brokers trading in the office. After about a month, Sweaty called the first meeting. About ten guys from the floor stuck around. Bill spoke first.

“Seems like your traders are pretty good at trading momentum. I took Kyle to lunch, you gave them a solid strategy for trading swings over three to five days.” “Yeah, we developed Saturation Plays a few years ago. It’s been our bread and butter, a great strategy for cash flow.” “How does it work?” Bill asked.

Essentially we stalk price and volume over a 2-6 day period. The goal is to identify when institutions are active, and when they step aside. It’s not dependent on the longer term bias, it’s pure tape reading over that short window.

As the market alternates between buying and selling pressure, our objective is to enter as this pressure “saturates” in a value area to buy, and “saturates” in a profit taking area to sell or sell short.

When the market opens, we monitor three specific levels that determine today’s tape. Once the strategy is locked in, the trader will always know what expect. The most powerful aspect of the trade is anticipating the opening price action. We know exactly what to expect the first 90 minutes, and the correct levels to trade.

Each day we plan ten to fifteen trades. We only need two or three to unfold as planned, to make consistent money. Many amateur believe the opening hour is confusing, and too volatile to interpret. The Saturation Play gives our traders confidence on the open, because when the “expected” happens, they literally planned for it.

They are taught to let everything else go. It’s really a thing of beauty when you learn to read the swing. “What happens if a lot of trades trigger at once?” Sweaty asked. They are trained to flawlessly take every trade. Our traders understand the system makes money over time, so you can’t cherry-pick the winners.

Trading doesn’t work if you only take some of the signals.. Once a trader gets used to the Game Plan, it’s actually easier to manage five positions than one. You aren’t watching every up-tick or down-tick. You manage the aggregate of the positions. The only way a traders gets in trouble, is if he doesn’t exit the losers.

Building a Profitable System on Simple Math

The Origins of Ten Perfect Trades

Everything starts with stocks that close in the top or bottom ten percent of the range. These setups have a 90% chance of following through in the same direction the next morning. But, they have only a 50% chance of closing above the previous day’s high (for a long), or below for a weak close.

Put simply, a strong close with a higher opening has a 50% probability of failing, when combined with the Saturation Play setup. The trigger without the setup is worthless. When you add the entry criteria, the trade is a thing of beauty.

Saturation Plays are designed to capture the move from the low to the high, or from the high to the low. The key to the trade is knowing whether or not you should expect the high or low to be made first each morning.

Once you know the setup, the opening play and the projected entry price, the trade is just a matter of placing limit orders at the correct price to begin working the trade.

The secret to the play is defining your bias and never deviating. You can’t fight the tape. There are day the momentum runs longer than usual, but it simply sets up the same trade the next day. Take your accepted loss and move on with your day.

You come into the day as a buyer, seller, or looking for a short sale. You don’t flip-flop during the day.

“What’s the trade objective?” Moose asked

Best case scenario is to hold to the close, but truth be told, when you have multiple positions that are profitable all at once, your P&L can explode pretty quickly, it can be hard not to book profits.

We need to add some element that tells us when to get aggressive with our hold time, and when to exit into momentum.

“Maybe I can help with that, said Greg, you need to add a bigger view of the tape.” Greg the quiet one, blurted out. He was a specialist for Vandy from 1996-2007.

Taking Order Flow Deeper

Working order flow was a balance between making a fair and orderly market, with taking the wrong side of the order flow to provide liquidity. If there was an imbalance and the stock had an unusual supply or demand, we were on the wrong side of that trade. It was our responsibility to fill those orders.

Once the order flow slowed down, we could trade out of the position or even earn profits if we accepted the risk. Your trade needs a component that shows you when to trade with the momentum and when to fade it. When to add to positions and when to exit into momentum.

Greg went to the whiteboard and drew out this phase of market action viewed from the specialist perspective. It was close to the Saturation Play but we didn’t consider this last piece.

“Stocks-in play, Greg continued, tip their hand. A large buyer or seller will try to get shares as quietly as possible, until they can’t. Greg drew the candlesticks on the whiteboard. You this this, stay away, it’s chop city, you see these, in this order with this type of close, you are trading with the order flow.

Generally speaking this type of flow can last from three weeks, to 3 months.”

But here is where everyone screws it up. Most traders only watch price. They watch how much they are up or down in the trade. A stock moves against them and they are focused on price. You need to read the tape, not just the price, and the tape includes how many shares traded at that price.

“From the bitching I hear in the office, a few of your traders are getting stopped out of profitable trades and not sizing up on the winners. They find winners but get scared too easily. Every up-tick and down-tick is life or death.”

They get stopped out on price because they can’t read the tape. Everyone reads charts, including CNBC and such, but very few read the tape. Think of it this way, maybe this will help you explain it tomorrow…

If you buy one share at $10. Your demand and commitment to the idea is $10. If I buy two shares at $10, my commitment and demand is $20.

The price is the same, but the tape is telling a different story.This simple example explains why the public is always wrong. They only trade price.

You need to monitor it on these two time frames. (more whiteboard stuff) That’s what we did on the floor. When we needed a view of the tape, outside of our own order flow, this is what we monitored.

Reading the tape must include the action of the volume. It is not price action, but volume – – the amount of money, the supply and the demand – – which best tells the story. Tape reading determines if institutional activity currently favors the buy side or the sell side, the supply or demand.

Do not forget that every purchase of a share of stock means also a sell. Our job is to determine the balance of the supply and demand: whether the demand is greater than the supply, in which case the price advances, or the reverse.

The action of the volume tells us of the supply and demand; price merely denotes the value of the volume!

One last thing to consider is tracking the volume on a daily basis. Order flow is not going to jump off the page and bite you in the ass, but when you study a handful of stocks, you can learn the tape quickly.

How Tape Readers See the Cause

But Chart Readers See the Effects

Order flow isn’t discussed on CNBC or penned in the Wall St Journal…

Big money doesn’t advertise…

Or do they?

Jim D. had the answer. “If I had natural buyer with size behind it, we tested the market to gauge interest.”

“If my buyer wants to build a position, we shook the tree, to bring out sellers. We sold stock to stimulate selling. My client sat on the bid buying more than they sold.

To attract buyers, the process was similar.

The public is attracted by higher prices. More specifically, fast-moving higher prices. Chart readers see higher prices with wide fluctuations, after a significant move higher.

The “fluctuations” give retail buyers a second chance at a better price.

So we are clear, a “sloppy/whippy” topping pattern (after a mark up/up trend), is when institutions are marketing stock for sale. They are telling you they need to get out.

Institutions Marketing Stocks for Sale:

Order Flow on the Tape

== >> The beginning of the mark up is orderly. Not attracting attention yet.

== >> Just prior to “A” the first attempt to market stock for sale is completed in a $4 trading range. Price falls quickly during the few days of “A” but there is too much stock for sale. We need higher prices and more “second chances” to get a hot stock at a better price. Think of spot “A” as the movie preview. It gets your interest in things to come.

== >>Area “B” is the marketing machine at it’s best. New high prices that violently decline and give you another chance to buy. The wider the swings, the more attempts at a new high, the more lemmings drawn to the buy button before the coming decline.

Is that legal?

Yes. It’s just institutions marketing what they need you to see and believe.

Big money can’t buy or exit large positions without your help.

Tape readers see distribution.

Chart readers see “action.”

Order Flow: What is it?

What exactly are Institutions?” In trading terms, I’m talking about major financial institutions. Hedge funds, mutual funds, pension funds, the big players who need to earn returns to keep their jobs.

These players account for an estimated 67% of the volume in the stock market on any given day. Smart traders benefit by tracking their order flow.

The term order flow comes from market makers and specialists receiving large orders to work. The better price they got for the order, the more order flow they got. The more order flow, the more they made in commissions.

Order Flow in the Age of Algorithms

Struggling chart readers like to blame the “algos.”

They complain about getting stopped out by three cents, only to watch the stock march higher without them. Eventually they believe algos are out to get them. The book “Flash Boys” by Michael Lewis does a great job perpetuating the anger.

Narrow-minded people, only see where they focus. They forget when order flow is obvious, and algos catapult the stock so high, so fast you can’t possibly mess up the buying opportunity.

If I have a choice between a bunch of annoying small losses, versus a tsunami of buying (or selling), sign me up. Tape reading and seeing order flow, solves the algo crisis.